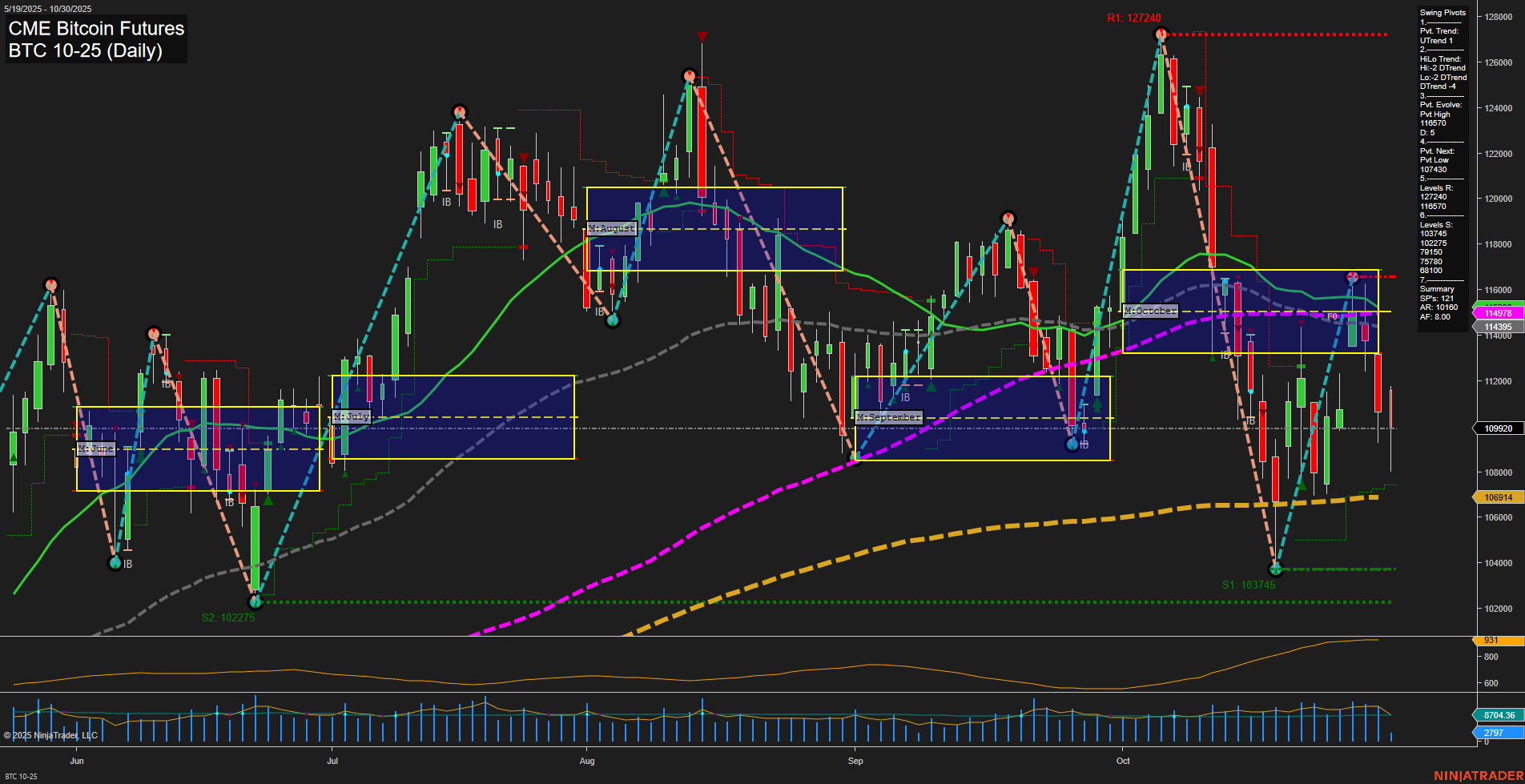

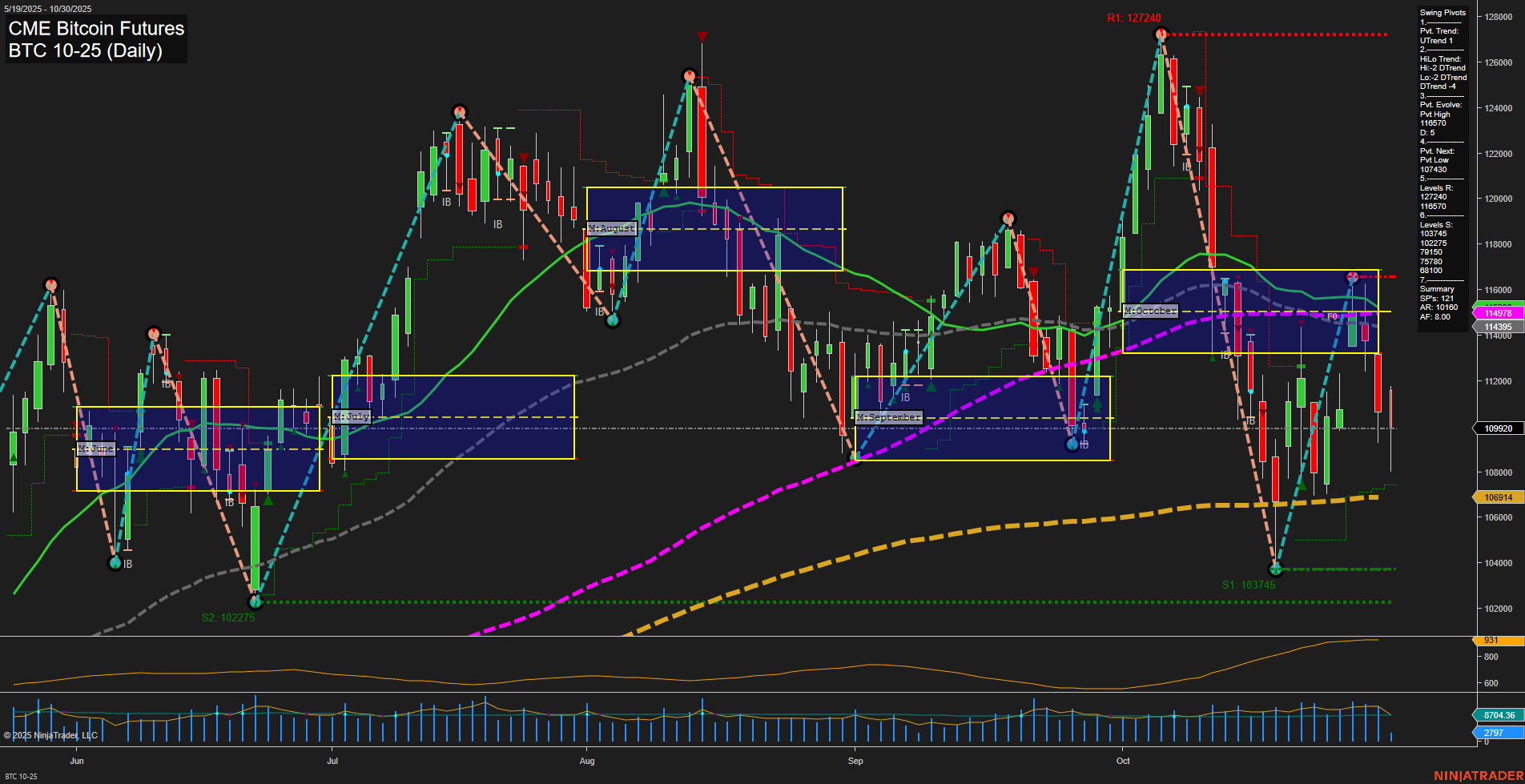

BTC CME Bitcoin Futures Daily Chart Analysis: 2025-Oct-30 07:03 CT

Price Action

- Last: 109920,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -33%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -36%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 35%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 116070,

- 4. Pvt. Next: Pvt Low 107430,

- 5. Levels R: 127240, 116570, 114295, 110620, 109275, 102775, 98780,

- 6. Levels S: 103745, 102275.

Daily Benchmarks

- (Short-Term) 5 Day: 114395 Down Trend,

- (Short-Term) 10 Day: 114395 Down Trend,

- (Intermediate-Term) 20 Day: 114978 Down Trend,

- (Intermediate-Term) 55 Day: 113095 Down Trend,

- (Long-Term) 100 Day: 109914 Up Trend,

- (Long-Term) 200 Day: 106914 Up Trend.

Additional Metrics

Recent Trade Signals

- 29 Oct 2025: Short BTC 10-25 @ 112555 Signals.USAR.TR120

- 28 Oct 2025: Short BTC 10-25 @ 113145 Signals.USAR-MSFG

- 27 Oct 2025: Long BTC 10-25 @ 115395 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The current BTC CME futures daily chart shows a clear short-term and intermediate-term bearish bias, with price action below both the weekly and monthly session fib grid NTZ centers and all short/intermediate moving averages trending down. The most recent swing pivot is a high at 116070, with the next key support at 107430, indicating the market is in a corrective phase after a failed rally attempt. The long-term trend remains bullish, supported by the 100 and 200 day moving averages still in uptrend and price holding above the yearly fib grid center. Volatility is moderate, and volume is steady, suggesting the market is digesting recent moves rather than entering a panic phase. Recent trade signals have shifted to the short side, confirming the short-term and intermediate-term downtrend. The market is currently in a pullback or retracement phase within a larger bullish structure, with potential for further downside tests before any significant recovery. Swing traders should note the presence of lower highs and lower lows, with resistance levels stacked above and limited support until the 107430-103745 zone.

Chart Analysis ATS AI Generated: 2025-10-30 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.