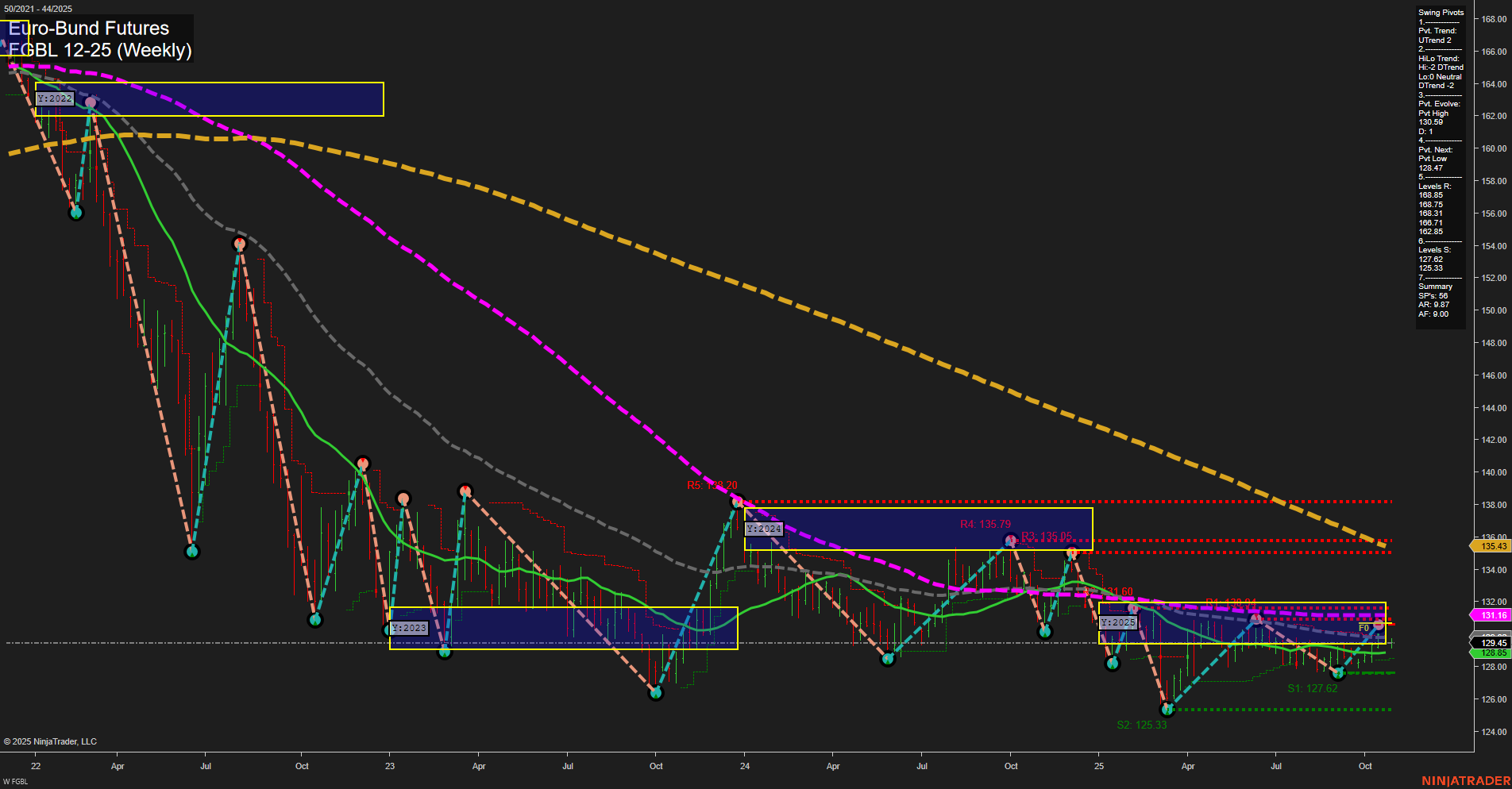

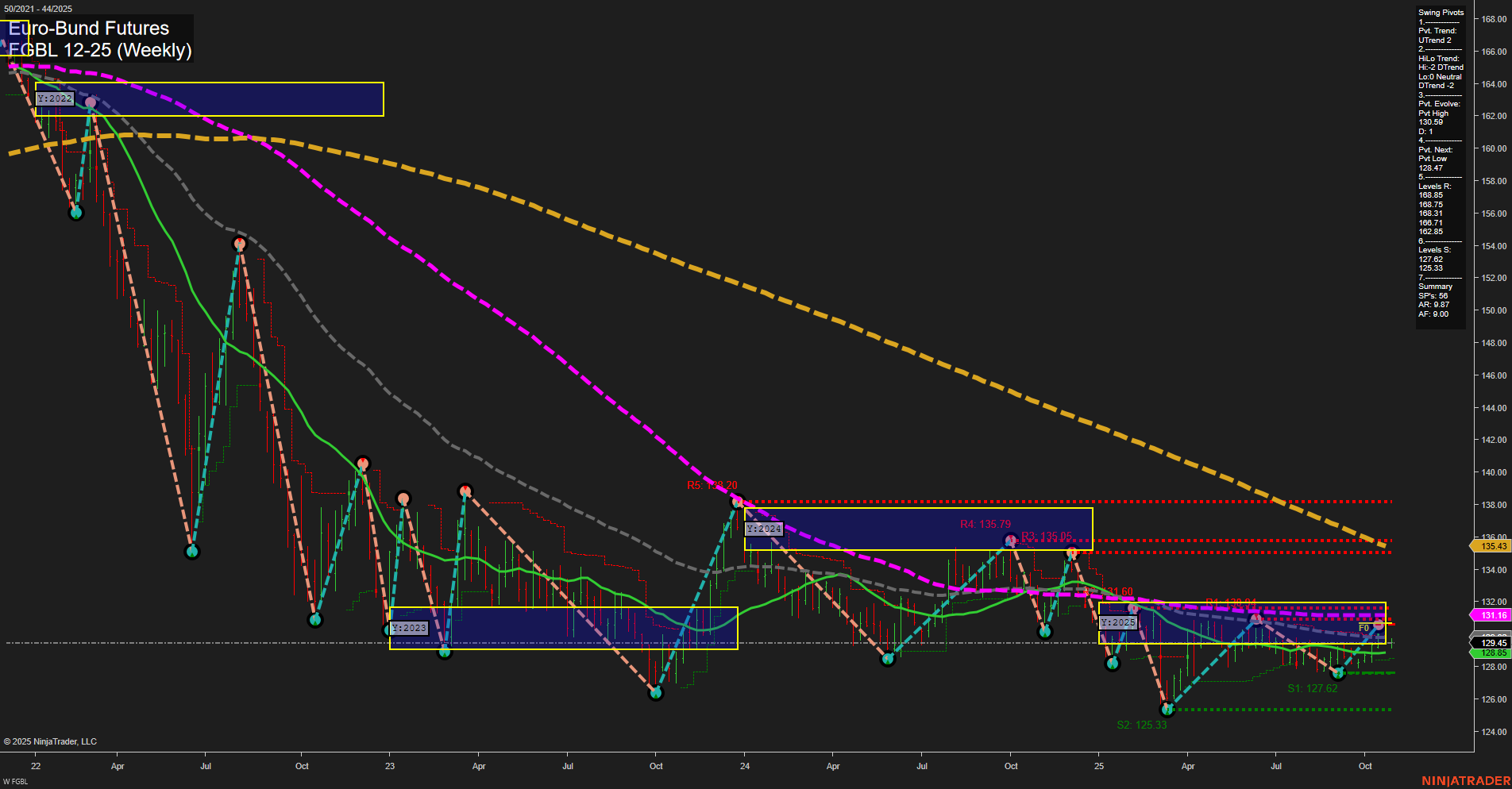

FGBL Euro-Bund Futures Weekly Chart Analysis: 2025-Nov-02 18:11 CT

Price Action

- Last: 129.45,

- Bars: Small to Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 51%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -10%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 130.19,

- 4. Pvt. Next: Pvt low 127.62,

- 5. Levels R: 135.79, 135.05, 131.71, 130.19, 128.75,

- 6. Levels S: 127.62, 125.33.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 129.85 Up Trend,

- (Intermediate-Term) 10 Week: 131.16 Down Trend,

- (Long-Term) 20 Week: 131.15 Down Trend,

- (Long-Term) 55 Week: 135.43 Down Trend,

- (Long-Term) 100 Week: 143.20 Down Trend,

- (Long-Term) 200 Week: 153.43 Down Trend.

Recent Trade Signals

- 31 Oct 2025: Short FGBL 12-25 @ 129.33 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The FGBL Euro-Bund Futures weekly chart shows a market in a prolonged downtrend, with the price currently consolidating near the lower end of its yearly range. Short-term price action is neutral, with small to medium bars and slow momentum, indicating a lack of strong directional conviction. The WSFG (Weekly Session Fib Grid) trend remains down, with price below the NTZ (neutral zone), while the monthly MSFG (Intermediate-Term) trend is up, suggesting a possible countertrend rally or retracement within a broader bearish context. Yearly trend metrics confirm a dominant long-term downtrend, with price well below major moving averages (20, 55, 100, and 200 week), all of which are sloping downward. Swing pivots highlight a recent upward move (UTrend) in the short-term, but the intermediate-term HiLo trend is still down, and resistance levels cluster above current price, especially around 130–135. Support is seen at 127.62 and 125.33. The most recent trade signal was a short entry, aligning with the prevailing bearish structure. Overall, the market is in a corrective phase within a larger downtrend, with any rallies likely to encounter significant resistance from overhead levels and long-term moving averages.

Chart Analysis ATS AI Generated: 2025-11-02 18:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.