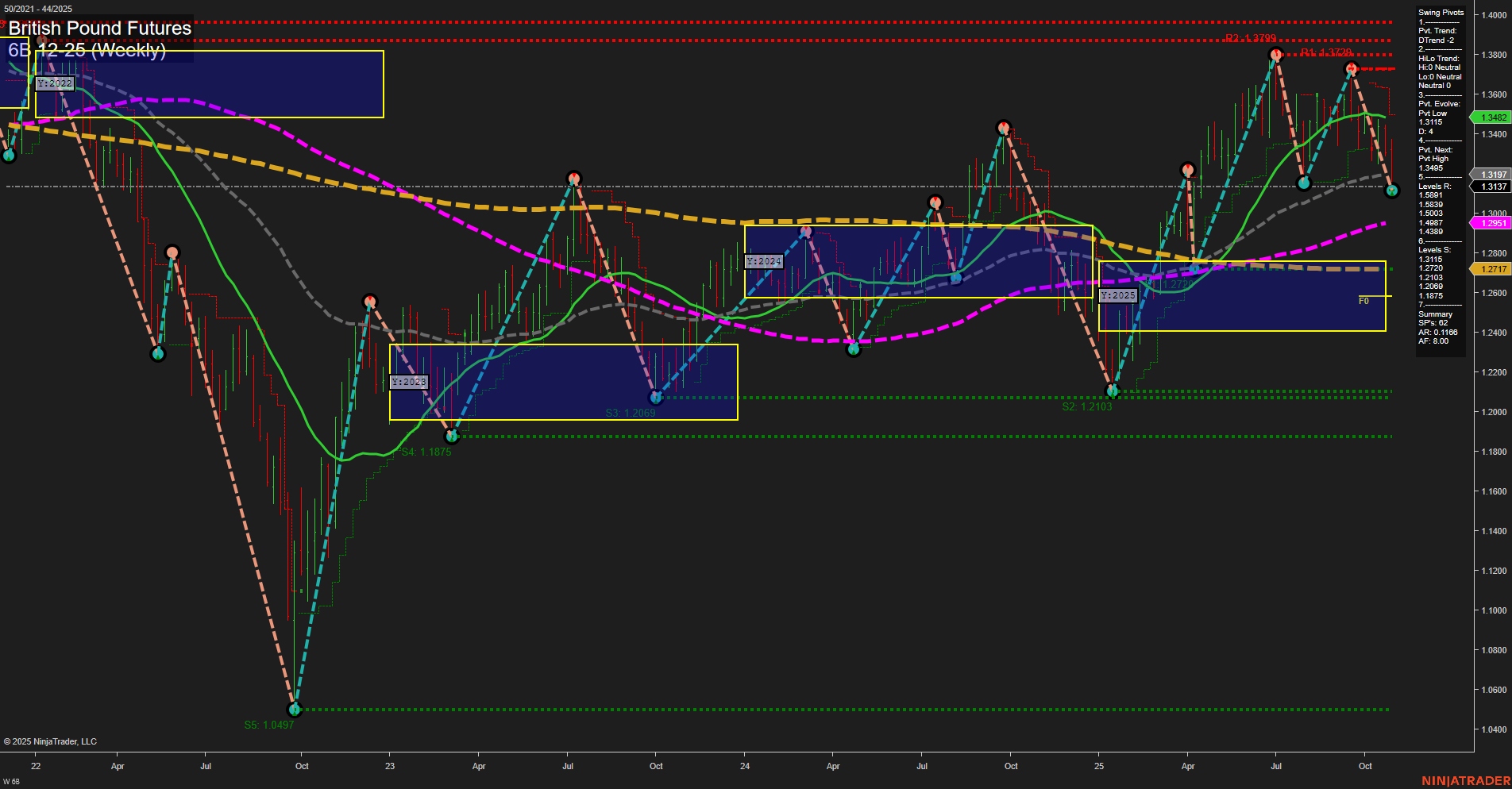

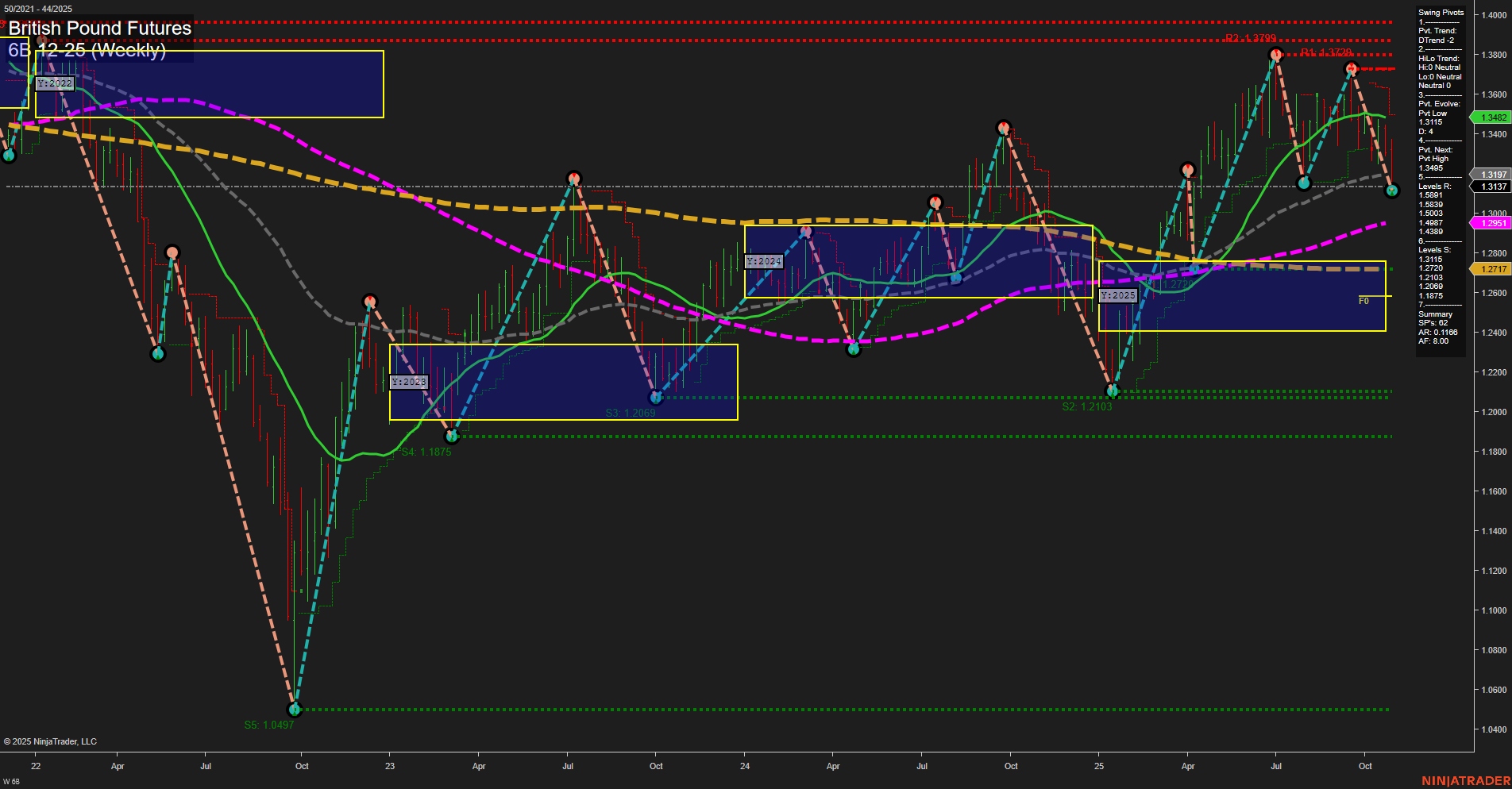

6B British Pound Futures Weekly Chart Analysis: 2025-Oct-31 07:01 CT

Price Action

- Last: 1.3197,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -98%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -70%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 31%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.3197,

- 4. Pvt. Next: Pvt high 1.3482,

- 5. Levels R: 1.3738, 1.3799,

- 6. Levels S: 1.3197, 1.3137, 1.2069, 1.1875, 1.2103, 1.0497.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.3197 Down Trend,

- (Intermediate-Term) 10 Week: 1.3137 Down Trend,

- (Long-Term) 20 Week: 1.3482 Up Trend,

- (Long-Term) 55 Week: 1.2901 Up Trend,

- (Long-Term) 100 Week: 1.2717 Up Trend,

- (Long-Term) 200 Week: 1.2770 Up Trend.

Recent Trade Signals

- 28 Oct 2025: Short 6B 12-25 @ 1.3277 Signals.USAR.TR120

- 28 Oct 2025: Short 6B 12-25 @ 1.3284 Signals.USAR-WSFG

- 23 Oct 2025: Short 6B 12-25 @ 1.3349 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The British Pound Futures (6B) weekly chart shows a clear divergence between short/intermediate-term and long-term trends. Price action is currently subdued with medium bars and slow momentum, reflecting a period of consolidation or mild retracement after recent declines. Both the Weekly and Monthly Session Fib Grids (WSFG, MSFG) indicate strong downward pressure, with price trading well below their respective NTZ/F0% levels and recent short signals confirming this bearish bias. Swing pivots reinforce the downtrend, with the most recent pivot low at 1.3197 and the next resistance at 1.3482, while support levels cluster below current price, suggesting potential for further downside tests. However, the long-term Yearly Session Fib Grid (YSFG) and all major long-term moving averages remain in uptrends, indicating that the broader bullish structure is intact despite the current pullback. This setup is typical of a corrective phase within a larger uptrend, where short-term weakness may eventually give way to renewed buying interest if key support levels hold. The market is currently in a corrective or counter-trend move within a longer-term bullish cycle, with volatility likely to persist as price tests support and resistance zones.

Chart Analysis ATS AI Generated: 2025-10-31 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.