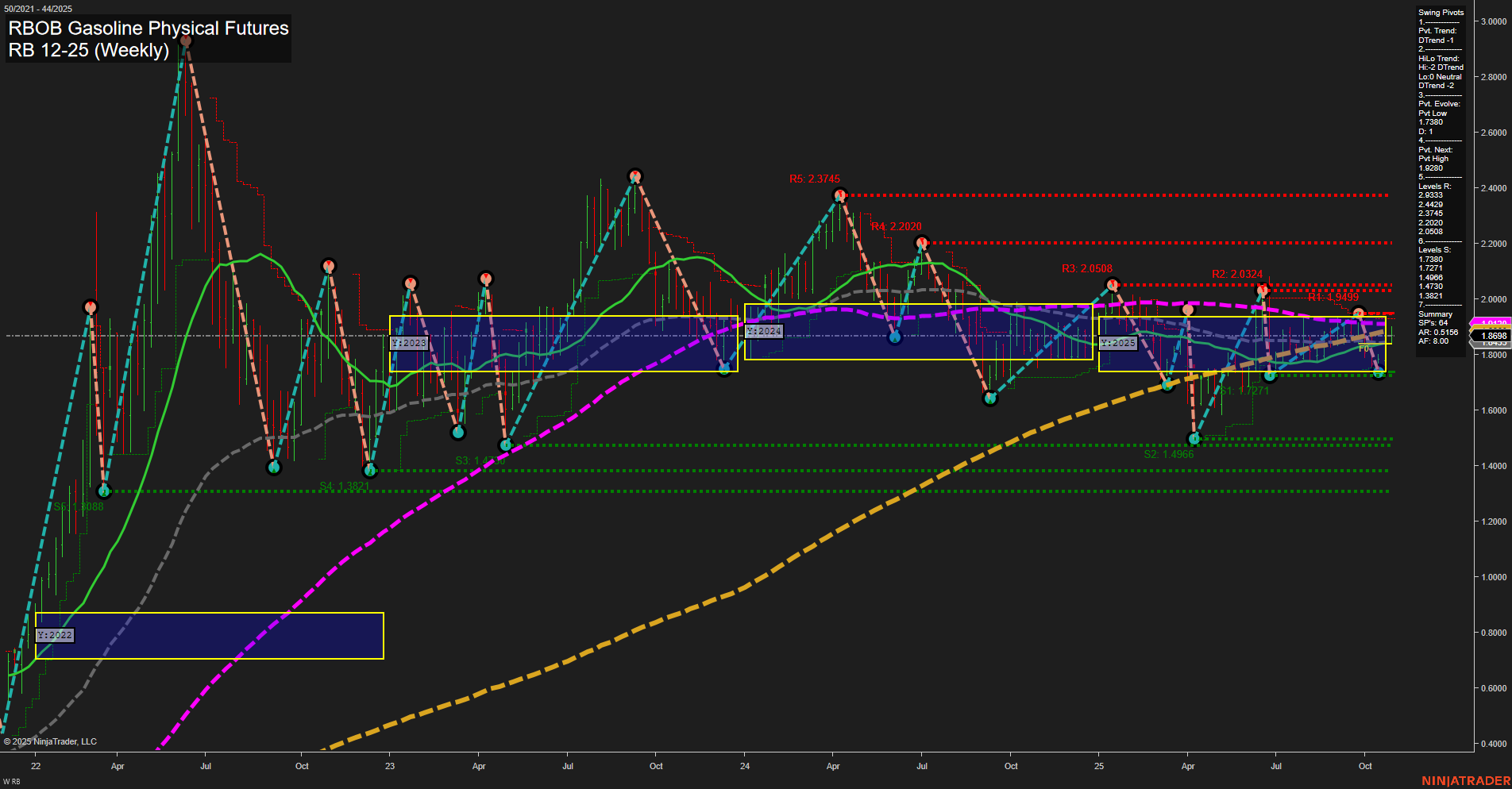

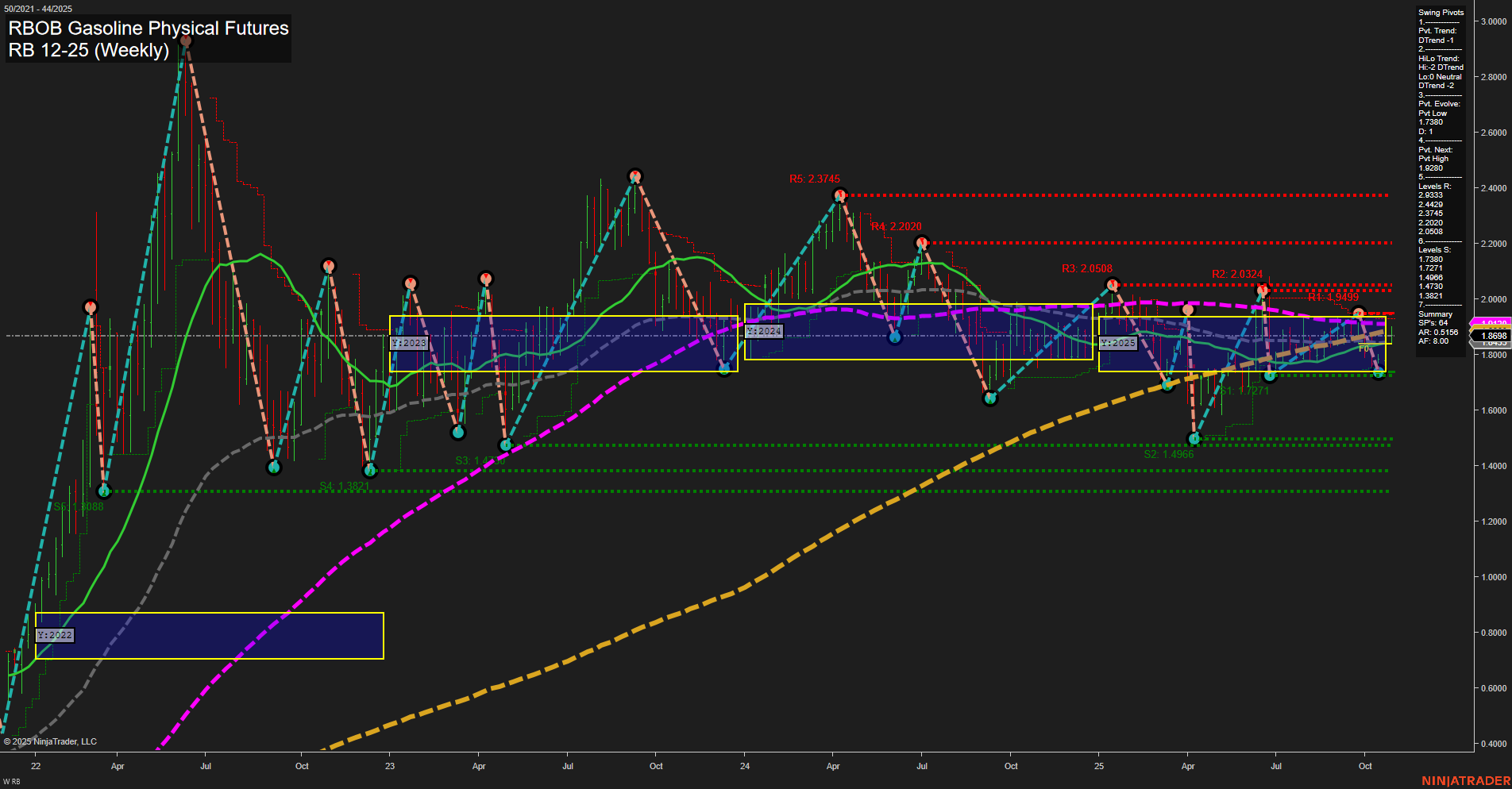

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Oct-30 07:13 CT

Price Action

- Last: 1.86598,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 6%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.7308,

- 4. Pvt. Next: Pvt high 1.9283,

- 5. Levels R: 2.3745, 2.2020, 2.0508, 2.0324, 1.9499,

- 6. Levels S: 1.7308, 1.4986, 1.3921, 1.3088.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.8844 Down Trend,

- (Intermediate-Term) 10 Week: 1.8911 Down Trend,

- (Long-Term) 20 Week: 1.9049 Down Trend,

- (Long-Term) 55 Week: 1.8658 Down Trend,

- (Long-Term) 100 Week: 1.7516 Up Trend,

- (Long-Term) 200 Week: 1.6010 Up Trend.

Recent Trade Signals

- 30 Oct 2025: Long RB 12-25 @ 1.8817 Signals.USAR-WSFG

- 29 Oct 2025: Long RB 12-25 @ 1.8888 Signals.USAR-MSFG

- 23 Oct 2025: Long RB 12-25 @ 1.8816 Signals.USAR.TR720

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The RBOB Gasoline weekly chart shows a market in transition. Price is currently above the NTZ center line across all session fib grids, indicating underlying bullish structure, but recent price action is characterized by medium bars and slow momentum, suggesting a lack of strong directional conviction. Both short-term and intermediate-term swing pivot trends are down, with the most recent pivot low at 1.7308 and the next resistance pivot high at 1.9283. Multiple resistance levels cluster above, while support is well-defined below. Weekly moving averages (5, 10, 20, 55) are all trending down, reflecting recent weakness, but the longer-term 100 and 200 week averages remain in uptrends, supporting a bullish long-term outlook. Recent trade signals have triggered new longs, aligning with the upward bias in the session fib grids, but the market remains range-bound between major support and resistance. Overall, the chart suggests a consolidative environment with a long-term bullish undertone, as the market digests prior moves and awaits a catalyst for a sustained breakout or breakdown.

Chart Analysis ATS AI Generated: 2025-10-30 07:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.