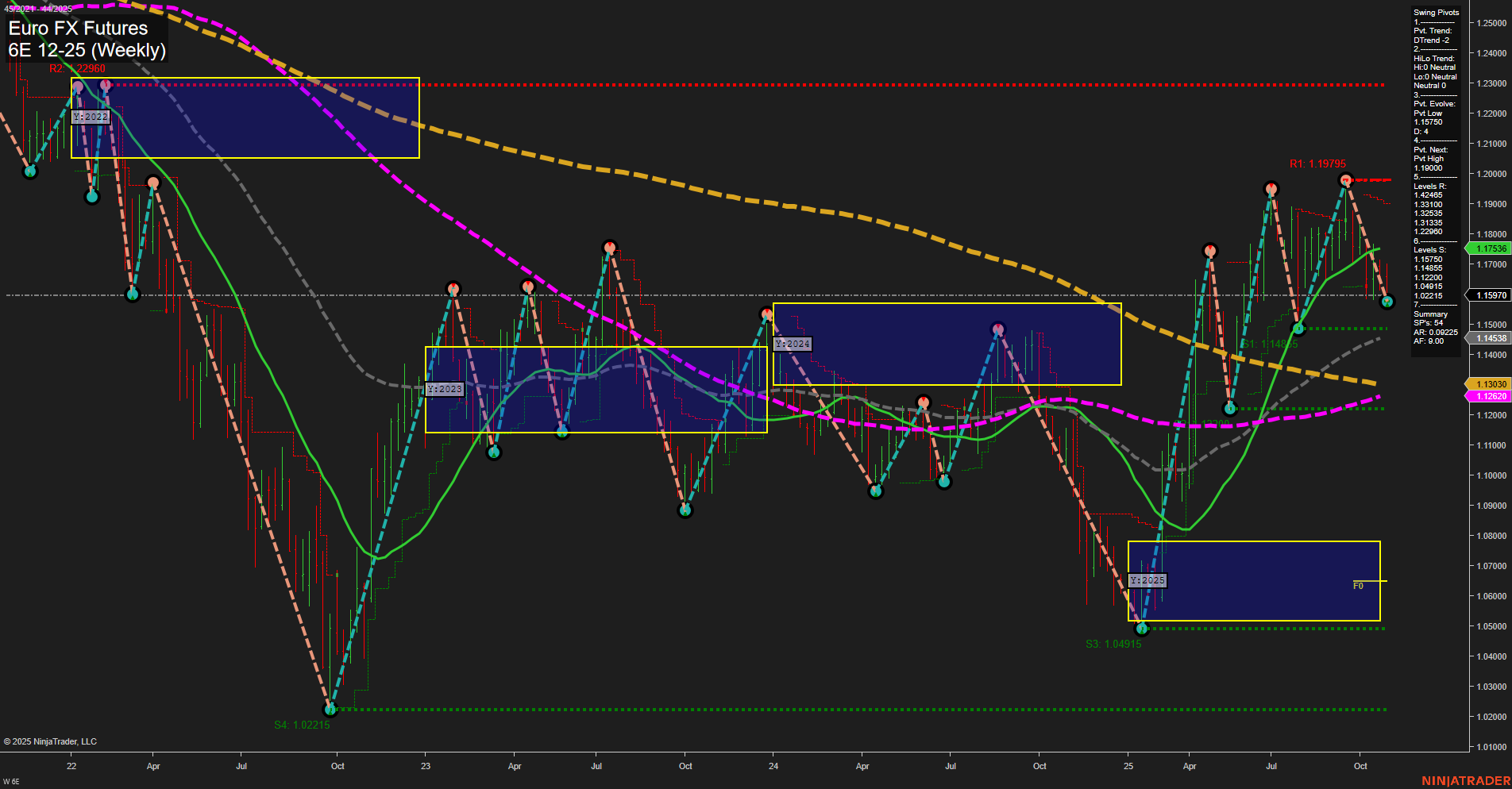

The 6E Euro FX Futures weekly chart shows a market under short-term and intermediate-term pressure, with both the WSFG and MSFG trends pointing down and price trading below their respective NTZ/F0% levels. The most recent swing pivot trend is down, and the last two trade signals have been short, confirming the prevailing bearish sentiment in the short-term. Momentum is slow, and price action is consolidating near a recent swing low, with medium-sized bars indicating some volatility but not a breakout environment. Intermediate-term benchmarks (5 and 10 week MAs) are trending down, reinforcing the bearish bias, while long-term moving averages are mixed: the 20 and 55 week MAs are up, but the 100 and 200 week MAs remain in downtrends, suggesting the longer-term trend is still in transition and not yet decisively bullish. The yearly session fib grid (YSFG) trend is up, with price above the yearly NTZ/F0%, but this is being challenged by the current pullback. Support levels to watch are 1.15970 and 1.14456, with resistance at 1.17356 and 1.19005. The market is in a corrective phase within a broader long-term uptrend, but the short and intermediate-term outlook remains bearish until a reversal or strong bounce is confirmed. The chart reflects a market in a pullback or retracement phase, with potential for further downside before any resumption of the longer-term uptrend.