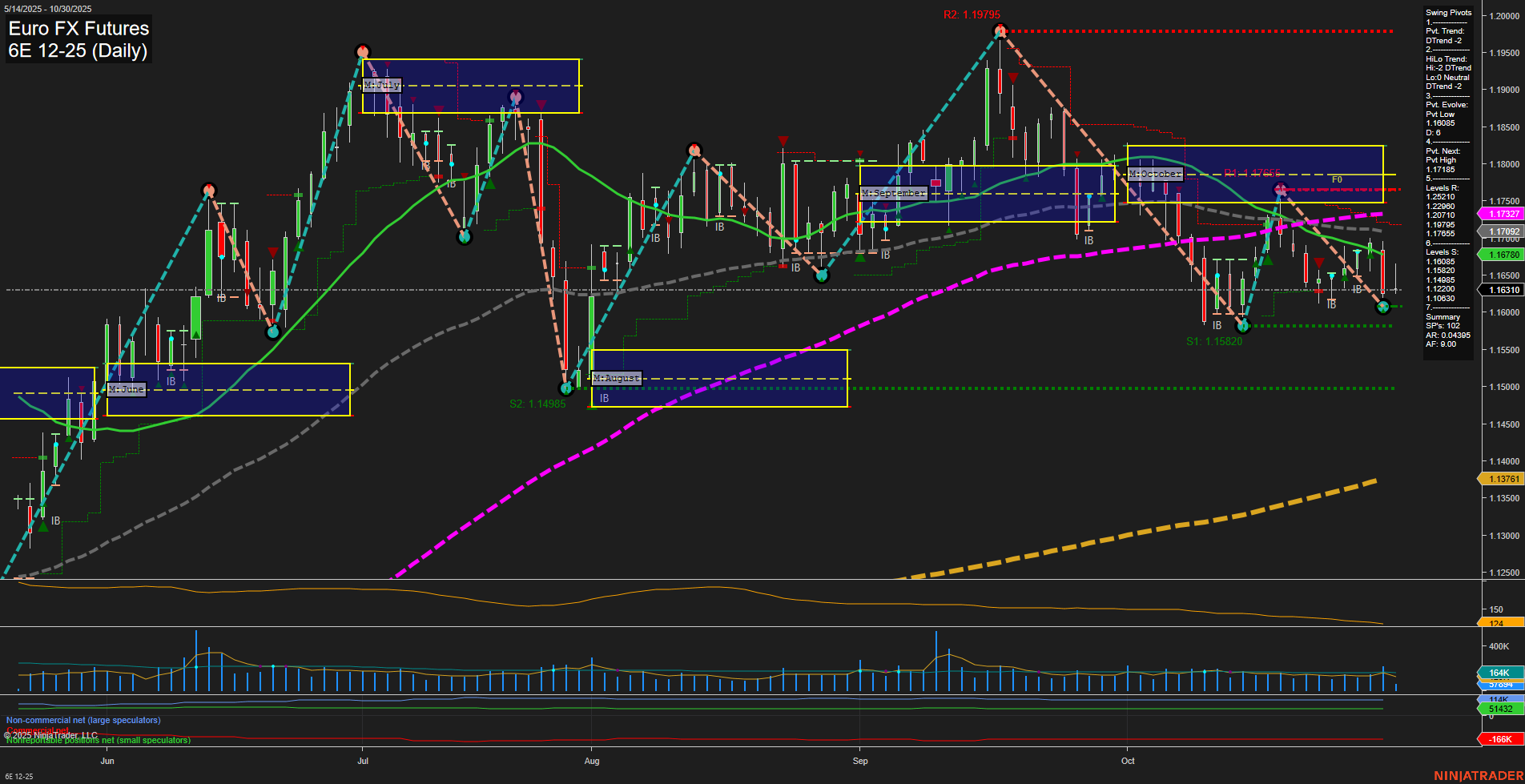

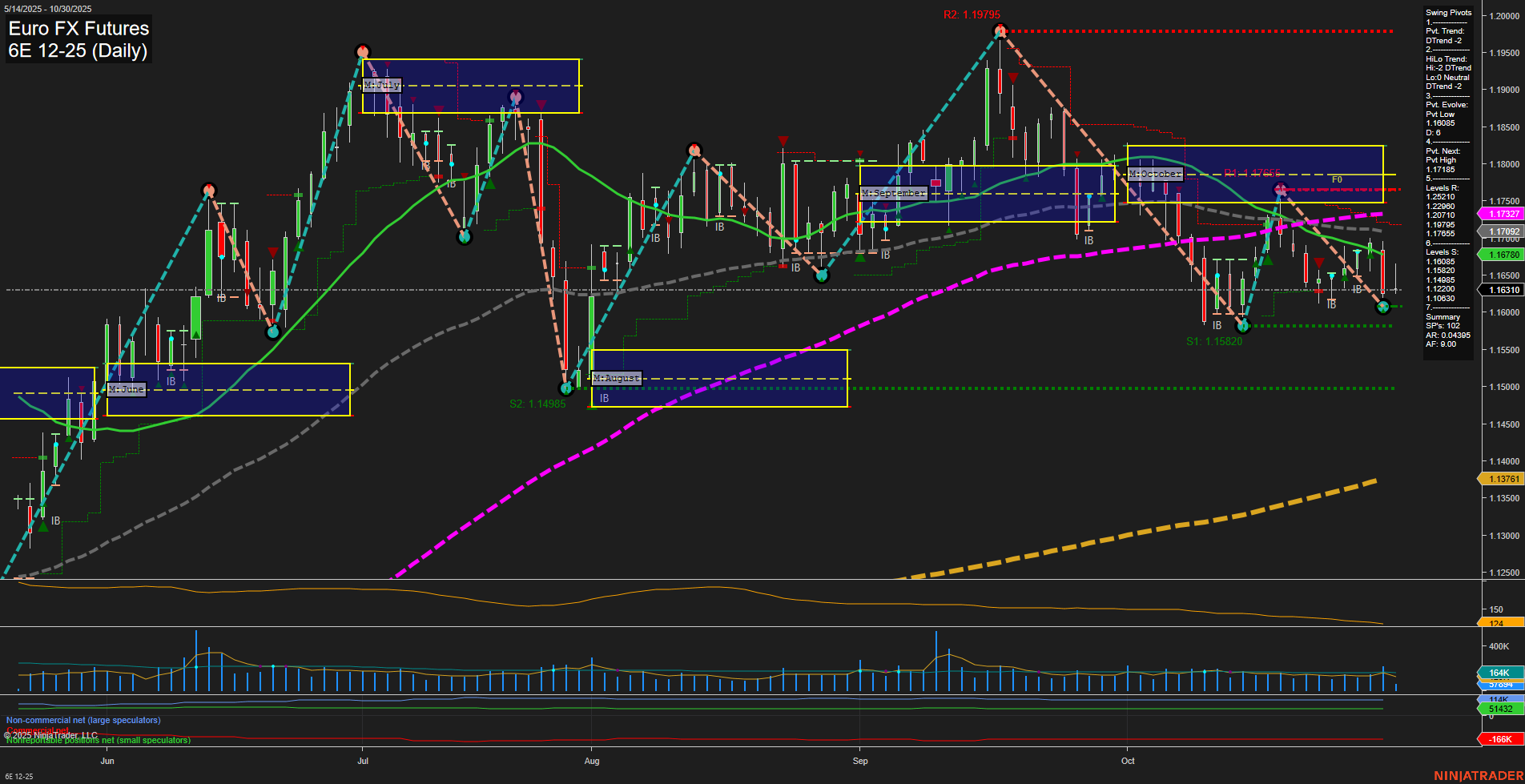

6E Euro FX Futures Daily Chart Analysis: 2025-Oct-30 07:01 CT

Price Action

- Last: 1.16310,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -21%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -45%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 77%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 1.16068,

- 4. Pvt. Next: Pvt High 1.17185,

- 5. Levels R: 1.17185, 1.19795,

- 6. Levels S: 1.15820, 1.14985.

Daily Benchmarks

- (Short-Term) 5 Day: 1.17092 Down Trend,

- (Short-Term) 10 Day: 1.17007 Down Trend,

- (Intermediate-Term) 20 Day: 1.17327 Down Trend,

- (Intermediate-Term) 55 Day: 1.17655 Down Trend,

- (Long-Term) 100 Day: 1.17965 Down Trend,

- (Long-Term) 200 Day: 1.13761 Up Trend.

Additional Metrics

Recent Trade Signals

- 30 Oct 2025: Short 6E 12-25 @ 1.1635 Signals.USAR-WSFG

- 29 Oct 2025: Short 6E 12-25 @ 1.16315 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures daily chart shows a clear short-term and intermediate-term bearish environment, with price action below both the weekly and monthly session fib grid NTZs and all key moving averages trending down except for the 200-day, which remains in a long-term uptrend. Swing pivots confirm the downward momentum, with the most recent pivot low at 1.16068 and resistance levels overhead at 1.17185 and 1.19795. Support is close by at 1.15820 and 1.14985, suggesting the market is testing lower boundaries. Recent trade signals have triggered short entries, aligning with the prevailing downtrend. Volatility is moderate, and volume remains steady. While the long-term trend is still up, the current price structure is dominated by lower highs and lower lows, indicating persistent selling pressure and a lack of bullish momentum in the near term. The market is in a corrective phase within a broader uptrend, with potential for further downside tests before any significant reversal or stabilization.

Chart Analysis ATS AI Generated: 2025-10-30 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.