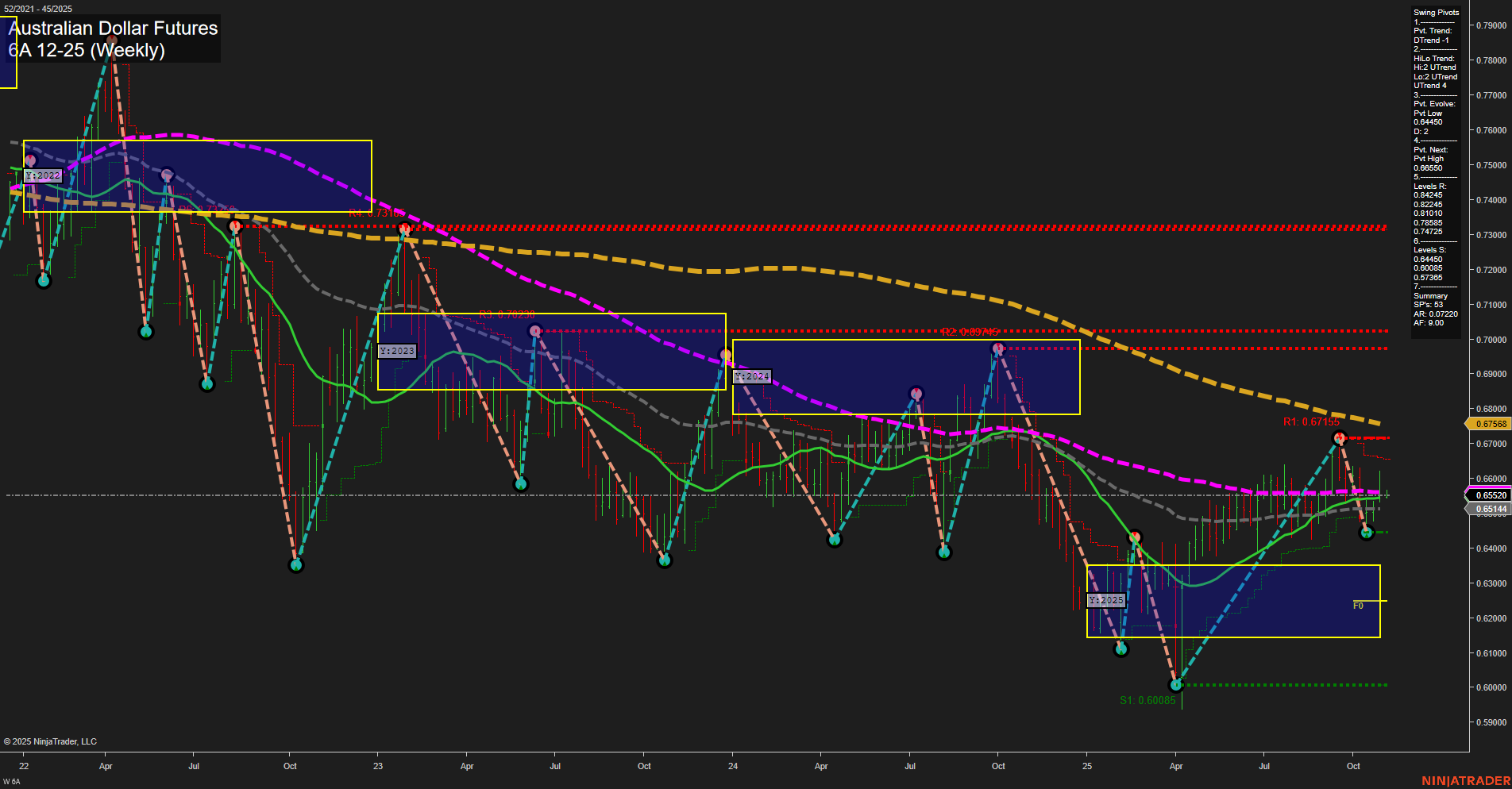

The 6A Australian Dollar Futures weekly chart is currently showing a slow momentum environment with medium-sized bars, indicating a lack of strong directional conviction. The price is consolidating near the lower end of the recent range, with the last price at 0.65525, just above the most recent swing low support at 0.65144. All major moving averages (from 5-week to 200-week) are trending down, reinforcing a bearish long-term structure. Swing pivots highlight a short-term downtrend, while the intermediate-term HiLo trend remains up, suggesting a possible tug-of-war between short-term selling pressure and intermediate-term recovery attempts. Resistance levels are stacked above, with the nearest at 0.67155, while support is thin below, with a significant gap down to 0.60085 if the current support fails. Recent trade signals have shifted to the short side, with both short-term and intermediate-term signals triggering shorts in the last week, reflecting the prevailing bearish sentiment. The neutral readings on the session fib grids (WSFG, MSFG, YSFG) indicate a lack of clear bias from the broader price structure, supporting the view of a consolidative or corrective phase within a larger downtrend. Overall, the chart reflects a market in a corrective pause within a dominant bearish trend, with short-term downside pressure and limited support below. The environment is characterized by choppy, range-bound action with a risk of further breakdown if support does not hold, while any rallies are likely to encounter strong resistance at multiple levels above.