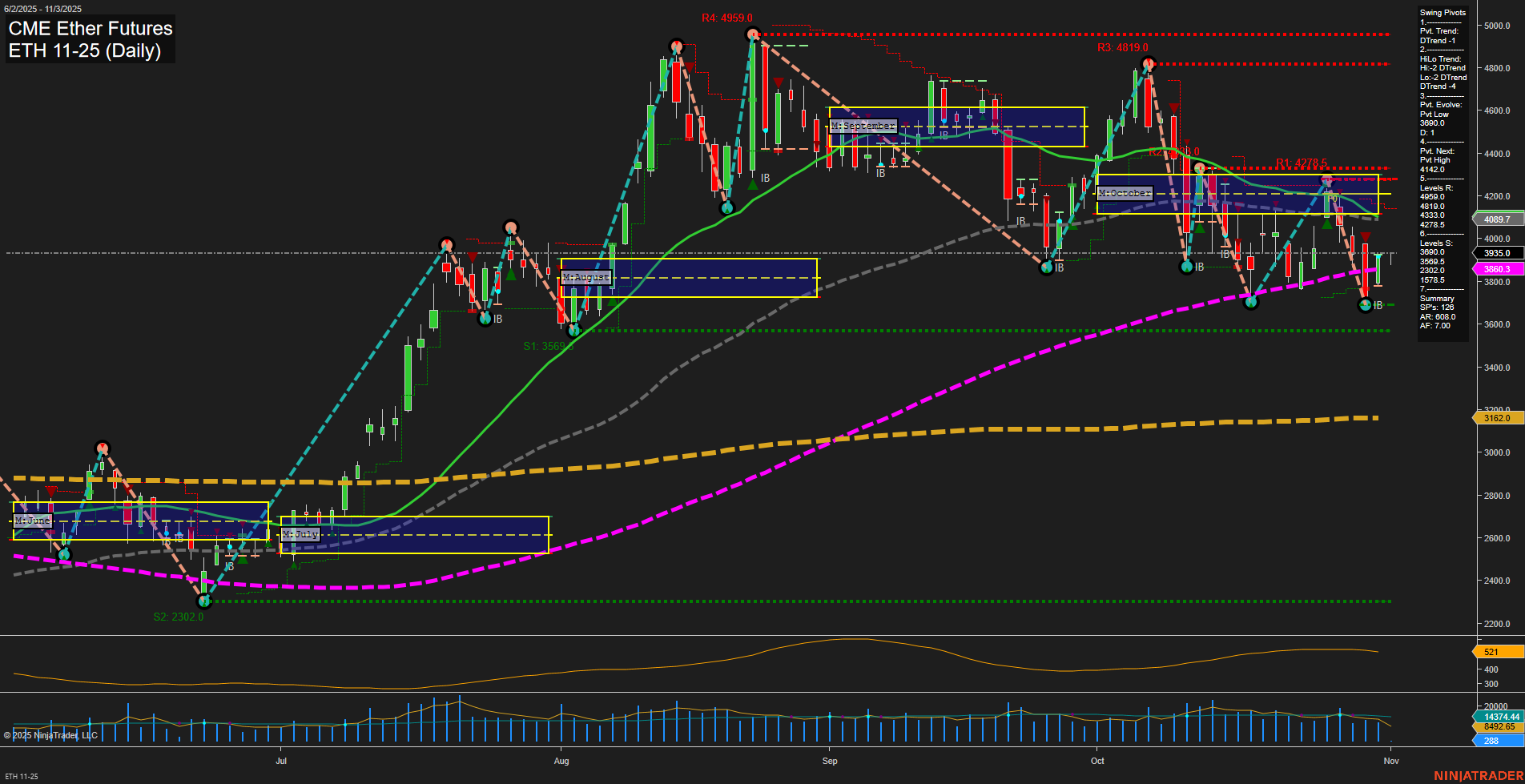

The current ETH CME Ether Futures daily chart shows a market in transition. Price action is consolidating with medium-sized bars and slow momentum, indicating a lack of strong directional conviction in the short term. The short-term (WSFG) trend is up, but the price is below the monthly session fib grid (MSFG) NTZ, and the intermediate-term trend is down, reflecting recent weakness and a series of lower highs and lower lows. Swing pivot analysis confirms a short-term and intermediate-term downtrend, with the most recent pivot low at 3935.0 acting as immediate support and resistance levels overhead at 4142.0 and 4278.5. Daily benchmarks show short-term and intermediate-term moving averages trending down, while longer-term averages remain in an uptrend, suggesting the broader bullish structure is intact but under pressure from recent pullbacks. The ATR and VOLMA indicate moderate volatility and steady volume, typical of a market in a corrective phase. Recent trade signals have shifted to short, aligning with the prevailing downtrend in the short and intermediate timeframes. Overall, the market is experiencing a corrective pullback within a longer-term uptrend, with key support and resistance levels defining the current trading range. Swing traders will note the potential for further downside in the near term, but the long-term bullish structure remains a factor to monitor for any signs of reversal or trend continuation.