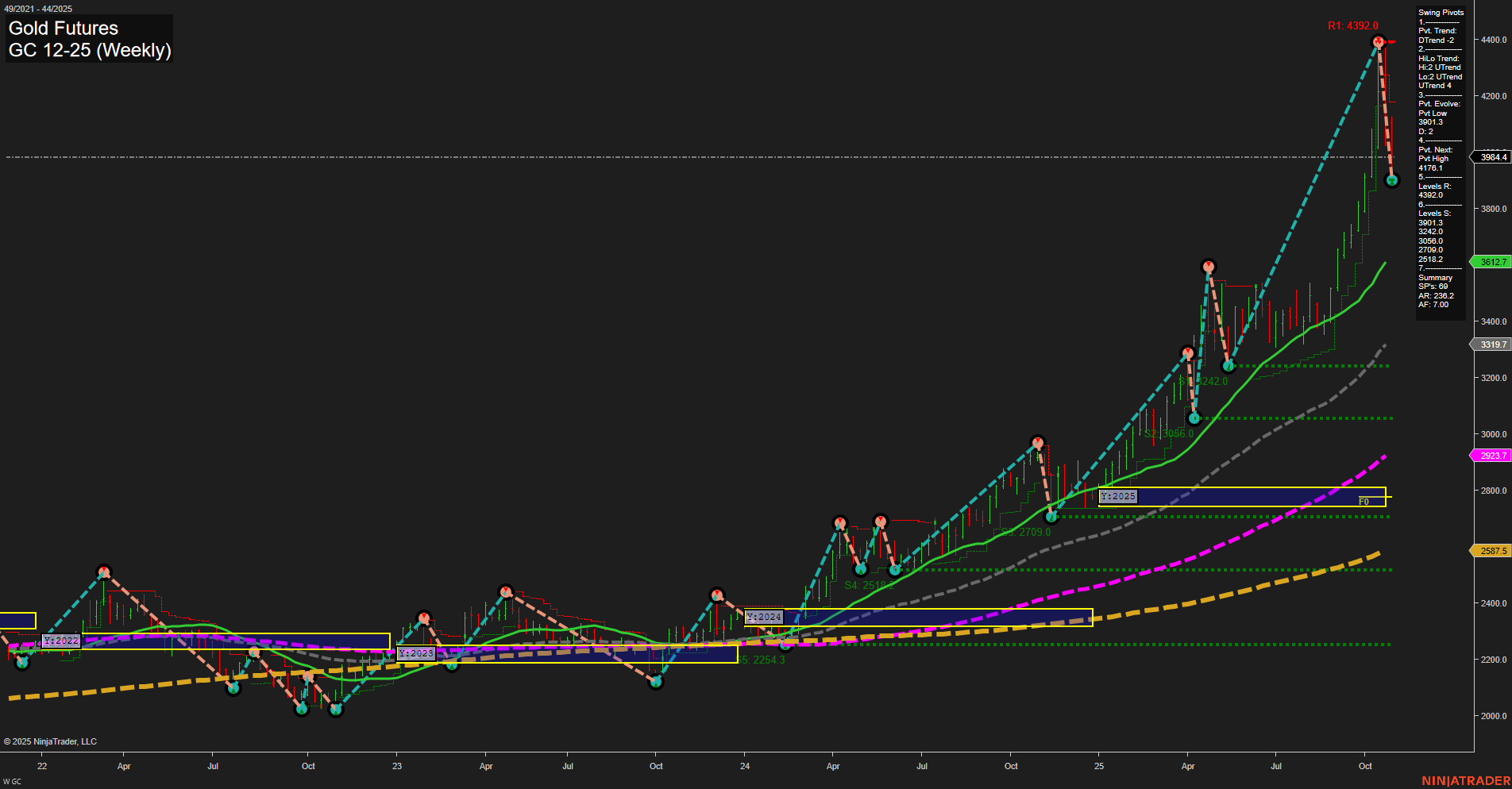

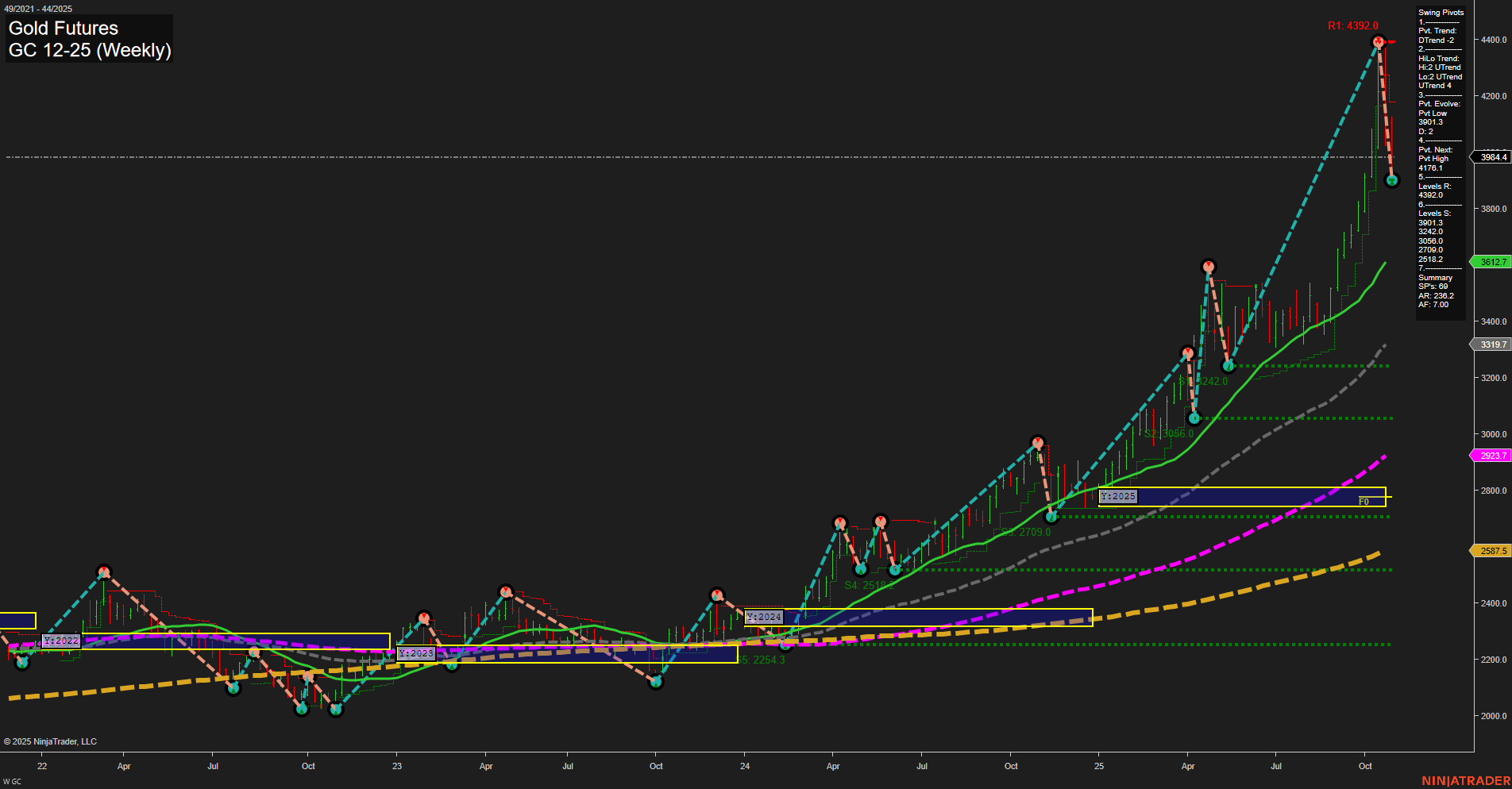

GC Gold Futures Weekly Chart Analysis: 2025-Oct-30 07:09 CT

Price Action

- Last: 3984.4,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -46%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 37%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 347%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 4392.0,

- 4. Pvt. Next: Pvt Low 3011.3,

- 5. Levels R: 4392.0,

- 6. Levels S: 2709.0, 2515.0, 2254.3.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3984.4 Up Trend,

- (Intermediate-Term) 10 Week: 3612.7 Up Trend,

- (Long-Term) 20 Week: 3319.7 Up Trend,

- (Long-Term) 55 Week: 2923.7 Up Trend,

- (Long-Term) 100 Week: 2585.7 Up Trend,

- (Long-Term) 200 Week: 2923.7 Up Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

Gold futures have experienced a significant rally, with price action showing large, fast-moving bars and a recent high at 4392.0. The short-term trend has shifted to the downside, as indicated by the WSFG and the most recent swing pivot, suggesting a pullback or correction phase after a strong advance. However, both intermediate and long-term trends remain firmly bullish, supported by upward-sloping moving averages and higher swing lows. The price remains well above key long-term support levels and all major moving averages, indicating underlying strength. The current environment reflects a classic scenario where a strong uptrend is undergoing a short-term retracement, potentially setting up for future trend continuation if support levels hold. Volatility is elevated, and the market is digesting recent gains, with the broader trend structure still favoring the bulls over the longer horizon.

Chart Analysis ATS AI Generated: 2025-10-30 07:09 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.