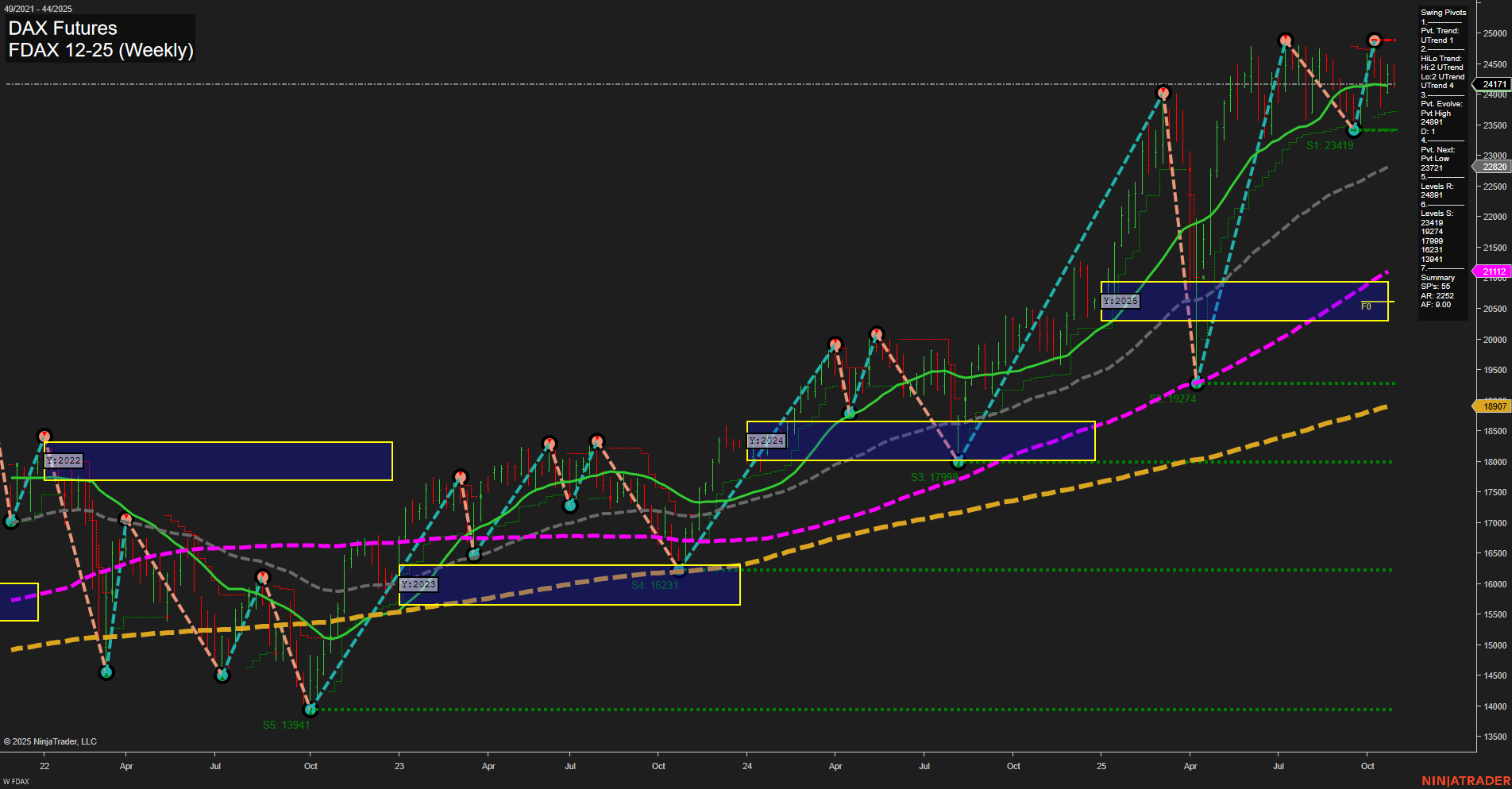

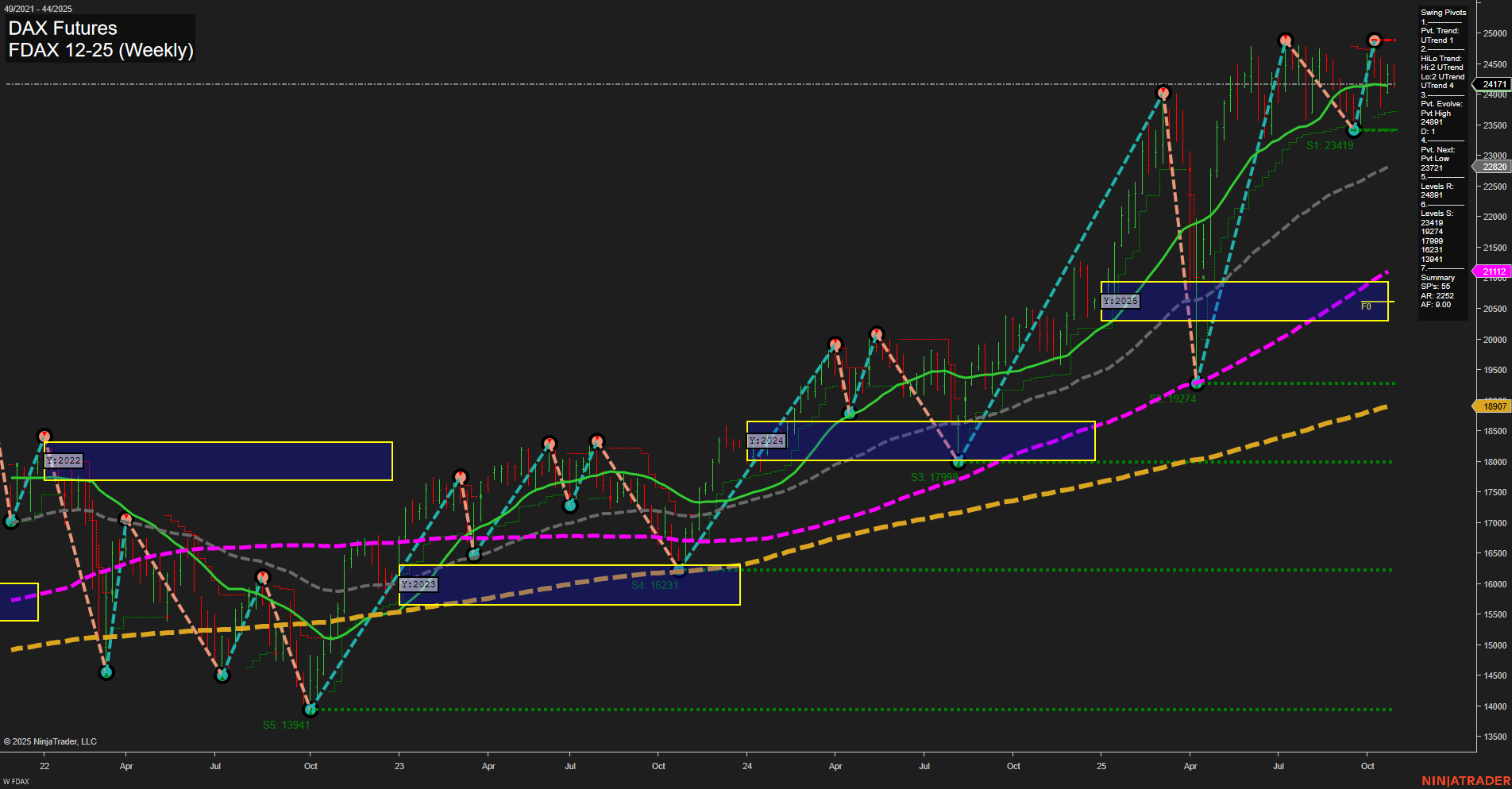

FDAX DAX Futures Weekly Chart Analysis: 2025-Oct-30 07:08 CT

Price Action

- Last: 24,171,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -25%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 12%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 110%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 24,491,

- 4. Pvt. Next: Pvt low 23,221,

- 5. Levels R: 24,491, 24,371, 23,974,

- 6. Levels S: 23,419, 22,620, 19,274, 16,231, 13,941.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 24,371 Up Trend,

- (Intermediate-Term) 10 Week: 23,974 Up Trend,

- (Long-Term) 20 Week: 23,419 Up Trend,

- (Long-Term) 55 Week: 21,112 Up Trend,

- (Long-Term) 100 Week: 18,907 Up Trend,

- (Long-Term) 200 Week: 18,907 Up Trend.

Recent Trade Signals

- 30 Oct 2025: Short FDAX 12-25 @ 24180 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The FDAX DAX Futures weekly chart shows a market in transition. Price action is currently at 24,171 with medium-sized bars and average momentum, indicating neither extreme volatility nor stagnation. The short-term Weekly Session Fib Grid (WSFG) trend is down, with price below the NTZ center, suggesting short-term weakness and a recent short signal. However, both the intermediate-term (MSFG) and long-term (YSFG) trends remain up, with price above their respective NTZ centers and strong upward momentum in the moving averages across all benchmark periods. Swing pivots confirm an uptrend in both short- and intermediate-term metrics, with the most recent pivot high at 24,491 acting as resistance and 23,419 as the nearest support. The market has recently pulled back from highs but remains well above major long-term support levels, indicating that the broader trend is still intact. This setup reflects a classic swing environment where short-term pullbacks occur within a larger bullish structure, and traders are likely watching for either a continuation of the pullback or a resumption of the uptrend as the next major move.

Chart Analysis ATS AI Generated: 2025-10-30 07:08 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.