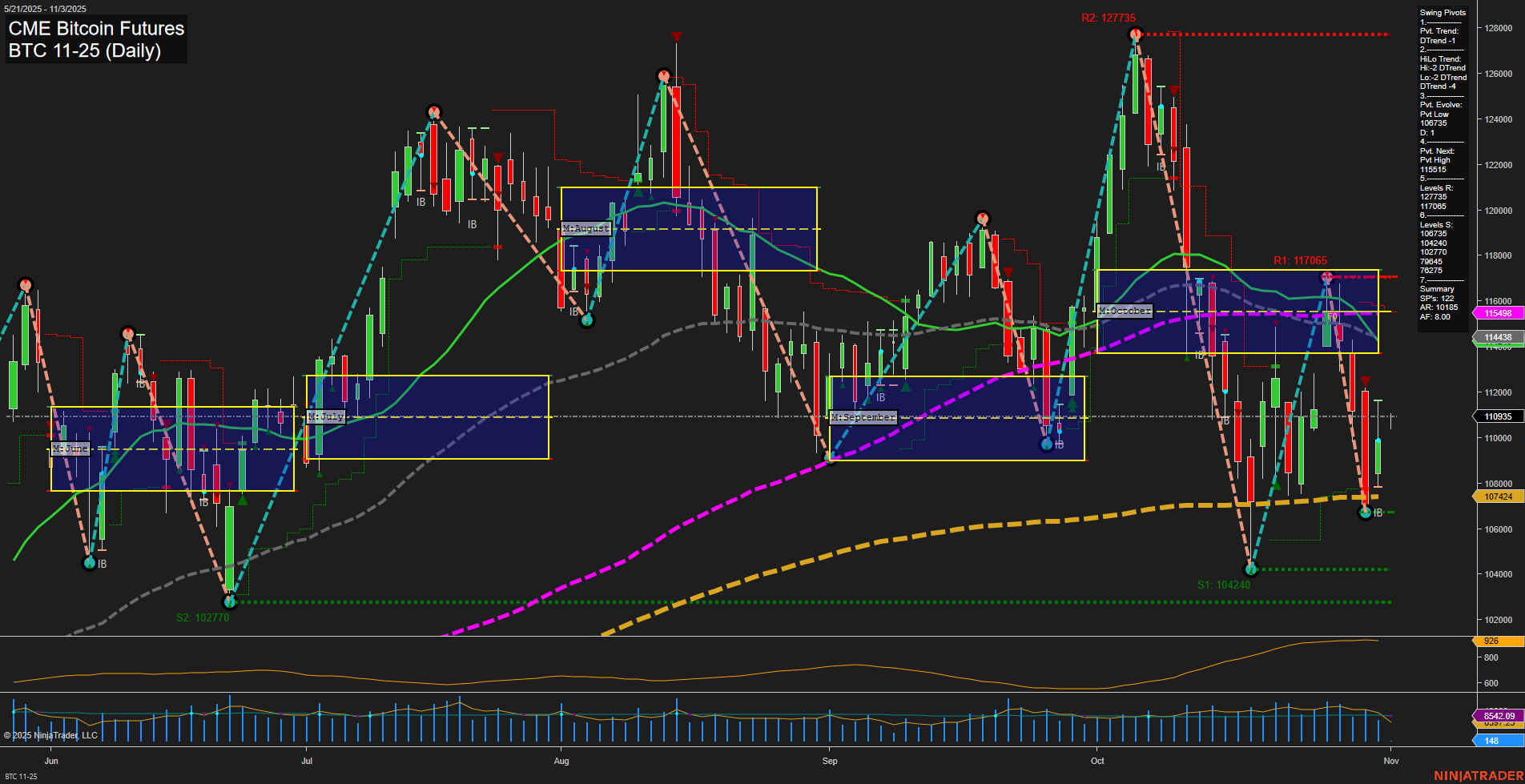

The current BTC CME futures daily chart reflects a market in transition. Price action is showing medium-sized bars with slow momentum, indicating a lack of strong conviction in either direction. Short-term and intermediate-term trends are both bearish, as confirmed by the downward direction of the 5, 10, 20, 55, and 100-day moving averages, as well as the swing pivot trends (DTrend). The most recent swing pivot is a low at 104240, with the next potential reversal at the 115615 pivot high, suggesting a wide range for possible price movement. The weekly session fib grid (WSFG) remains in an uptrend with price above the F0% level, but the monthly session fib grid (MSFG) is in a downtrend with price below its F0%, highlighting a divergence between short-term and intermediate-term outlooks. The yearly session fib grid (YSFG) is still up, supporting a longer-term bullish bias. Recent trade signals have favored the short side, aligning with the prevailing short-term and intermediate-term bearish structure. However, the 200-day moving average is still trending up, and the yearly fib grid trend remains positive, suggesting that the broader bull cycle is intact despite the current retracement. Volatility, as measured by ATR, is moderate, and volume metrics are stable, indicating that the market is not experiencing extreme moves or panic. The chart structure shows a series of lower highs and lower lows, with key resistance levels overhead and support clustered around the recent swing lows. In summary, the market is currently in a corrective phase within a larger bullish context. Short and intermediate-term traders are facing a bearish environment, while long-term participants may view this as a potential pullback within an ongoing uptrend. The market is consolidating after a recent sell-off, and traders are watching for either a continuation lower or a reversal from support.