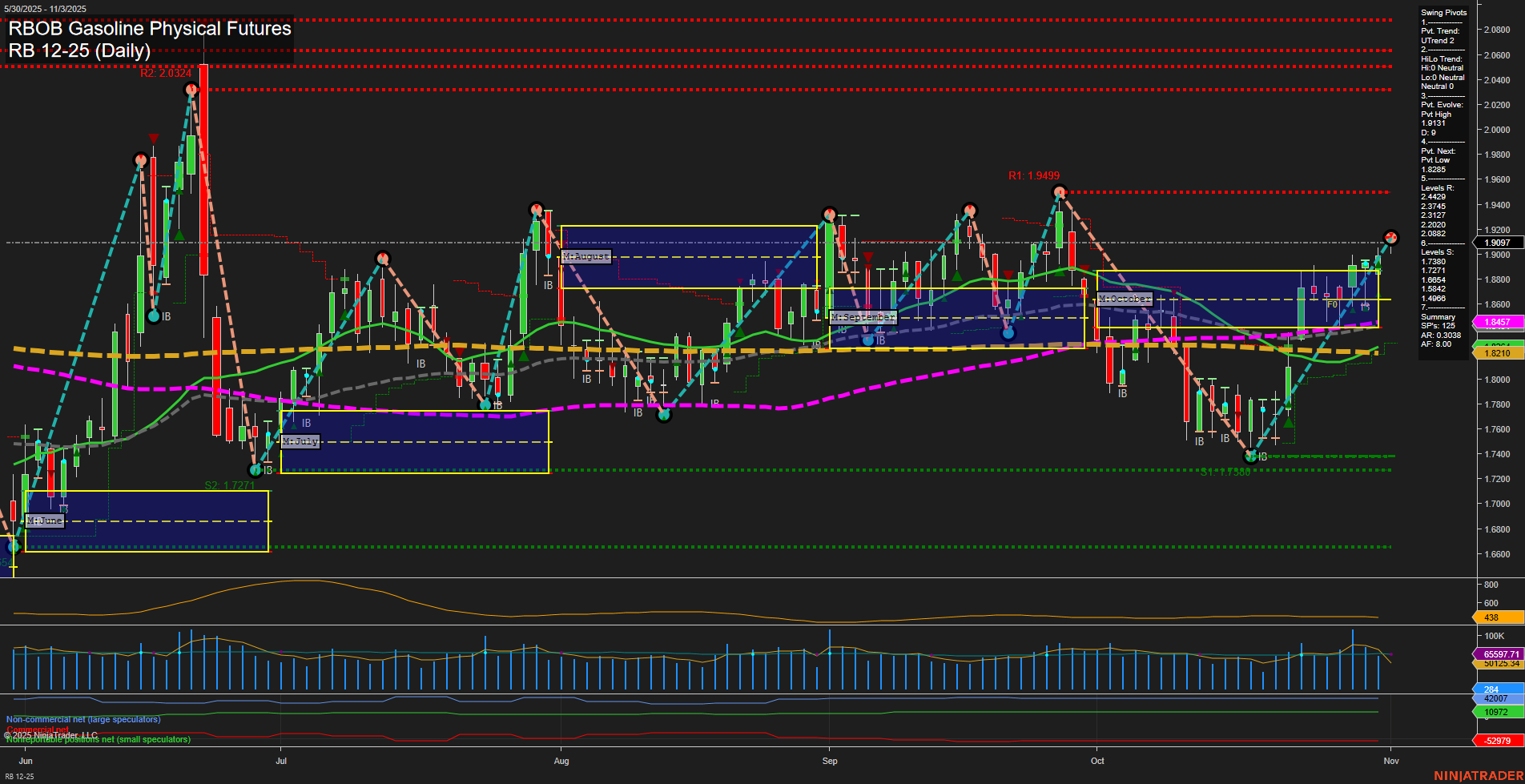

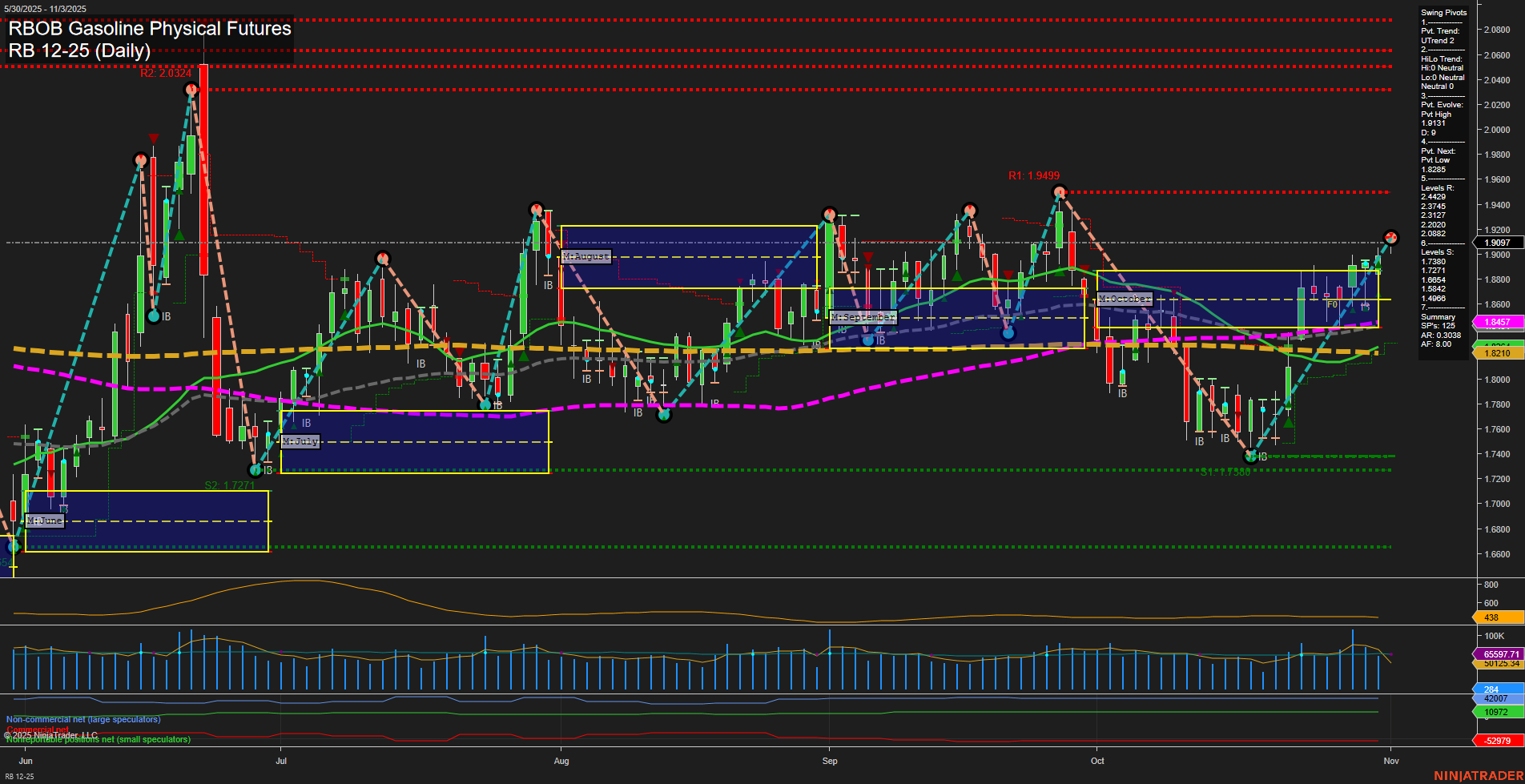

RB RBOB Gasoline Physical Futures Daily Chart Analysis: 2025-Nov-02 18:16 CT

Price Action

- Last: 1.9097,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 34%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 7%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt High 1.9131,

- 4. Pvt. Next: Pvt Low 1.8221,

- 5. Levels R: 2.0442, 2.0172, 2.0142, 2.0127, 2.0102, 1.9499, 1.9131, 1.9082,

- 6. Levels S: 1.8730, 1.8261, 1.8221, 1.8066, 1.7721.

Daily Benchmarks

- (Short-Term) 5 Day: 1.8847 Up Trend,

- (Short-Term) 10 Day: 1.8570 Up Trend,

- (Intermediate-Term) 20 Day: 1.8457 Up Trend,

- (Intermediate-Term) 55 Day: 1.8210 Up Trend,

- (Long-Term) 100 Day: 1.8600 Up Trend,

- (Long-Term) 200 Day: 1.8457 Up Trend.

Additional Metrics

Recent Trade Signals

- 31 Oct 2025: Long RB 12-25 @ 1.8843 Signals.USAR-MSFG

- 31 Oct 2025: Long RB 12-25 @ 1.8799 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The RBOB Gasoline futures market is showing a strong bullish structure across all timeframes. Price is currently trading above all key moving averages, with the short-term, intermediate-term, and long-term benchmarks all in uptrends. The recent swing pivot trend has shifted to an uptrend, and the most recent pivots indicate a push toward resistance at 1.9131, with multiple higher resistance levels above. Support is well-defined below, with the nearest at 1.8730 and 1.8221. The ATR and volume metrics suggest healthy, sustained activity, and recent trade signals confirm renewed upside momentum. The market has rebounded from a prior pullback, forming a higher low and breaking out of a consolidation range, which aligns with seasonal strength often seen in gasoline markets during this period. The overall technical landscape favors continuation of the current rally, with the potential for further tests of overhead resistance if momentum persists.

Chart Analysis ATS AI Generated: 2025-11-02 18:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.