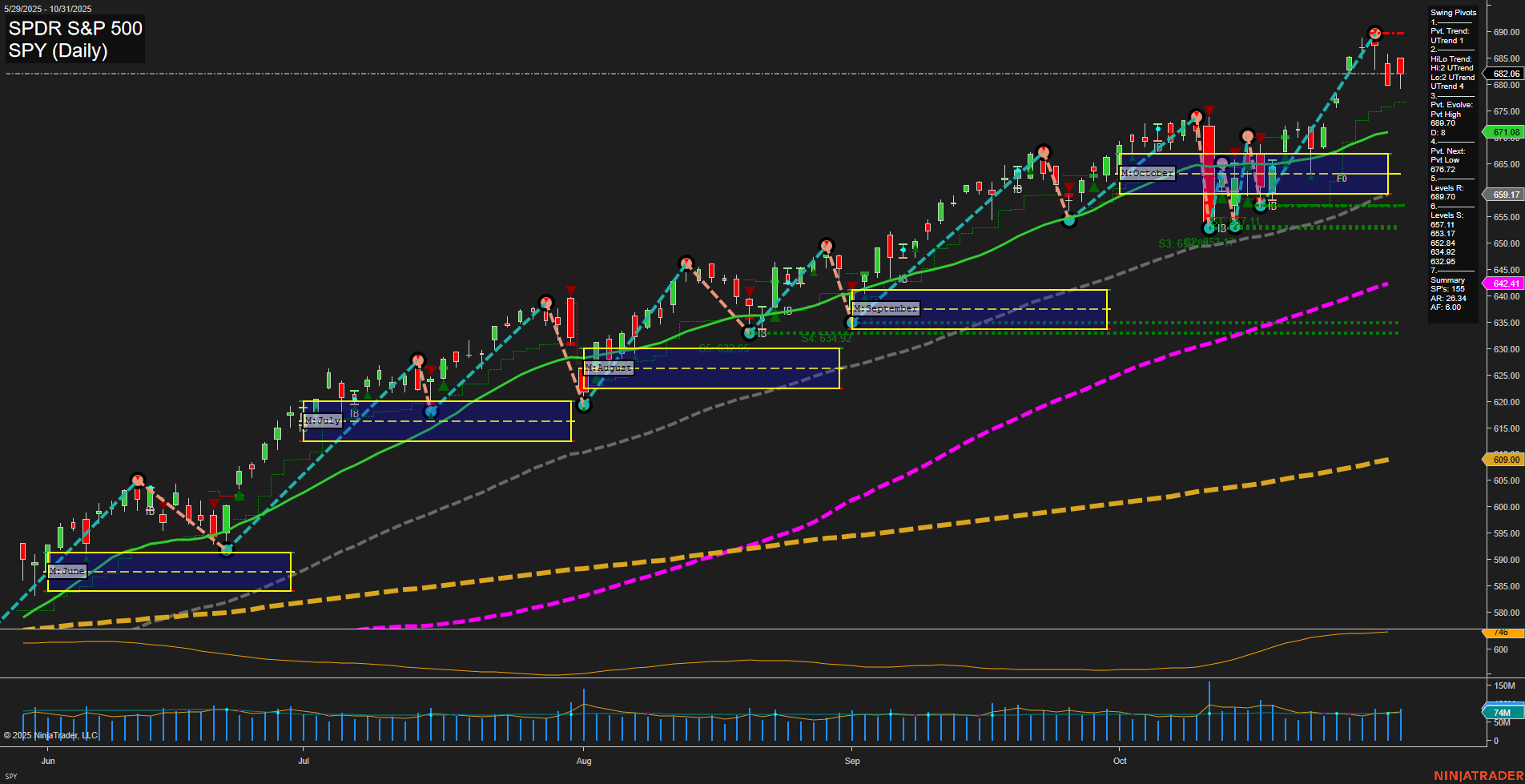

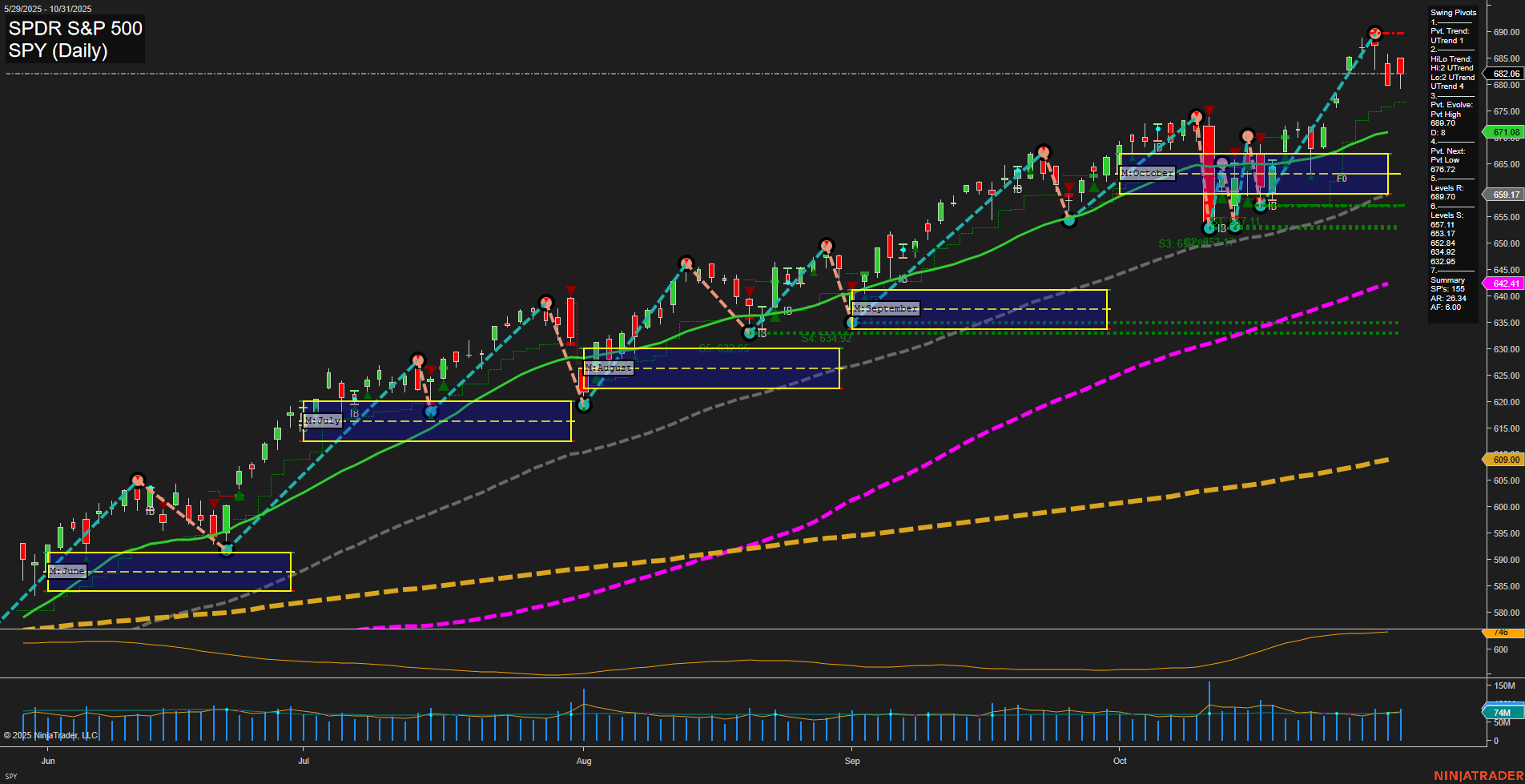

SPY SPDR S&P 500 Daily Chart Analysis: 2025-Nov-02 18:20 CT

Price Action

- Last: 682.06,

- Bars: Medium,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 682.06,

- 4. Pvt. Next: Pvt low 671.82,

- 5. Levels R: 685.00, 682.06,

- 6. Levels S: 671.82, 659.21, 652.84, 642.17.

Daily Benchmarks

- (Short-Term) 5 Day: 677.28 Up Trend,

- (Short-Term) 10 Day: 672.72 Up Trend,

- (Intermediate-Term) 20 Day: 662.41 Up Trend,

- (Intermediate-Term) 55 Day: 645.09 Up Trend,

- (Long-Term) 100 Day: 642.41 Up Trend,

- (Long-Term) 200 Day: 609.00 Up Trend.

Additional Metrics

- ATR: 564,

- VOLMA: 47470907.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The SPY daily chart shows a strong and persistent uptrend across all timeframes, with price action making new highs and momentum remaining fast. All benchmark moving averages (from short to long-term) are aligned in uptrends, confirming broad market strength. Swing pivot analysis highlights a current pivot high at 682.06, with the next potential pivot low at 671.82, and multiple support levels below, suggesting a well-supported advance. The ATR indicates moderate volatility, while volume remains robust. Despite a neutral bias from the session fib grids, the technical structure is decisively bullish, with higher highs and higher lows dominating the recent price action. The market is in a trend continuation phase, with no immediate signs of exhaustion or reversal, and any pullbacks are being met with strong buying interest. This environment favors trend-following strategies, with the potential for further upside as long as support levels hold and momentum persists.

Chart Analysis ATS AI Generated: 2025-11-02 18:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.