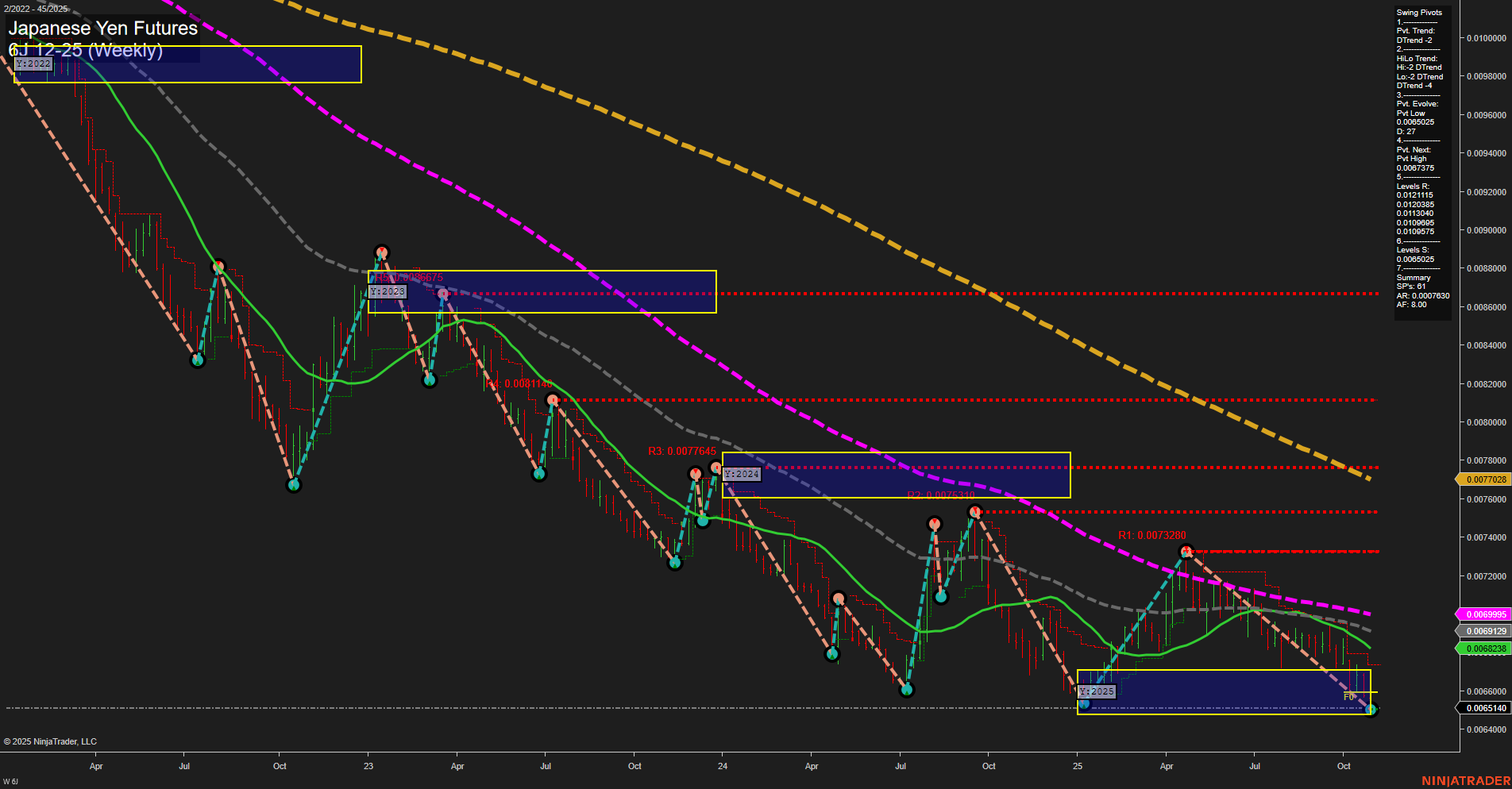

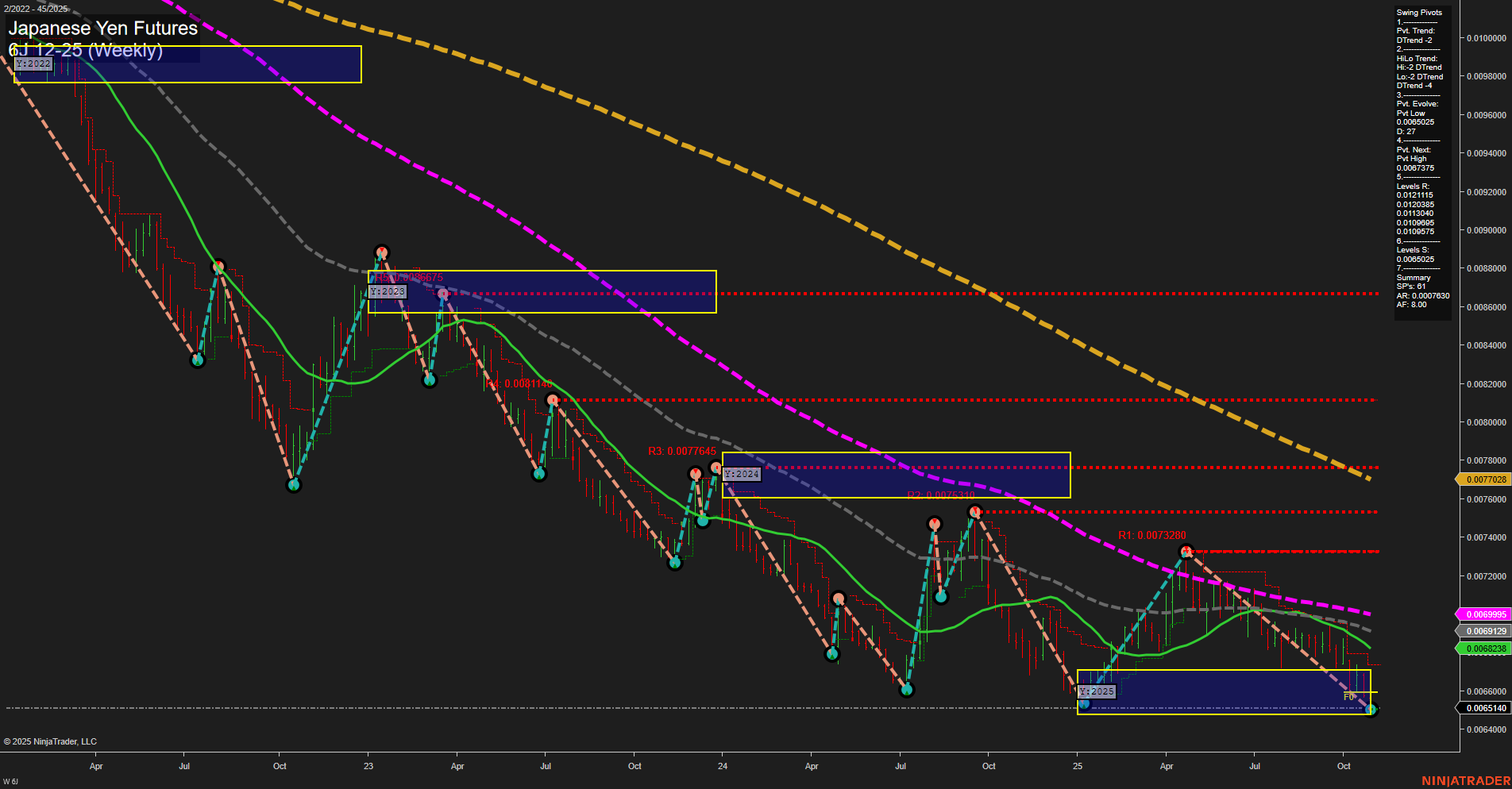

6J Japanese Yen Futures Weekly Chart Analysis: 2025-Nov-03 07:03 CT

Price Action

- Last: 0.006272,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -120%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -7%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 0.0062025,

- 4. Pvt. Next: Pvt high 0.0067875,

- 5. Levels R: 0.0122115, 0.0123845, 0.011304, 0.0108925, 0.0101875, 0.0077645, 0.007328,

- 6. Levels S: 0.0062025.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.006283 Down Trend,

- (Intermediate-Term) 10 Week: 0.006328 Down Trend,

- (Long-Term) 20 Week: 0.006913 Down Trend,

- (Long-Term) 55 Week: 0.006995 Down Trend,

- (Long-Term) 100 Week: 0.007703 Down Trend,

- (Long-Term) 200 Week: 0.008728 Down Trend.

Recent Trade Signals

- 30 Oct 2025: Short 6J 12-25 @ 0.0065315 Signals.USAR-WSFG

- 29 Oct 2025: Short 6J 12-25 @ 0.006579 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The Japanese Yen futures (6J) continue to exhibit a persistent downtrend across all timeframes. Price action remains weak, with the last price at 0.006272, and momentum is slow, indicating a lack of bullish conviction or reversal attempts. The weekly, monthly, and yearly session fib grids all show price trading below their respective NTZ/F0% levels, reinforcing a strong downward bias. Swing pivot analysis confirms the dominance of lower lows and lower highs, with the most recent pivot low at 0.0062025 and the next potential resistance at 0.0067875. All benchmark moving averages from short to long term are trending down, and the price is below every key average, highlighting the entrenched bearish structure. Recent trade signals have also favored the short side, aligning with the prevailing trend. Overall, the chart reflects a market in a sustained bearish phase, with no technical evidence of a reversal or significant support holding at this time. The environment is characterized by trend continuation, with periodic minor retracements failing to alter the broader downward trajectory.

Chart Analysis ATS AI Generated: 2025-11-03 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.