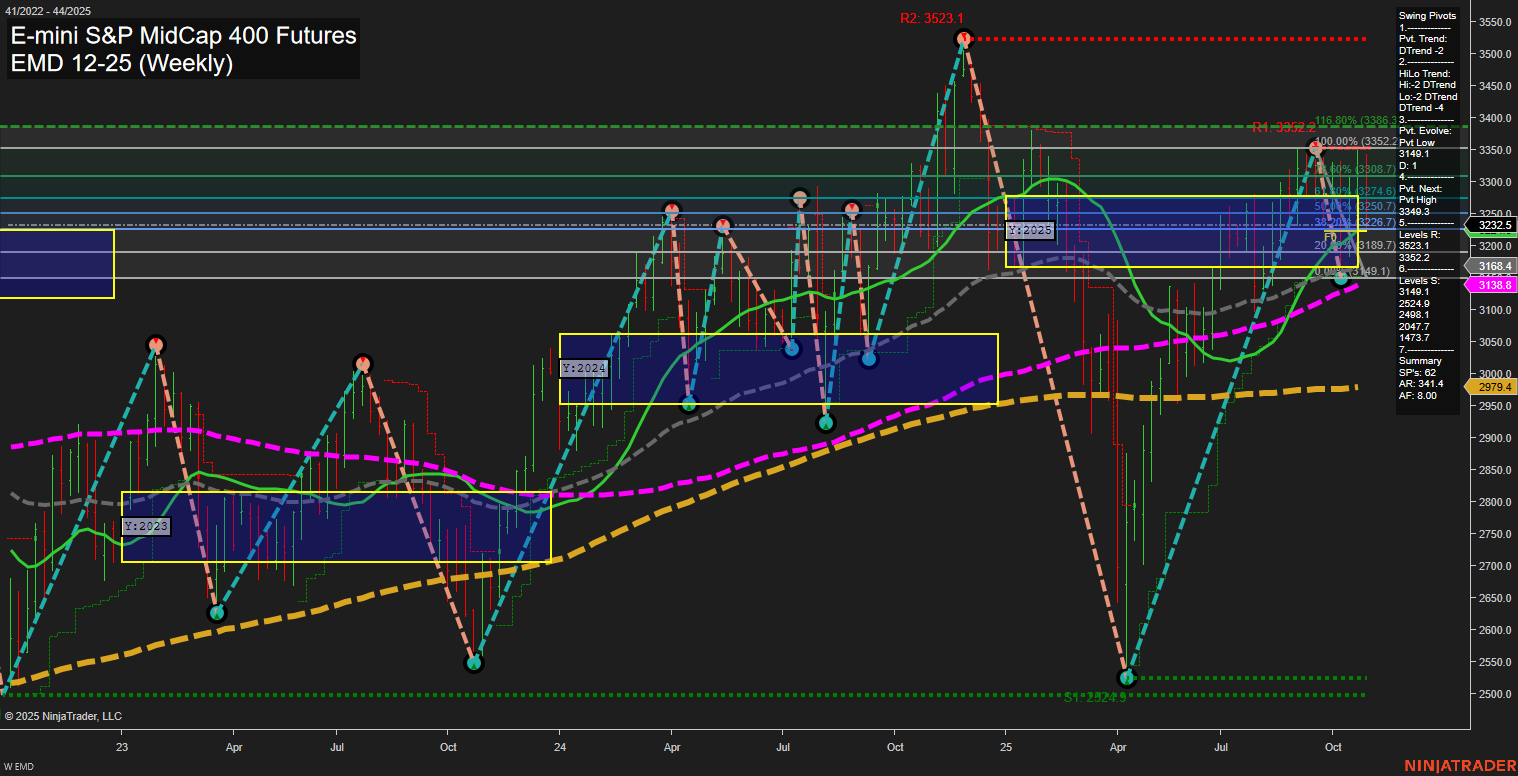

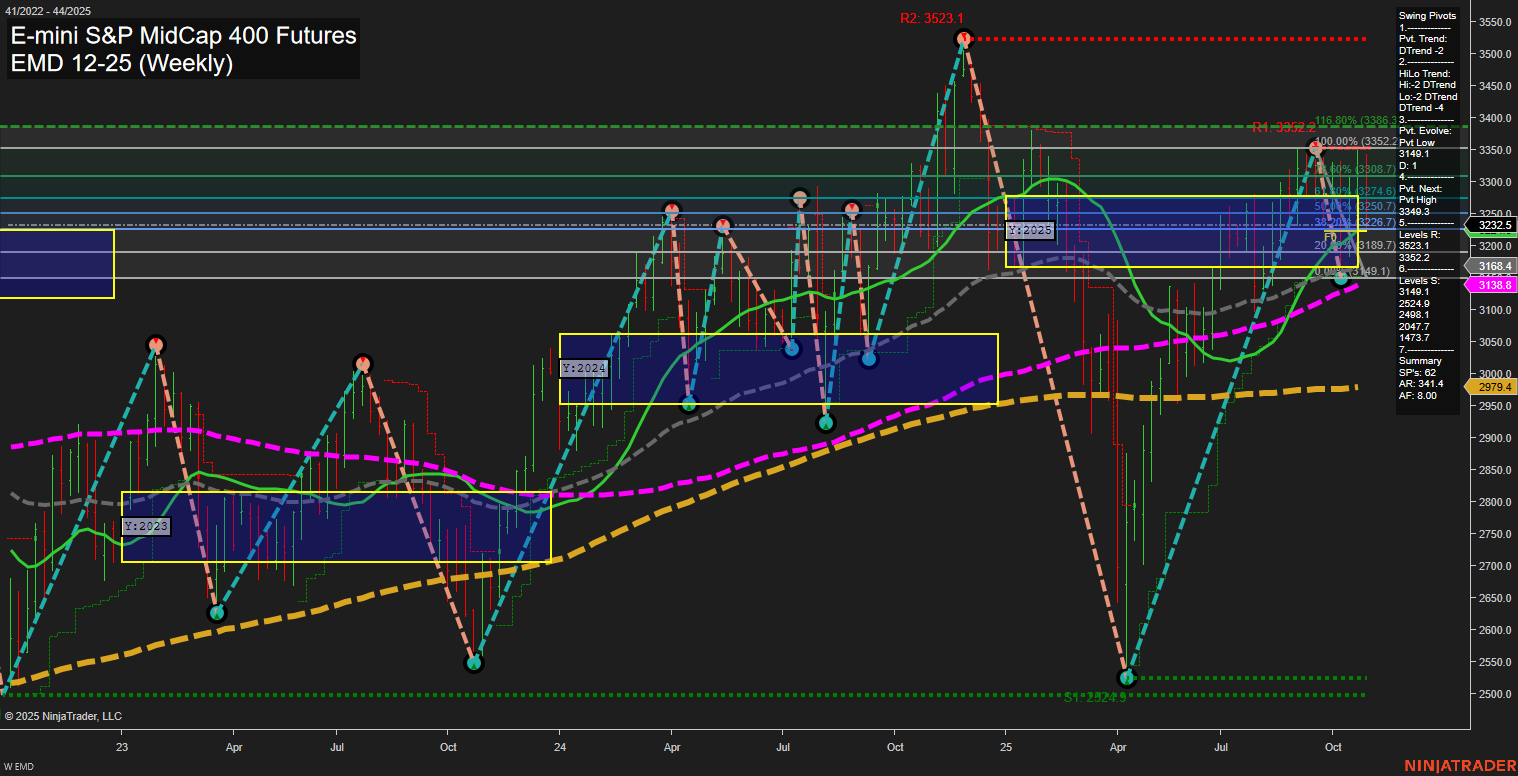

EMD E-mini S&P MidCap 400 Futures Weekly Chart Analysis: 2025-Oct-31 07:06 CT

Price Action

- Last: 3232.5,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -70%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -20%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 3352.2,

- 4. Pvt. Next: Pvt low 3149.1,

- 5. Levels R: 3523.1, 3352.2, 3247.6,

- 6. Levels S: 3149.1, 2524.9, 2489.1, 2047.7, 1473.7.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3274.6 Down Trend,

- (Intermediate-Term) 10 Week: 3276.9 Down Trend,

- (Long-Term) 20 Week: 3168.4 Up Trend,

- (Long-Term) 55 Week: 3138.8 Up Trend,

- (Long-Term) 100 Week: 2977.4 Up Trend,

- (Long-Term) 200 Week: 2990.0 Up Trend.

Recent Trade Signals

- 30 Oct 2025: Short EMD 12-25 @ 3237.5 Signals.USAR-MSFG

- 28 Oct 2025: Short EMD 12-25 @ 3294.5 Signals.USAR-WSFG

- 28 Oct 2025: Short EMD 12-25 @ 3300.6 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The EMD futures weekly chart shows a pronounced shift in short- and intermediate-term momentum to the downside, as evidenced by large, fast-moving bars and a series of recent short trade signals. Both the WSFG and MSFG trends are down, with price trading below their respective NTZ/F0% levels, confirming a bearish bias in the near term. Swing pivot analysis highlights a developing downtrend, with the next key support at 3149.1 and resistance at 3352.2 and 3523.1. However, the long-term YSFG trend remains up, and all major long-term moving averages (20, 55, 100, 200 week) are still in uptrends, suggesting underlying structural strength. The market appears to be in a corrective phase within a broader uptrend, with volatility elevated and a potential test of lower support zones underway. This environment is characterized by sharp pullbacks and possible retracements, with the potential for a bounce or trend continuation depending on how price reacts at key support levels.

Chart Analysis ATS AI Generated: 2025-10-31 07:07 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.