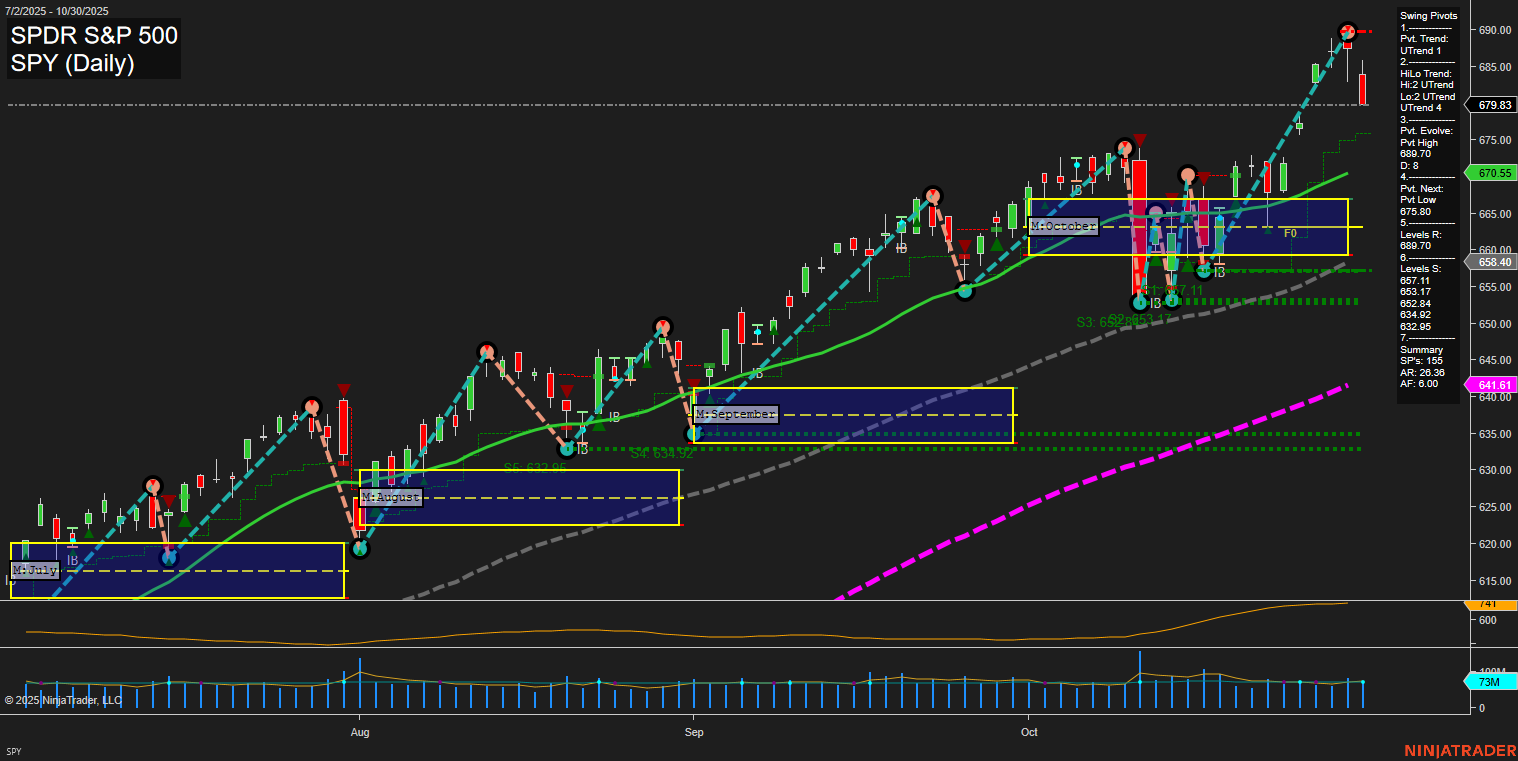

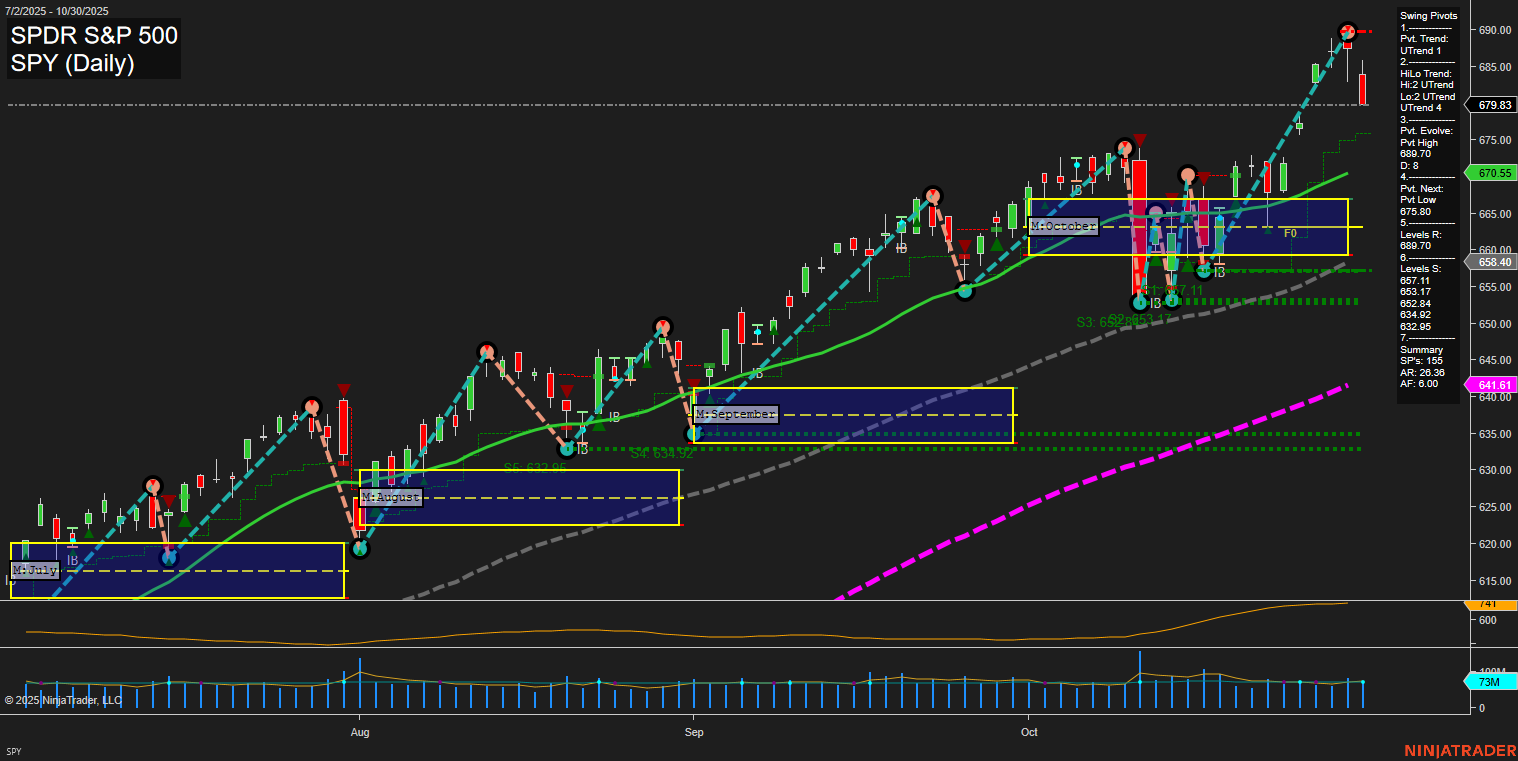

SPY SPDR S&P 500 Daily Chart Analysis: 2025-Oct-31 07:16 CT

Price Action

- Last: 679.83,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 679.83,

- 4. Pvt. Next: Pvt Low 658.80,

- 5. Levels R: 679.83,

- 6. Levels S: 657.11, 653.17, 652.34, 634.92, 632.95.

Daily Benchmarks

- (Short-Term) 5 Day: 670.55 Up Trend,

- (Short-Term) 10 Day: 658.40 Up Trend,

- (Intermediate-Term) 20 Day: 641.61 Up Trend,

- (Intermediate-Term) 55 Day: 641.61 Up Trend,

- (Long-Term) 100 Day: 641.61 Up Trend,

- (Long-Term) 200 Day: 641.61 Up Trend.

Additional Metrics

- ATR: 564,

- VOLMA: 47470907.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

SPY is exhibiting strong bullish momentum with a large, fast-moving price bar closing at new highs, confirming a short-term and intermediate-term uptrend in both swing pivots and moving averages. All benchmark moving averages are aligned in uptrends, supporting a robust trend structure. The most recent swing pivot is a new high at 679.83, with the next potential pivot low at 658.80, and multiple support levels below, indicating a well-supported advance. Volatility (ATR) is elevated, and volume remains healthy, suggesting active participation in the current move. The market has broken out from a consolidation zone, with no immediate resistance above, and is in a clear trend continuation phase. This environment is favorable for trend-following swing strategies, with the structure showing higher highs and higher lows, and no technical signs of exhaustion or reversal at this stage.

Chart Analysis ATS AI Generated: 2025-10-31 07:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.