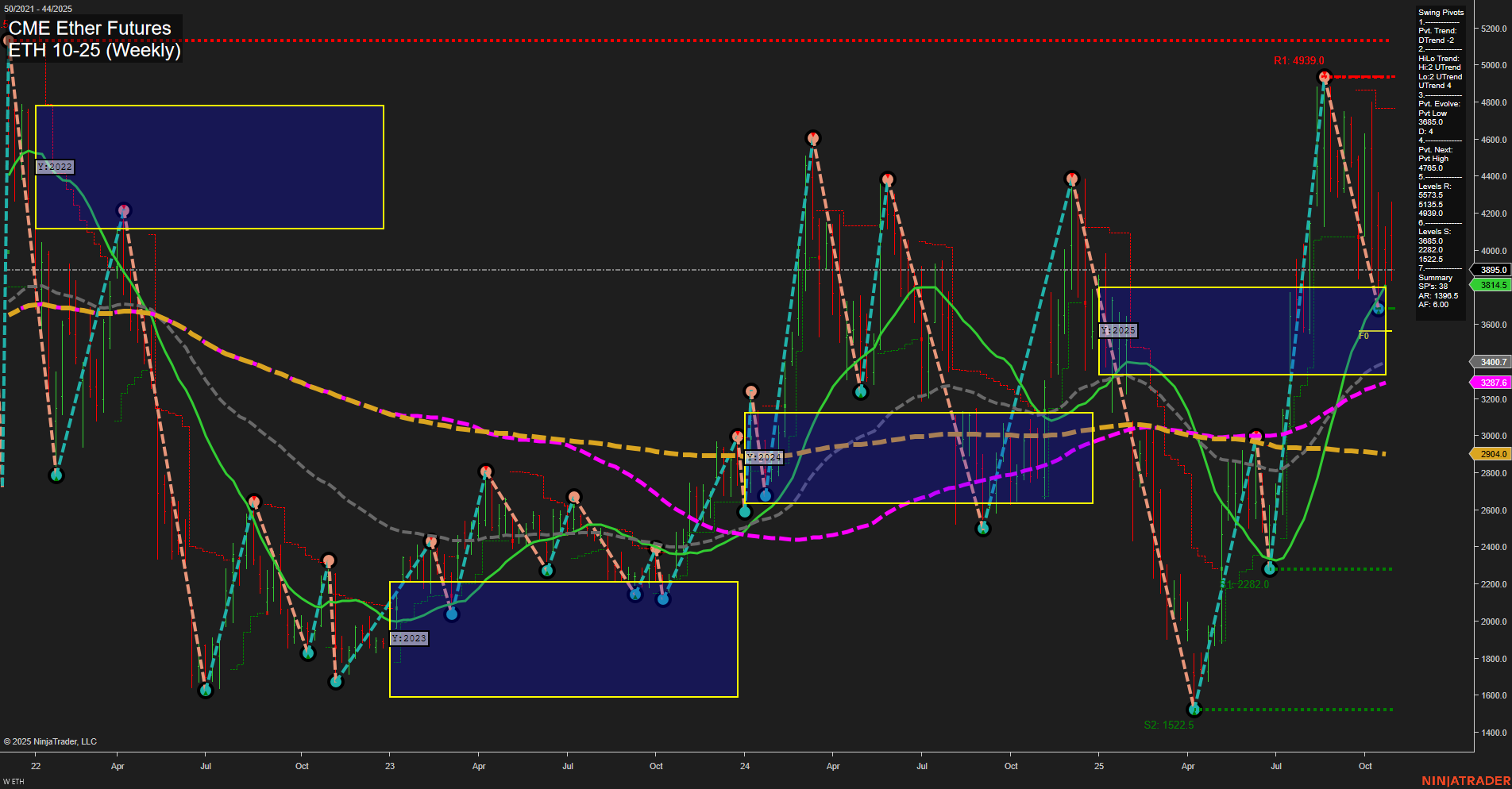

The current weekly chart for ETH CME Ether Futures shows a strong recent selloff, with large bars and fast momentum to the downside. Both the short-term (WSFG) and intermediate-term (MSFG) session fib grid trends are down, with price trading below their respective NTZ/F0% levels, confirming a bearish bias in the near and intermediate term. Swing pivot analysis also supports this, with both short-term and intermediate-term trends in a downtrend, and the most recent pivot evolving from a high at 4939, with the next significant support at 2282. Resistance levels are stacked above, with 3885 as the nearest, followed by 4535, 4755, and 4939. Weekly benchmarks show mixed signals: the 5-week MA is trending down, but the 10, 20, 55, 100, and 200-week moving averages are all in uptrends, indicating that the longer-term structure remains bullish despite the current pullback. Recent trade signals have shifted to short, aligning with the prevailing short- and intermediate-term bearish momentum. Overall, the chart reflects a market in corrective mode within a larger bullish structure. The recent sharp decline may be a retracement within a longer-term uptrend, but for now, the short- and intermediate-term outlooks remain bearish until a reversal or stabilization is confirmed. The market is currently testing key support and may be in a volatile, choppy phase as it seeks direction.