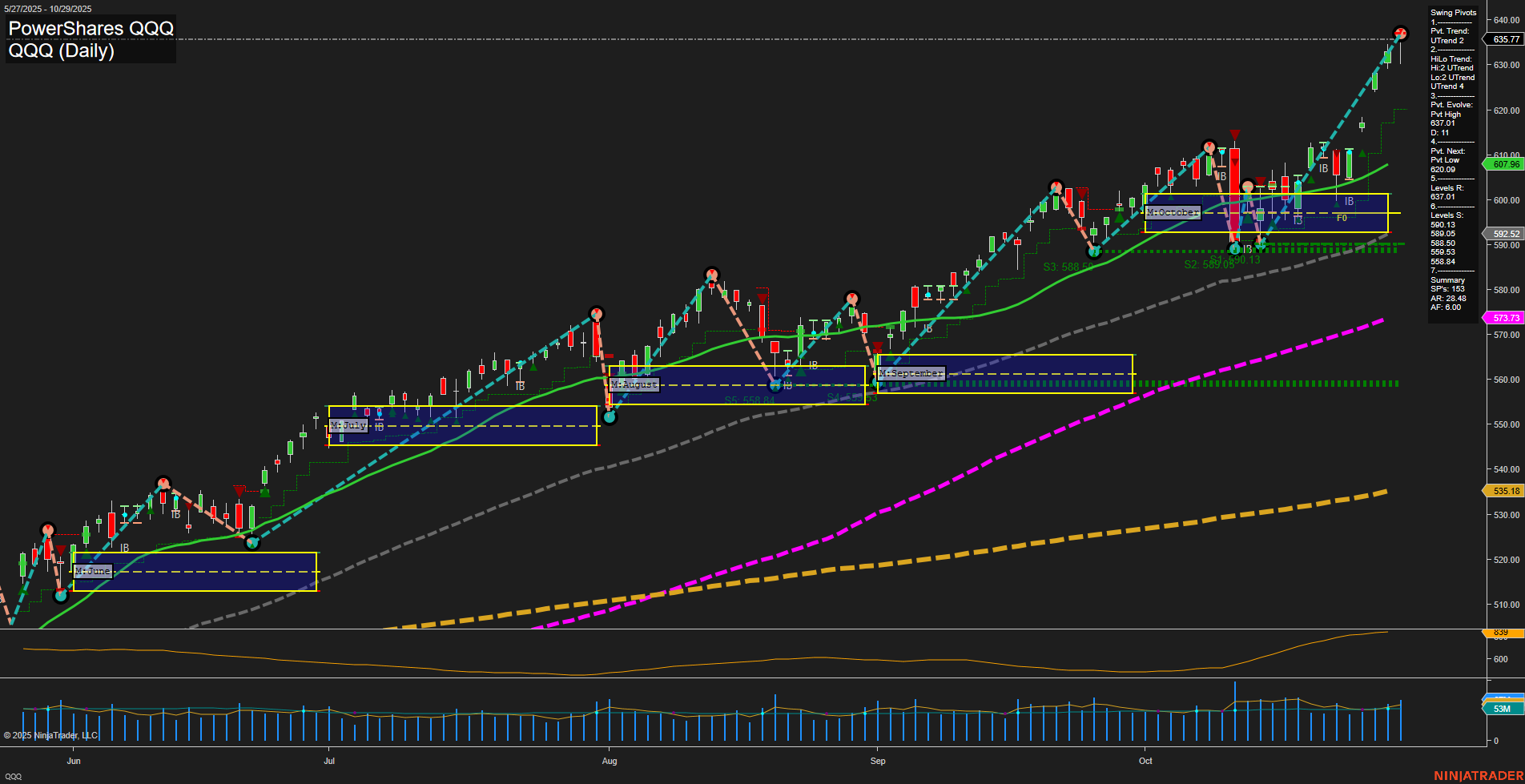

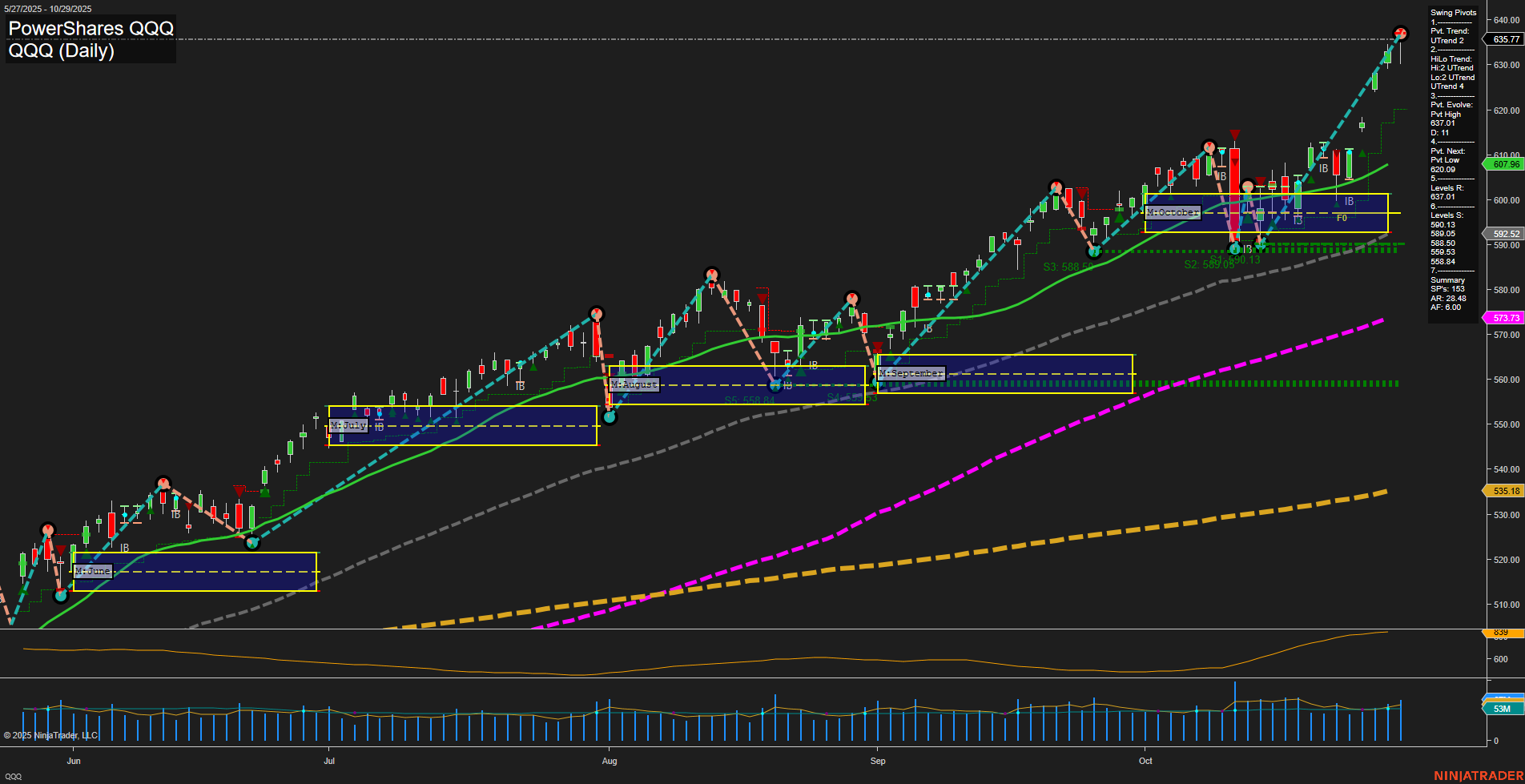

QQQ PowerShares QQQ Daily Chart Analysis: 2025-Oct-30 07:12 CT

Price Action

- Last: 635.77,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 637.01,

- 4. Pvt. Next: Pvt low 620.08,

- 5. Levels R: 635.77, 637.01,

- 6. Levels S: 620.08, 607.95, 588.65, 588.09, 573.73.

Daily Benchmarks

- (Short-Term) 5 Day: 629.18 Up Trend,

- (Short-Term) 10 Day: 620.11 Up Trend,

- (Intermediate-Term) 20 Day: 607.95 Up Trend,

- (Intermediate-Term) 55 Day: 573.73 Up Trend,

- (Long-Term) 100 Day: 535.18 Up Trend,

- (Long-Term) 200 Day: 489.59 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The QQQ daily chart is exhibiting strong bullish momentum, with price action making new highs and large bullish bars dominating recent sessions. All benchmark moving averages across short, intermediate, and long-term timeframes are in clear uptrends, confirming broad-based strength. Swing pivot analysis shows both short-term and intermediate-term trends are up, with the most recent pivot high at 637.01 and the next potential support at 620.08, indicating a healthy distance from current price to the next key support. The ATR remains elevated, reflecting increased volatility, while volume is robust, supporting the move. The market is in a clear trend continuation phase, with higher highs and higher lows, and no immediate signs of exhaustion or reversal. The technical landscape is supportive of further upside, with all major trend indicators aligned bullishly.

Chart Analysis ATS AI Generated: 2025-10-30 07:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.