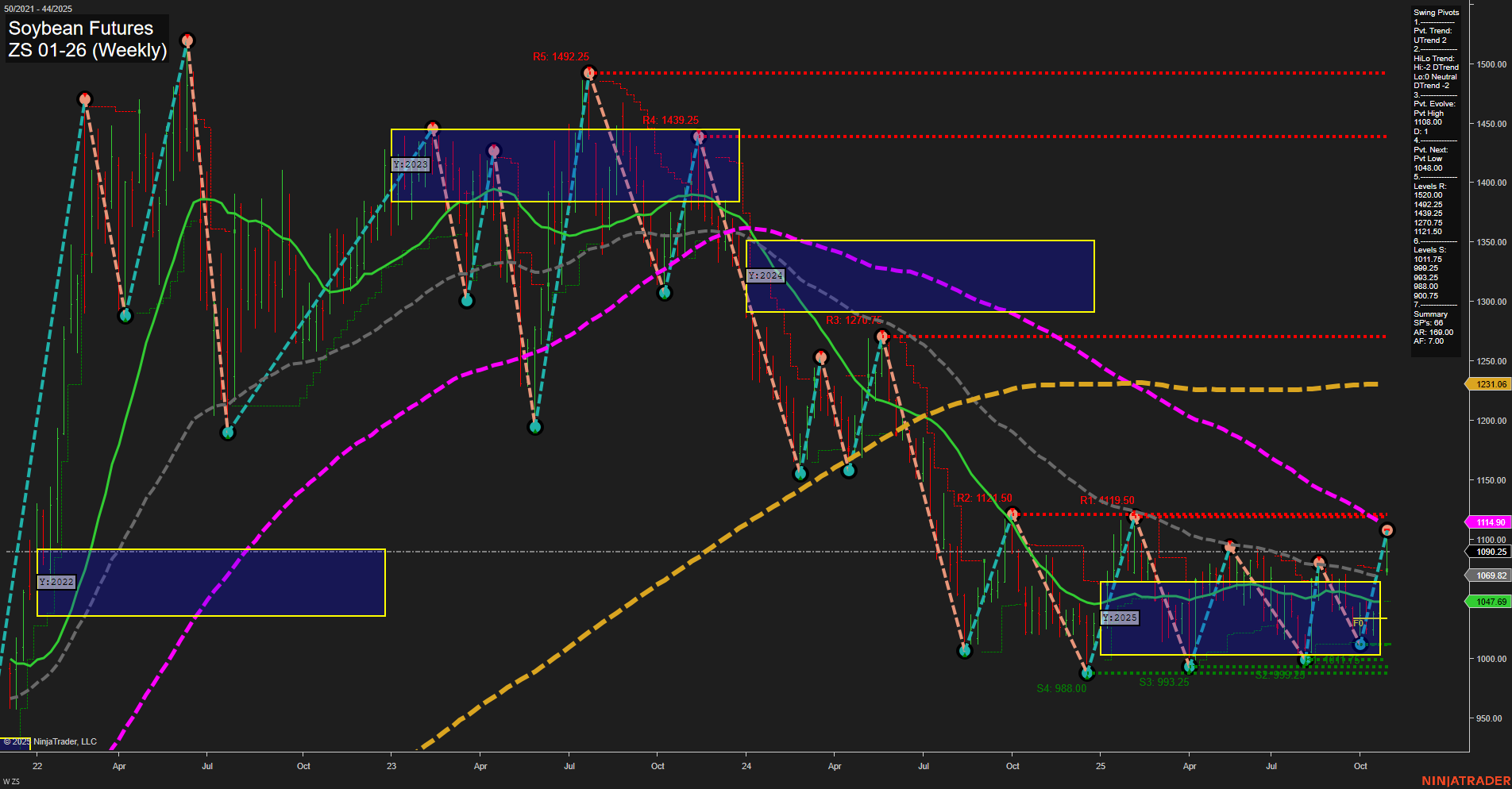

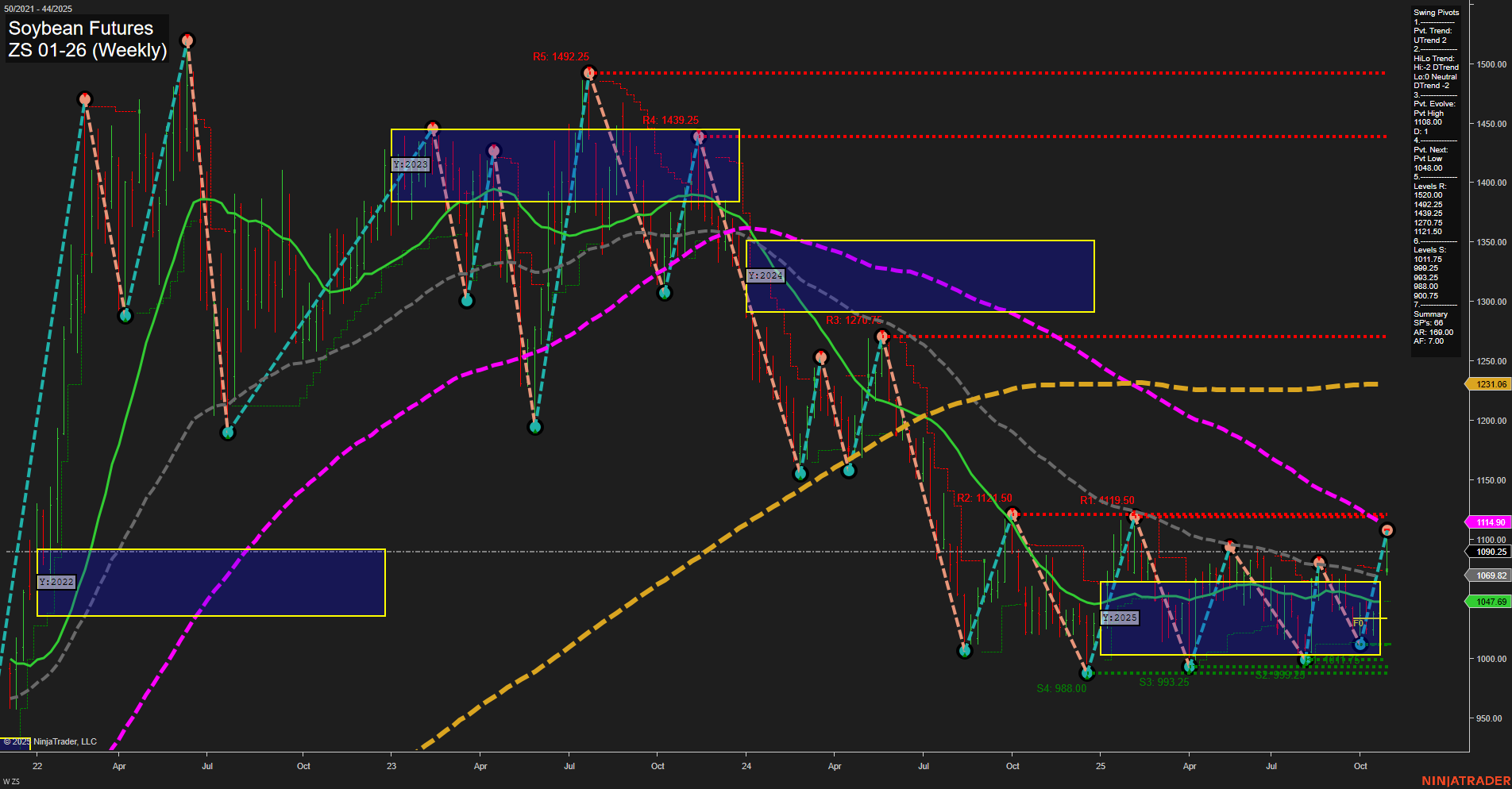

ZS Soybean Futures Weekly Chart Analysis: 2025-Oct-29 07:18 CT

Price Action

- Last: 1090.25,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 111%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 111%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 18%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 1106.00,

- 4. Pvt. Next: Pvt Low 1049.00,

- 5. Levels R: 1492.25, 1439.25, 1402.00, 1270.75, 1171.50, 1106.00,

- 6. Levels S: 1049.00, 988.00, 993.25, 969.25, 963.25, 905.75.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1099.25 Down Trend,

- (Intermediate-Term) 10 Week: 1069.82 Up Trend,

- (Long-Term) 20 Week: 1047.69 Up Trend,

- (Long-Term) 55 Week: 1231.06 Down Trend,

- (Long-Term) 100 Week: 1114.90 Down Trend,

- (Long-Term) 200 Week: 1311.90 Down Trend.

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

Soybean futures are currently trading in a medium-range bar environment with slow momentum, reflecting a market in consolidation after a prolonged downtrend. While the short-term WSFG and MSFG both show an upward trend with price above their respective NTZ/F0% levels, the swing pivot structure remains in a downtrend for both short- and intermediate-term, with the most recent pivot high at 1106.00 and next support at 1049.00. Resistance levels are stacked above, with significant overhead supply at 1171.50 and higher. The weekly benchmarks show mixed signals: the 5-week MA is trending down, while the 10- and 20-week MAs are up, but all longer-term MAs (55, 100, 200 week) remain in a downtrend, indicating persistent bearish pressure on a broader time frame. The overall structure suggests a market attempting to base and possibly transition, but still facing strong resistance and lacking decisive bullish momentum. The environment is characterized by choppy, range-bound price action with potential for further tests of support before any sustained recovery can develop.

Chart Analysis ATS AI Generated: 2025-10-29 07:19 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.