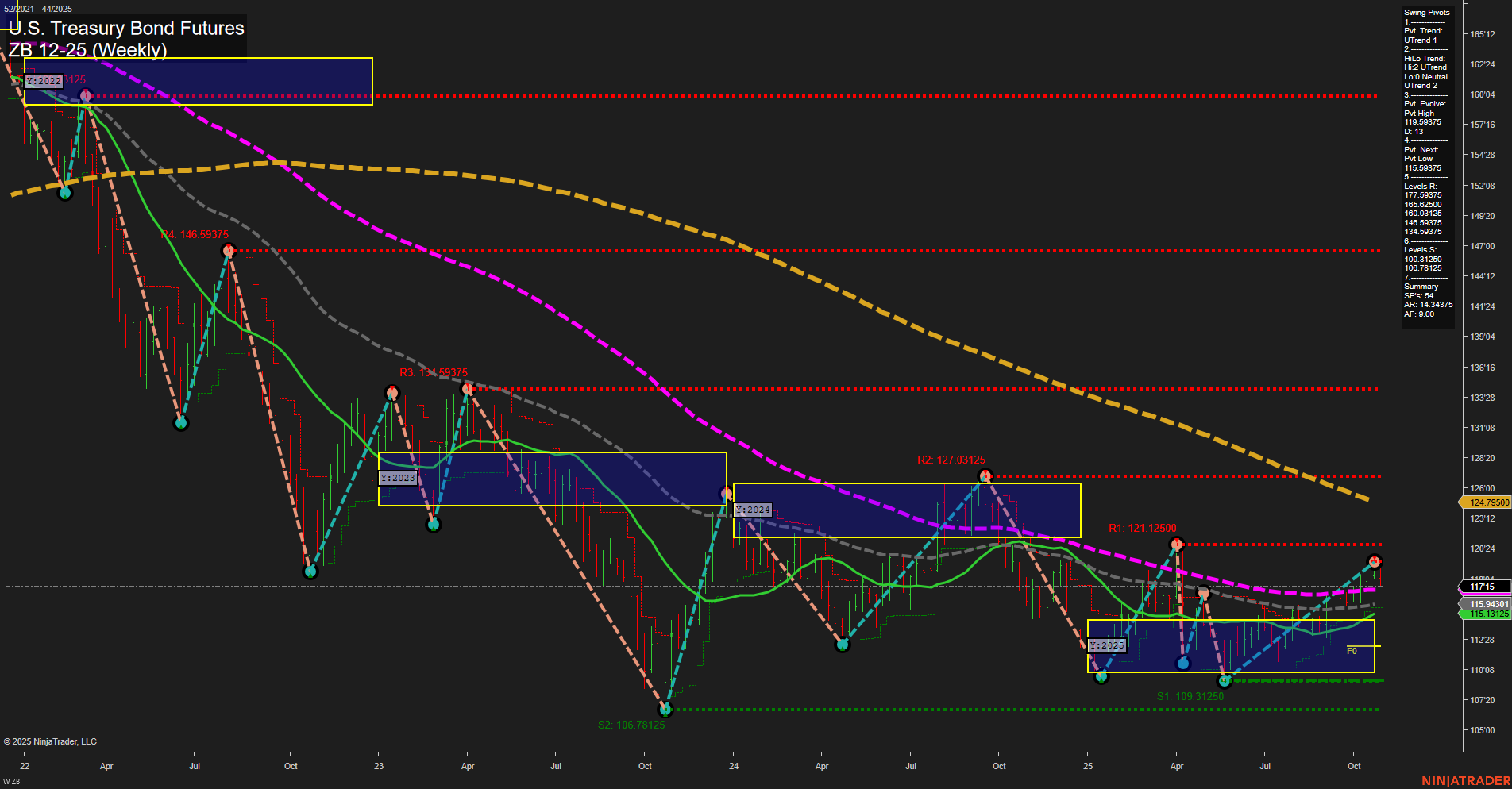

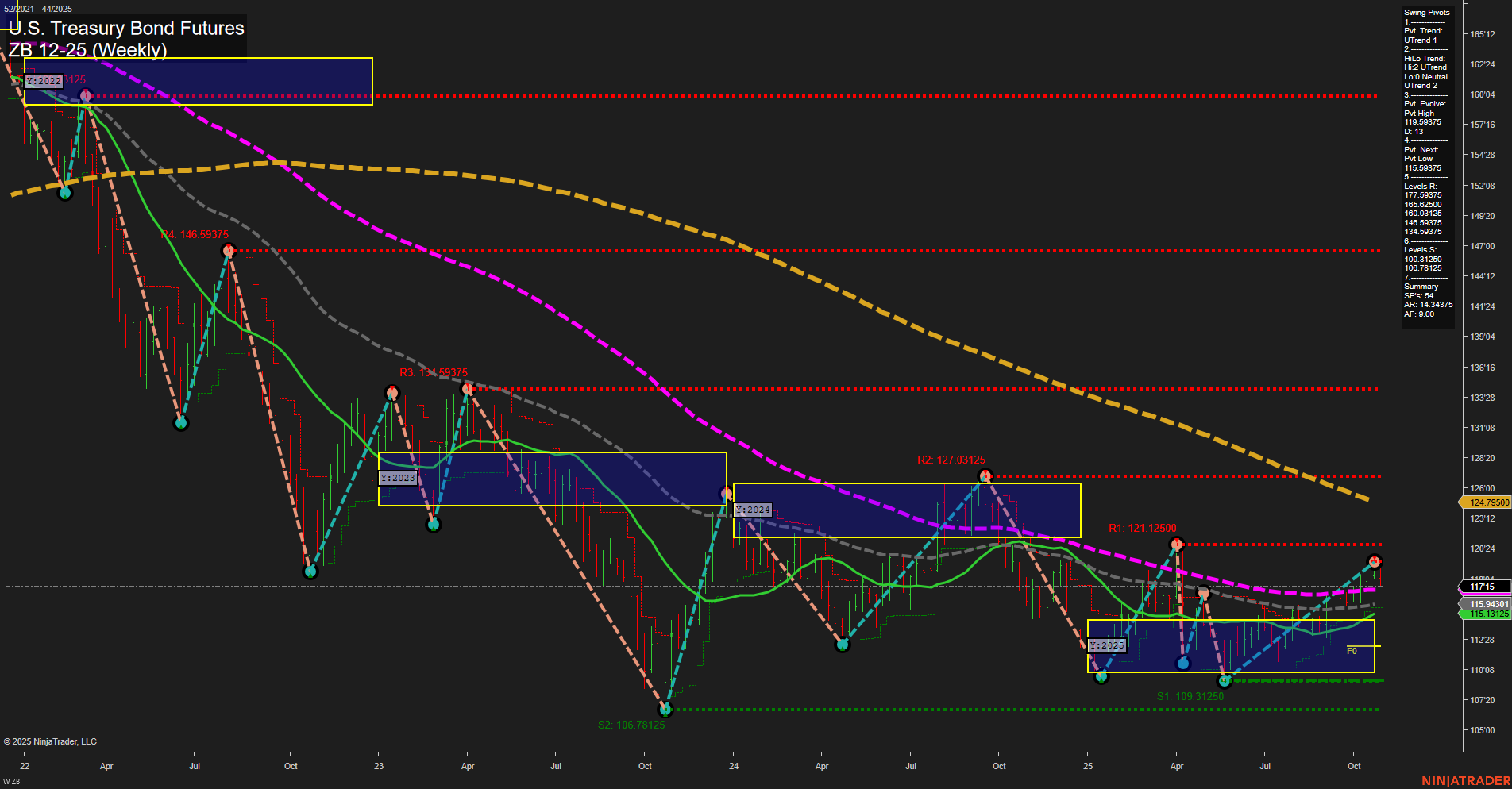

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Oct-30 07:18 CT

Price Action

- Last: 124'7950,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 119'59375,

- 4. Pvt. Next: Pvt Low 115'59375,

- 5. Levels R: 177'59375, 165'09375, 160'03125, 134'69375, 119'59375,

- 6. Levels S: 109'31250, 106'78125, 100'31250, 100'78125.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: NA Up Trend,

- (Intermediate-Term) 10 Week: NA Up Trend,

- (Long-Term) 20 Week: 117'15 Up Trend,

- (Long-Term) 55 Week: 115'13 Up Trend,

- (Long-Term) 100 Week: 121'12 Down Trend,

- (Long-Term) 200 Week: 146'59 Down Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart shows a notable shift in momentum, with both short-term and intermediate-term swing pivots trending upward, indicating a recovery phase from prior lows. Price is currently above the 20- and 55-week moving averages, both of which are in uptrends, reinforcing the bullish tone in the medium term. However, the 100- and 200-week moving averages remain in downtrends, suggesting that the longer-term structure is still neutral and has not fully reversed from the broader decline seen over the past two years. The price is consolidating above key support levels (notably 115'59375 and 109'31250), with resistance overhead at 119'59375 and 134'69375. The neutral bias in the session fib grids (WSFG, MSFG, YSFG) reflects a market in transition, with neither strong bullish nor bearish conviction dominating. The chart structure hints at a possible base-building process, with higher lows and a series of swing highs being tested. Volatility appears moderate, and the market is in a potential accumulation phase, awaiting a catalyst for a sustained breakout or reversal of the long-term trend.

Chart Analysis ATS AI Generated: 2025-10-30 07:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.