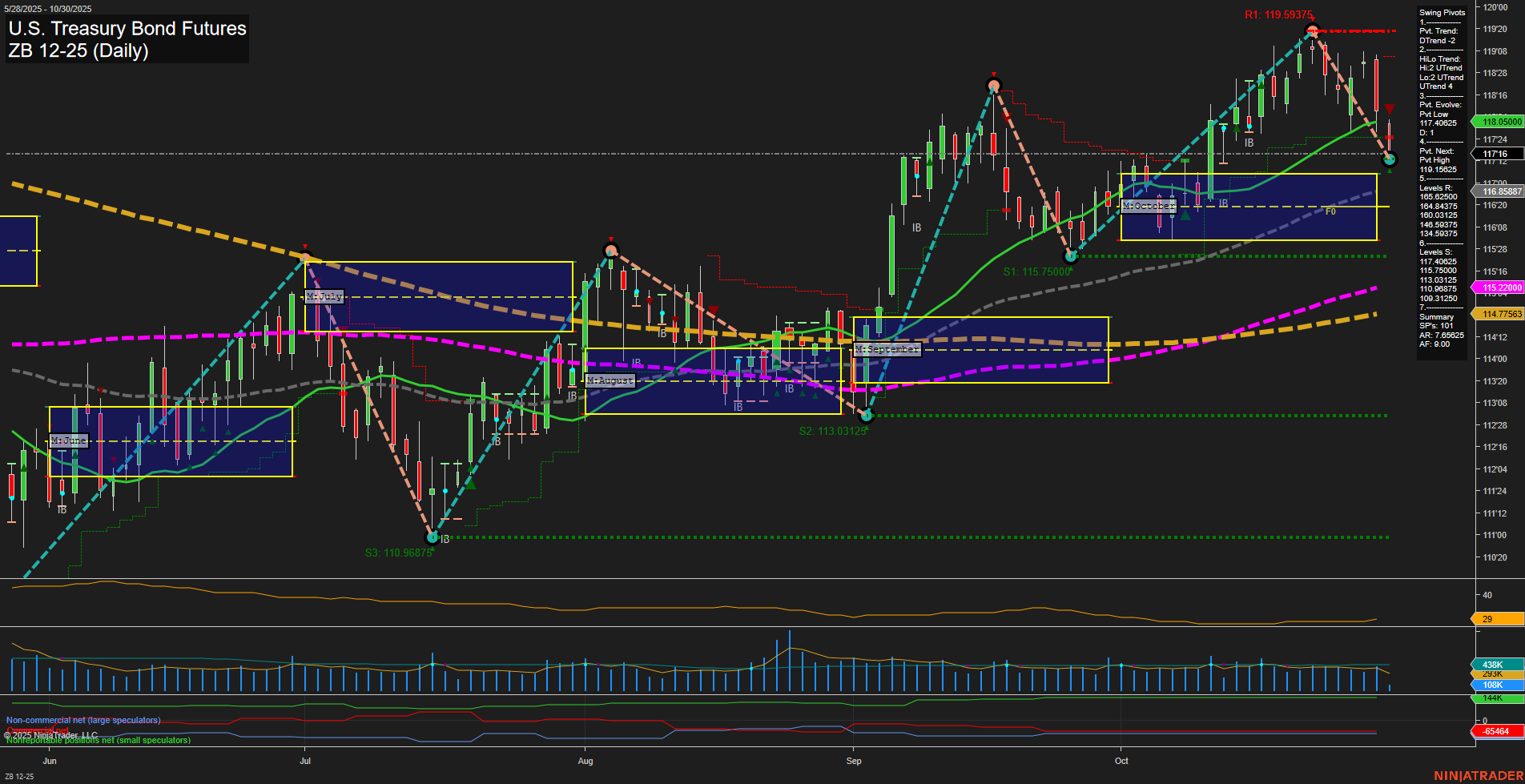

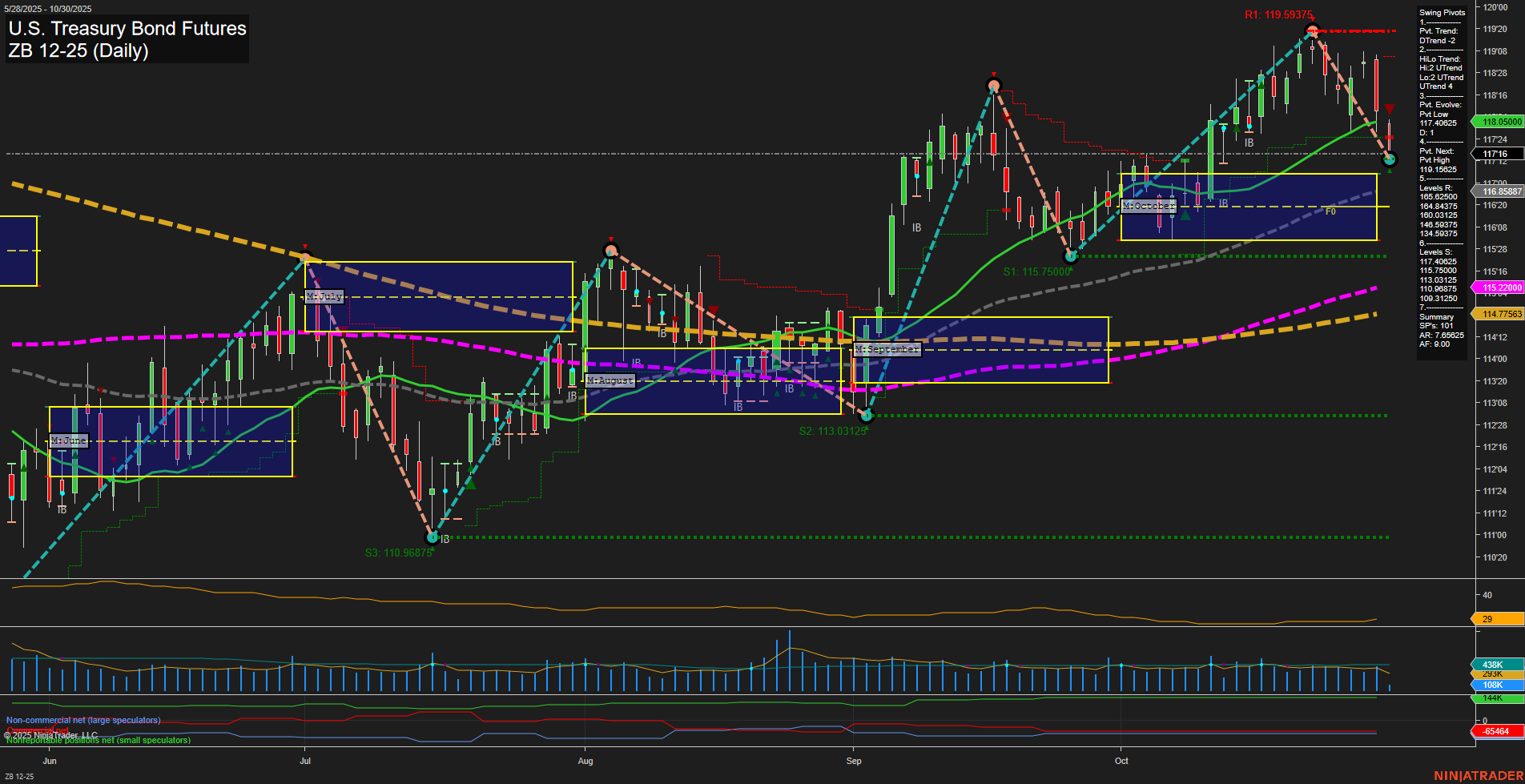

ZB U.S. Treasury Bond Futures Daily Chart Analysis: 2025-Oct-30 07:18 CT

Price Action

- Last: 118.05000,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 119.59375,

- 4. Pvt. Next: Pvt low 116.19525,

- 5. Levels R: 119.59375, 116.85887,

- 6. Levels S: 115.75000, 115.22000, 113.96875, 113.03125, 110.96875.

Daily Benchmarks

- (Short-Term) 5 Day: 117.74 Down Trend,

- (Short-Term) 10 Day: 116.85 Up Trend,

- (Intermediate-Term) 20 Day: 115.92 Up Trend,

- (Intermediate-Term) 55 Day: 115.16 Up Trend,

- (Long-Term) 100 Day: 114.78 Up Trend,

- (Long-Term) 200 Day: 115.22 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The ZB U.S. Treasury Bond Futures daily chart currently reflects a mixed environment. Price action shows a recent pivot high at 119.59375, with the short-term swing pivot trend turning down (DTrend), indicating a pullback or retracement phase after a strong rally. The intermediate and long-term trends, as indicated by both swing pivots and moving averages, remain upward, suggesting underlying bullish momentum. The 5-day MA is in a downtrend, but all other key moving averages (10, 20, 55, 100, 200-day) are trending up, reinforcing the longer-term bullish structure. Support levels are layered below, with the nearest at 115.75 and 115.22, while resistance is defined by the recent swing high. Volatility (ATR) and volume metrics are moderate, with no extreme readings. The overall structure suggests a short-term correction within a broader uptrend, typical of consolidation or a healthy pullback after a rally. No clear breakout or breakdown is evident, and the market appears to be digesting recent gains, possibly awaiting new catalysts or macroeconomic developments.

Chart Analysis ATS AI Generated: 2025-10-30 07:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.