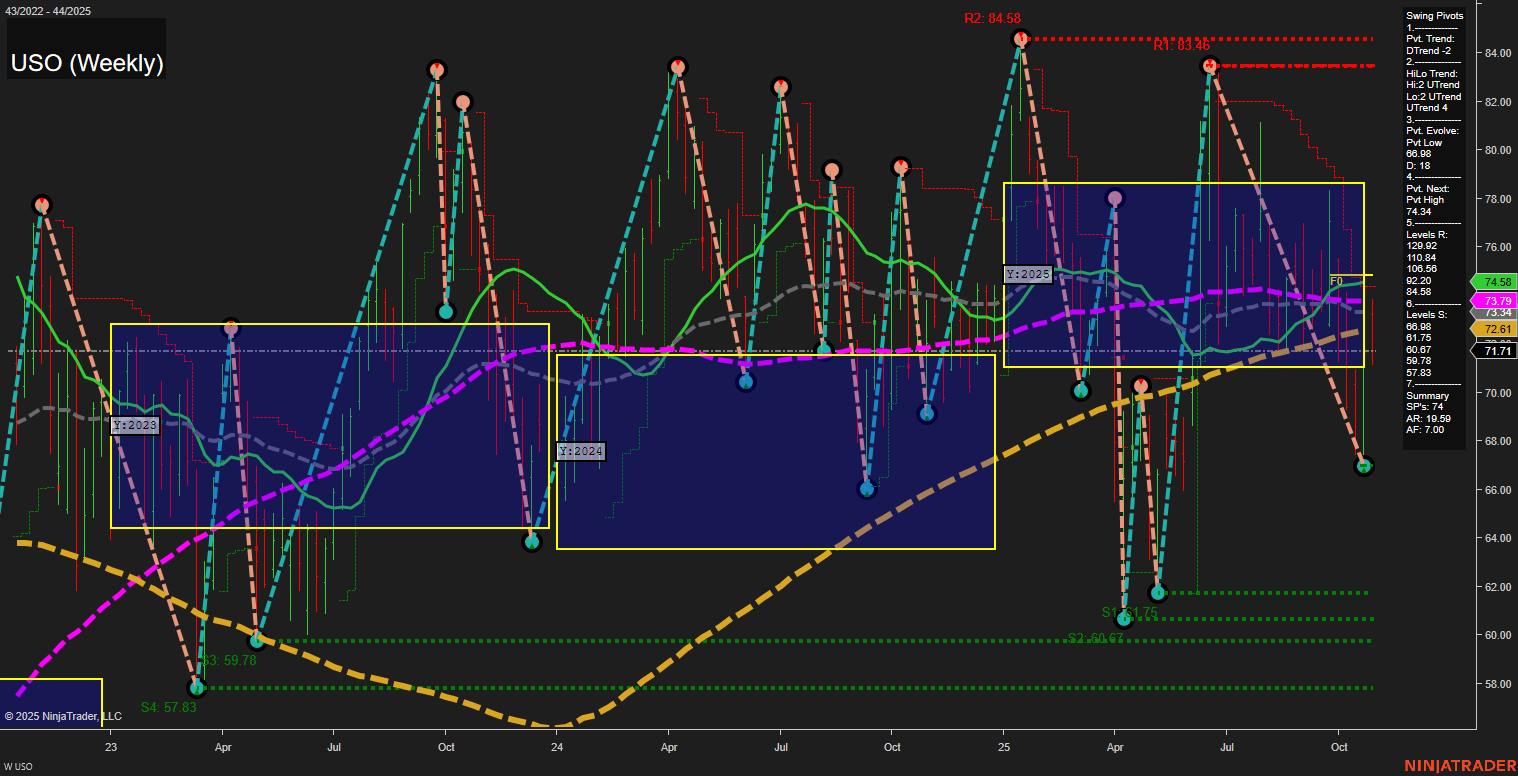

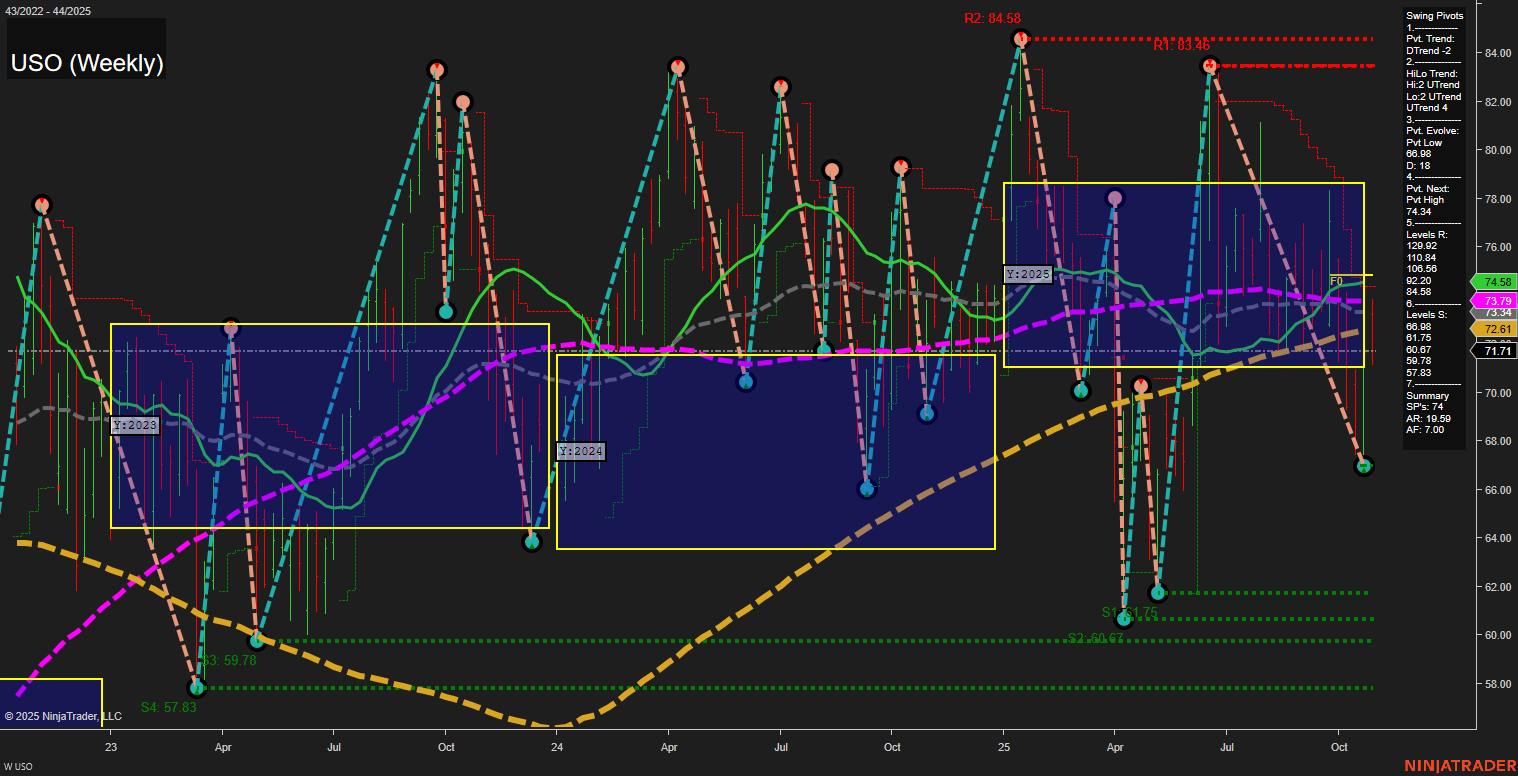

USO United States Oil Fund LP Weekly Chart Analysis: 2025-Oct-31 07:19 CT

Price Action

- Last: 71.71,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 61.75,

- 4. Pvt. Next: Pvt high 74.34,

- 5. Levels R: 120.98, 106.56, 92.20, 84.58, 83.46, 74.34,

- 6. Levels S: 71.71, 61.75, 60.69, 59.78, 57.83.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 73.79 Down Trend,

- (Intermediate-Term) 10 Week: 72.61 Down Trend,

- (Long-Term) 20 Week: 74.58 Down Trend,

- (Long-Term) 55 Week: 73.54 Down Trend,

- (Long-Term) 100 Week: 73.79 Down Trend,

- (Long-Term) 200 Week: 59.78 Up Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

USO is exhibiting pronounced volatility with large weekly bars and fast momentum, reflecting a sharp move lower in recent sessions. The short-term and intermediate-term swing pivot trends are both down, with the most recent pivot low at 61.75 and the next potential resistance at 74.34. All key weekly moving averages (5, 10, 20, 55, 100) are trending down and price is currently below these benchmarks, reinforcing a bearish bias in the short and intermediate term. The 200-week moving average remains in an uptrend, suggesting that the longer-term structure is still intact, but price is approaching key support levels. The chart shows a broad neutral bias from the session fib grids, indicating a lack of clear directional conviction on a yearly or monthly basis, but the prevailing technicals point to a market under pressure, with potential for further downside unless a strong reversal develops at support. The environment is choppy and reactive, with recent price action testing and rejecting higher levels, and the market currently probing lower support zones.

Chart Analysis ATS AI Generated: 2025-10-31 07:19 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.