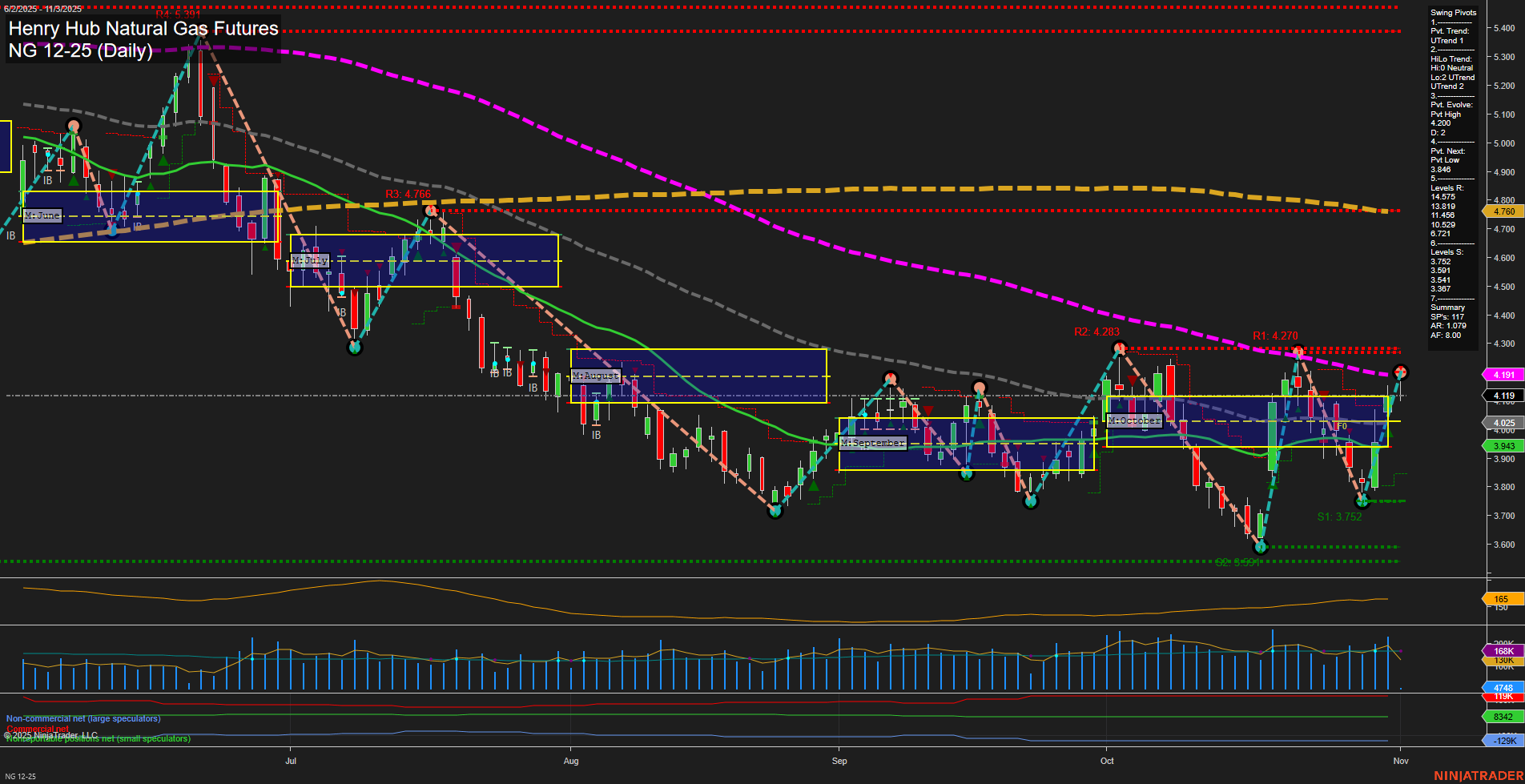

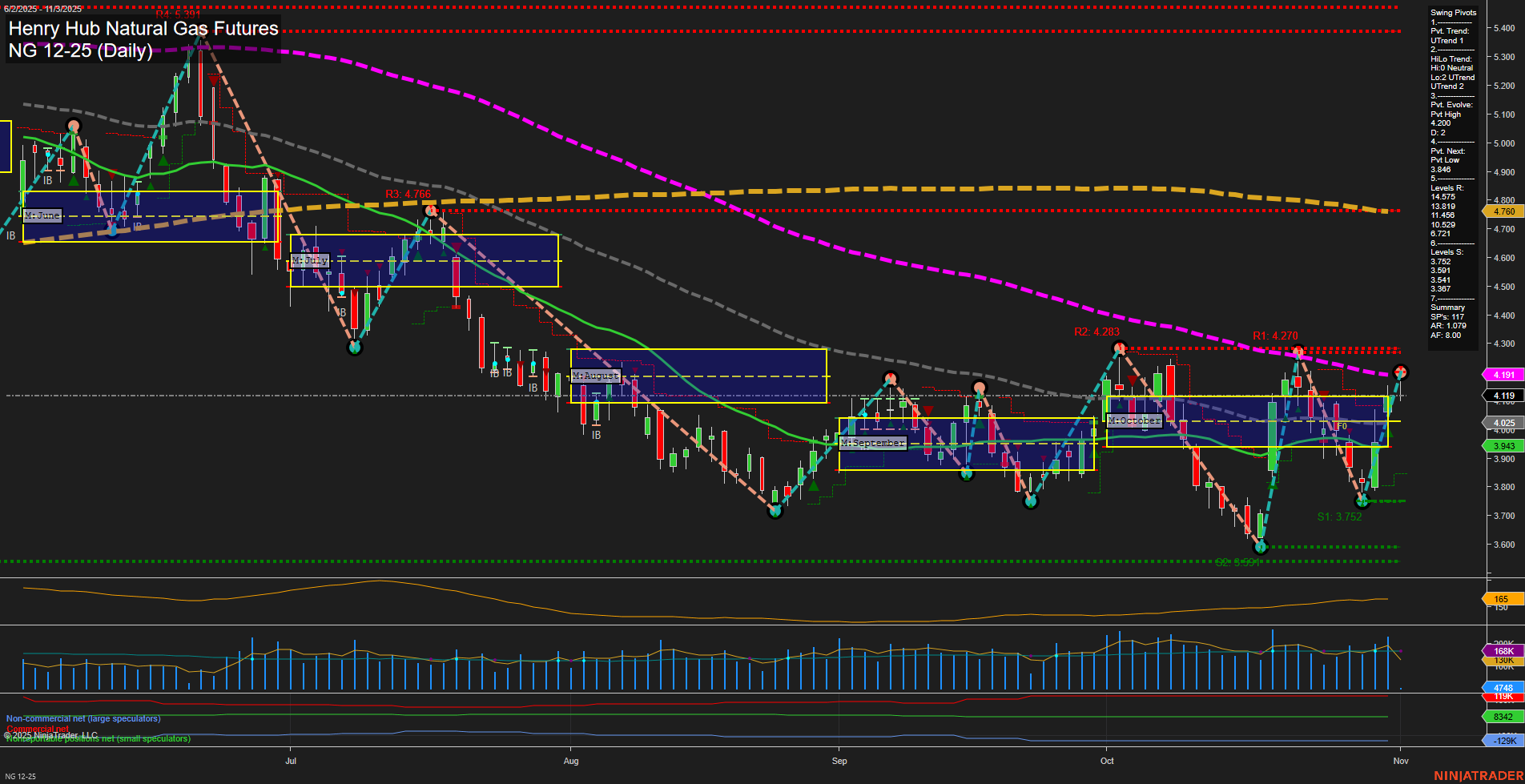

NG Henry Hub Natural Gas Futures Daily Chart Analysis: 2025-Nov-02 18:13 CT

Price Action

- Last: 4.119,

- Bars: Medium,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -26%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 4.270,

- 4. Pvt. Next: Pvt Low 3.848,

- 5. Levels R: 4.766, 4.283, 4.270, 4.119,

- 6. Levels S: 3.752, 3.561, 3.491, 3.267.

Daily Benchmarks

- (Short-Term) 5 Day: 3.943 Up Trend,

- (Short-Term) 10 Day: 4.025 Up Trend,

- (Intermediate-Term) 20 Day: 3.949 Up Trend,

- (Intermediate-Term) 55 Day: 4.191 Down Trend,

- (Long-Term) 100 Day: 4.119 Down Trend,

- (Long-Term) 200 Day: 4.760 Down Trend.

Additional Metrics

Recent Trade Signals

- 31 Oct 2025: Long NG 12-25 @ 4.111 Signals.USAR-MSFG

- 30 Oct 2025: Long NG 12-25 @ 3.922 Signals.USAR.TR120

- 27 Oct 2025: Short NG 12-25 @ 3.999 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

Natural gas futures have shifted into a strong short- and intermediate-term uptrend, as evidenced by the recent pivot to an UTrend in both the swing pivots and HiLo metrics, and confirmation from the WSFG and MSFG grids with price holding above their NTZ/F0% levels. The last price is above the short-term and intermediate-term moving averages, which are all trending up, while the long-term benchmarks (55, 100, 200-day) remain in a downtrend, highlighting a persistent bearish overhang on the yearly view. Recent trade signals have flipped long, aligning with the fast momentum and a notable increase in volatility (ATR) and volume (VOLMA). Resistance is layered above at 4.270, 4.283, and 4.766, with support at 3.752 and 3.561, suggesting the market is testing a key inflection zone after a sharp rally from recent lows. The overall structure points to a potential short-term breakout attempt, but the longer-term trend remains down, indicating this move could be a corrective rally within a broader bearish cycle. Swing traders will note the V-shaped recovery and the clustering of resistance just overhead, which could define the next major directional move.

Chart Analysis ATS AI Generated: 2025-11-02 18:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.