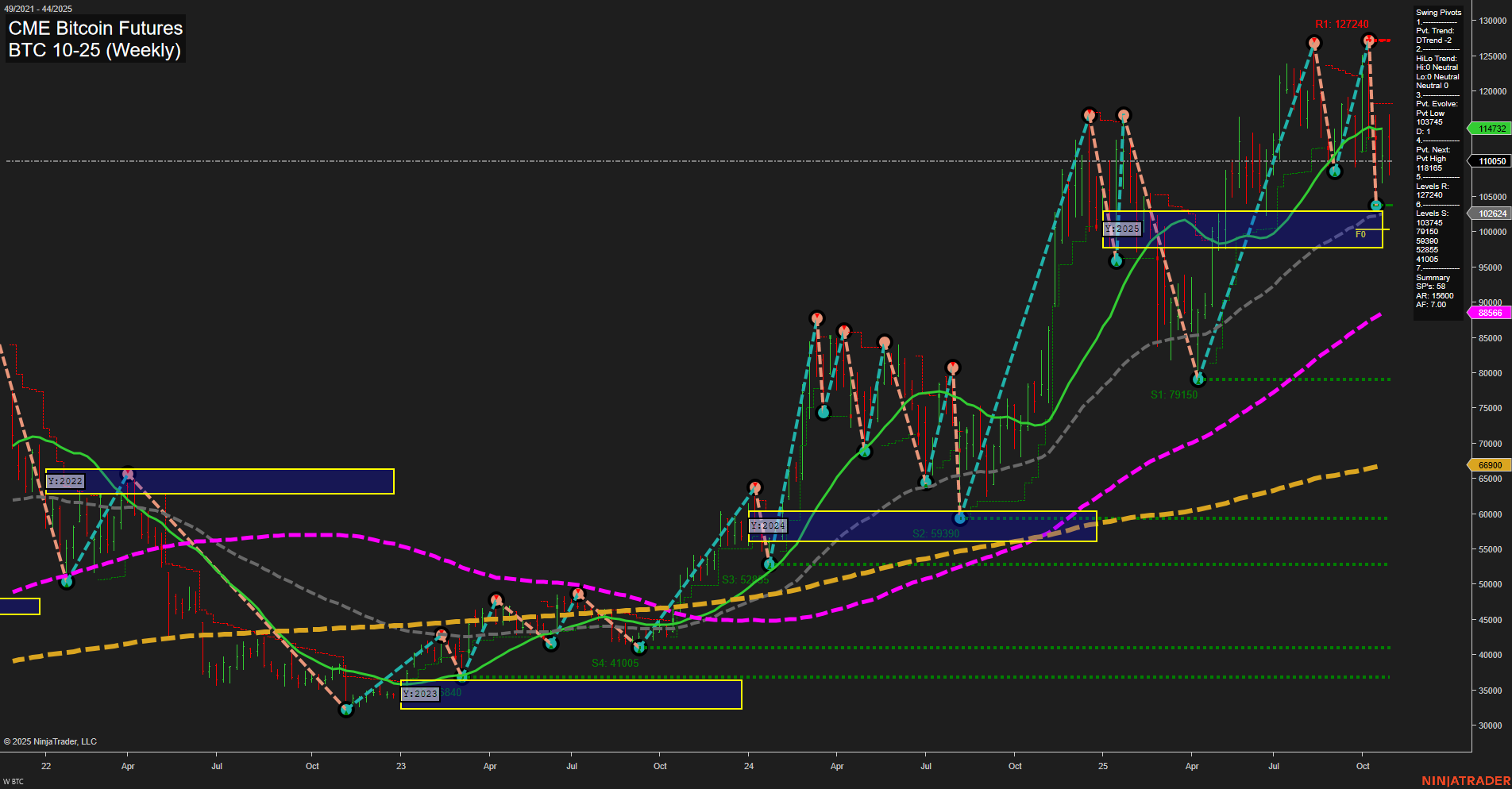

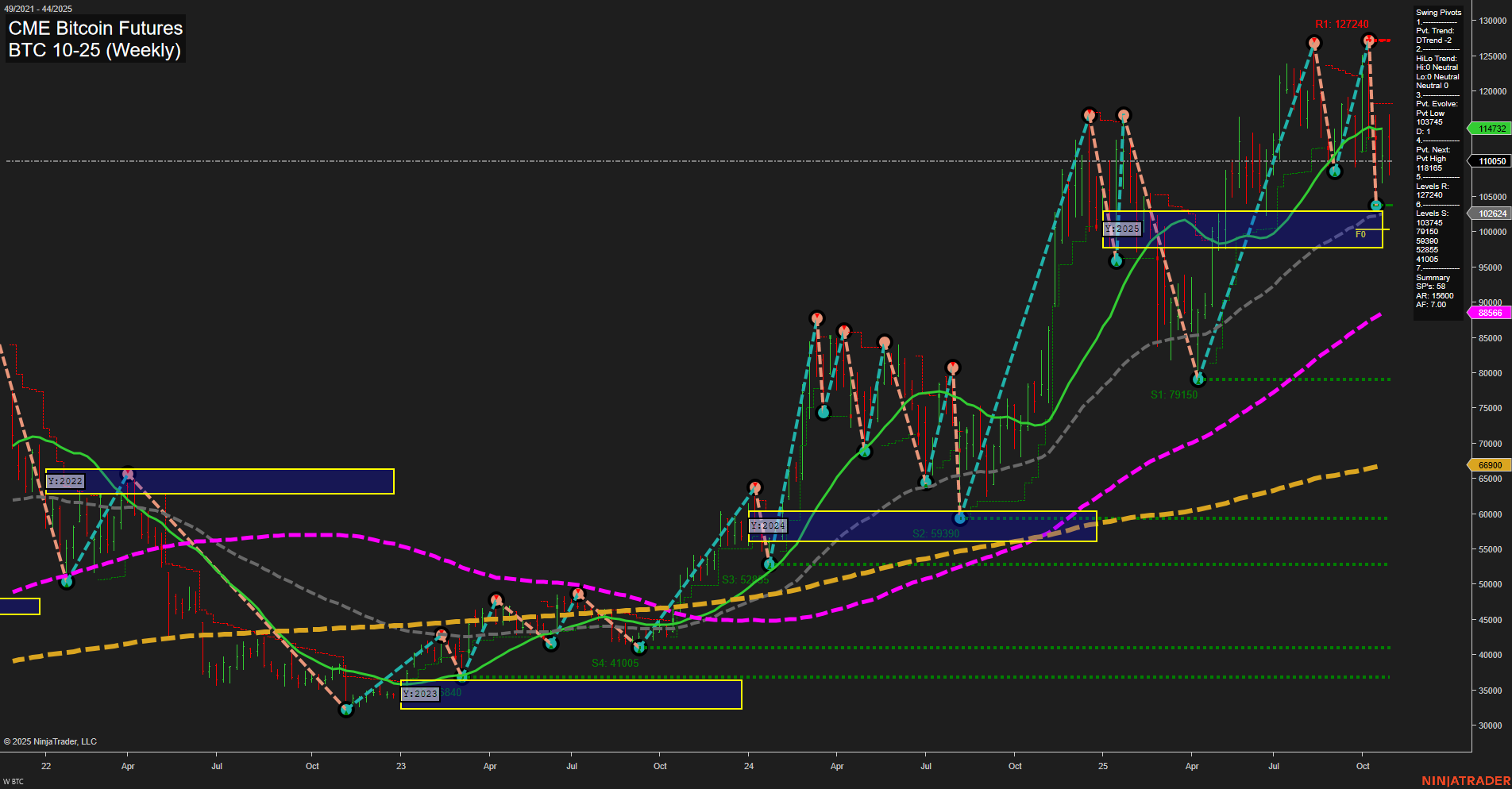

BTC CME Bitcoin Futures Weekly Chart Analysis: 2025-Oct-30 07:03 CT

Price Action

- Last: 114732,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -33%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -36%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 35%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: HiLo Neutral,

- 3. Pvt. Evolve: Pvt low 103475,

- 4. Pvt. Next: Pvt high 118145,

- 5. Levels R: 127240, 118145,

- 6. Levels S: 102624, 95300, 79150, 59390, 52310, 41005, 3840.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 110500 Down Trend,

- (Intermediate-Term) 10 Week: 113165 Down Trend,

- (Long-Term) 20 Week: 114732 Up Trend,

- (Long-Term) 55 Week: 102024 Up Trend,

- (Long-Term) 100 Week: 88566 Up Trend,

- (Long-Term) 200 Week: 66900 Up Trend.

Recent Trade Signals

- 29 Oct 2025: Short BTC 10-25 @ 112555 Signals.USAR.TR120

- 28 Oct 2025: Short BTC 10-25 @ 113145 Signals.USAR-MSFG

- 27 Oct 2025: Long BTC 10-25 @ 115395 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The current weekly chart for CME Bitcoin Futures shows a strong long-term uptrend, with price action well above the 55, 100, and 200 week moving averages, all of which are trending higher. However, the short-term and intermediate-term outlooks have shifted bearish to neutral, as indicated by the WSFG and MSFG trends both pointing down and price trading below their respective NTZ/F0% levels. The most recent swing pivot trend is down, with the next key resistance at 118145 and major support at 102624. Recent trade signals have favored short positions, reflecting the current pullback and increased volatility after a period of large, fast-moving bars. Despite the short-term weakness, the overall structure remains constructive for the long-term, with higher lows and a strong base of support below. The market appears to be in a corrective phase within a broader bullish cycle, with potential for further consolidation or a retest of lower support before resuming the primary uptrend.

Chart Analysis ATS AI Generated: 2025-10-30 07:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.