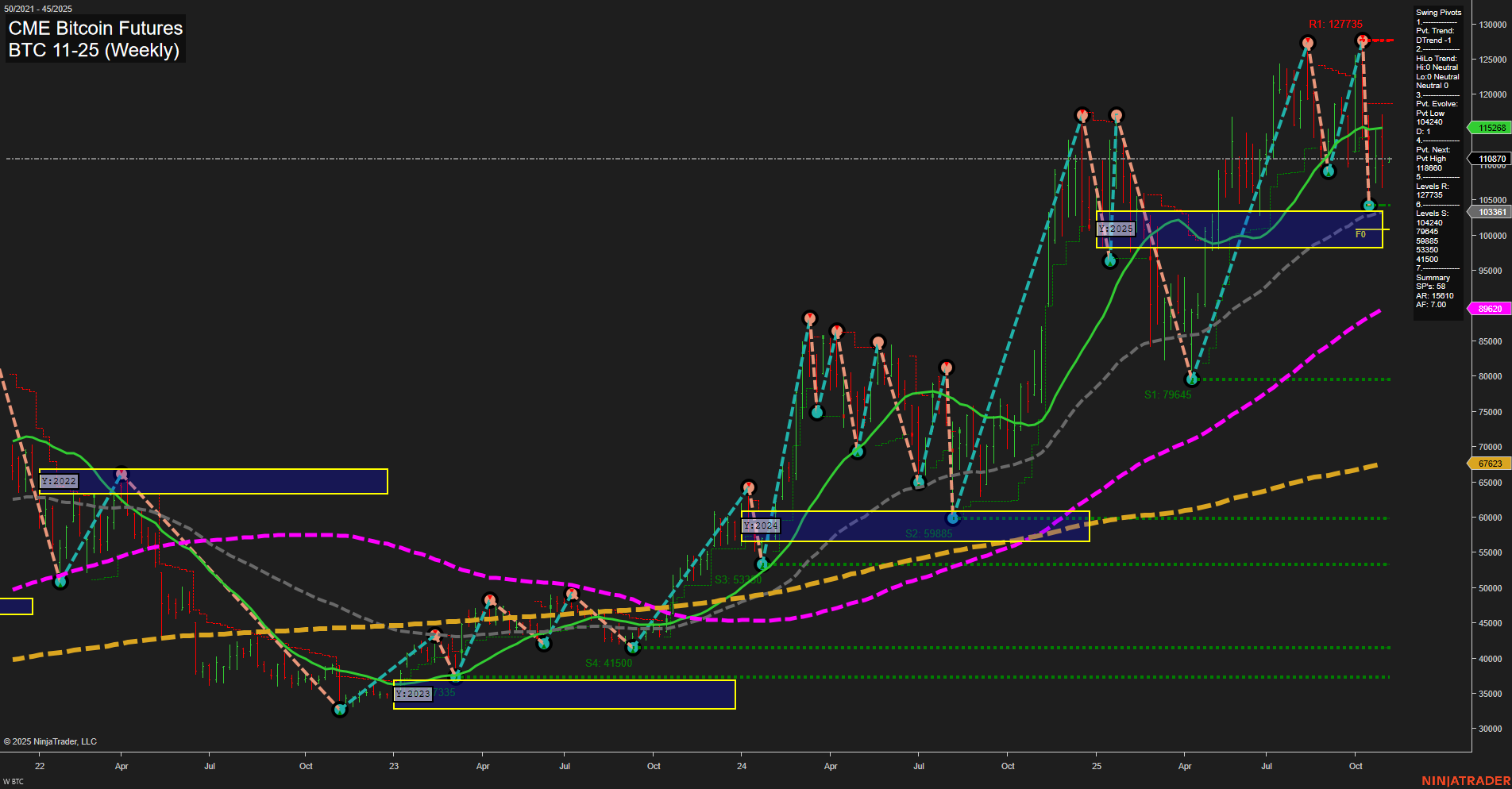

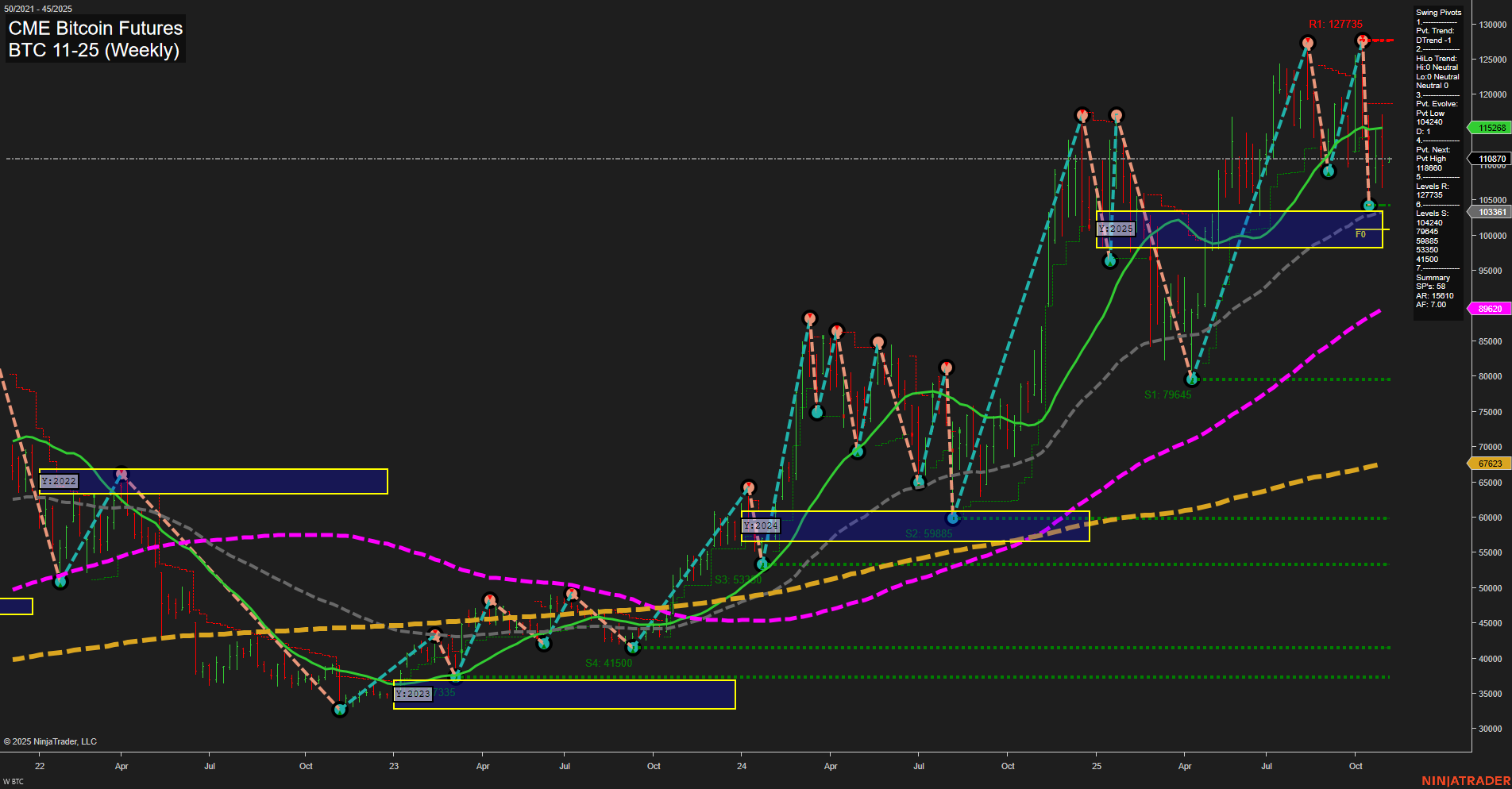

BTC CME Bitcoin Futures Weekly Chart Analysis: 2025-Nov-02 18:04 CT

Price Action

- Last: 115268,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 13%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -30%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 39%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt low 104242,

- 4. Pvt. Next: Pvt high 118460,

- 5. Levels R: 127735, 118460, 103361,

- 6. Levels S: 79645, 59886, 53305, 41500.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 113860 Up Trend,

- (Intermediate-Term) 10 Week: 110670 Up Trend,

- (Long-Term) 20 Week: 115268 Up Trend,

- (Long-Term) 55 Week: 99620 Up Trend,

- (Long-Term) 100 Week: 67623 Up Trend,

- (Long-Term) 200 Week: 59620 Up Trend.

Recent Trade Signals

- 29 Oct 2025: Short BTC 10-25 @ 112555 Signals.USAR.TR120

- 28 Oct 2025: Short BTC 10-25 @ 113145 Signals.USAR-MSFG

- 27 Oct 2025: Long BTC 10-25 @ 115395 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral

- Intermediate-Term: Neutral

- Long-Term: Bullish

Key Insights Summary

The BTC CME Bitcoin Futures weekly chart shows a market in transition. Price action is volatile with large bars and fast momentum, reflecting heightened activity and possible news-driven volatility. The short-term WSFG trend is up, with price holding above the NTZ center, but the most recent swing pivot trend has shifted to a short-term downtrend, suggesting a pullback or correction phase within the broader uptrend. Intermediate-term MSFG is down, with price below the monthly NTZ, and the HiLo trend is neutral, indicating indecision or consolidation after a strong move. Long-term YSFG and all major moving averages remain in strong uptrends, confirming the underlying bullish structure. Key resistance is overhead at 127735 and 118460, while support is well below at 104242 and 79645, highlighting a wide trading range. Recent trade signals show mixed short-term and intermediate-term shorts, but a long signal from the weekly session grid, reinforcing the current choppy, range-bound environment. Overall, the market is consolidating after a strong rally, with long-term bullish momentum intact but short- and intermediate-term trends showing signs of pause or retracement. Swing traders may see opportunities in both directions as the market tests key levels and digests recent gains.

Chart Analysis ATS AI Generated: 2025-11-02 18:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.