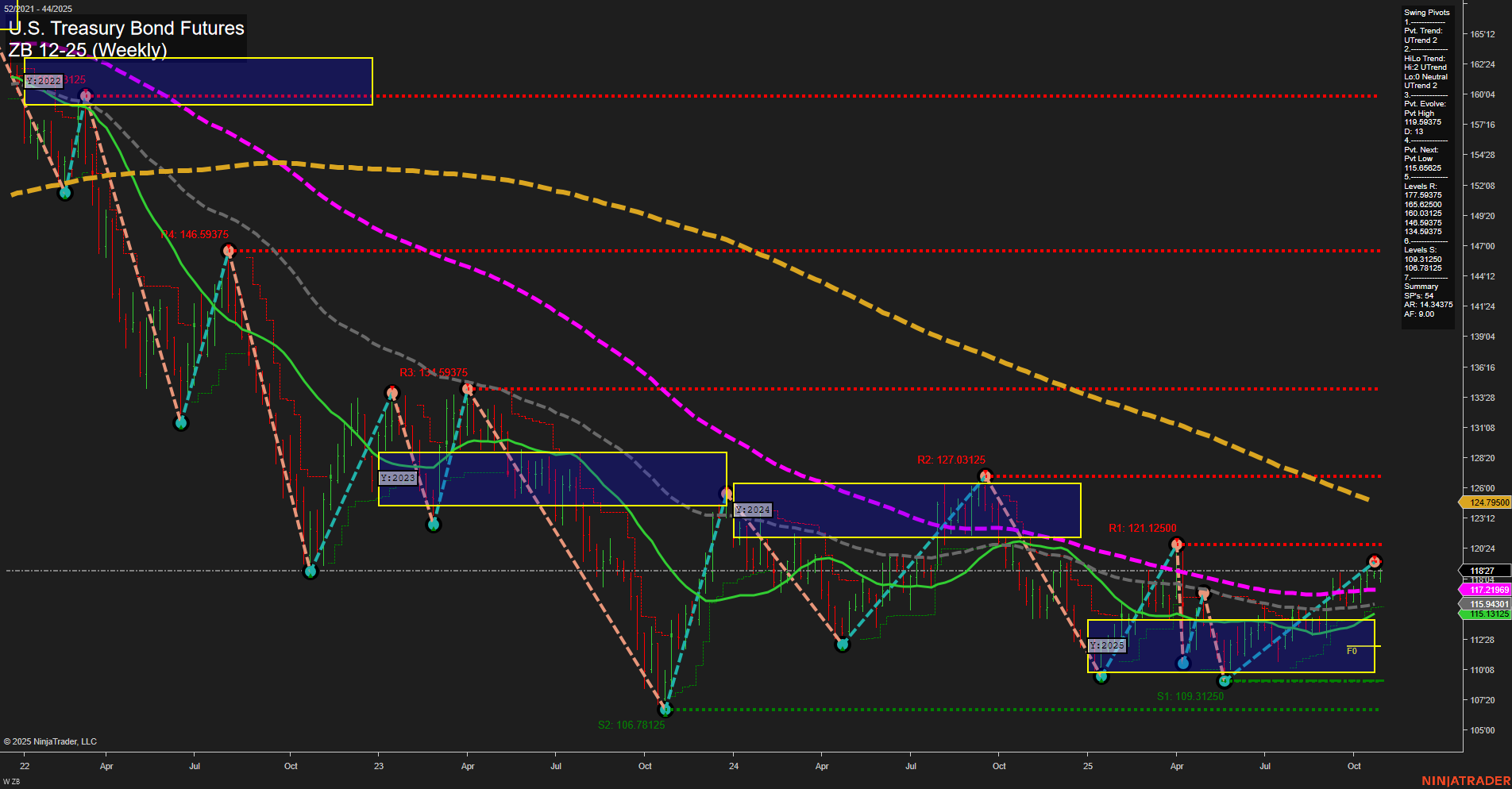

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action has shifted to an average momentum uptrend, with the last price at 124.79500 and medium-sized bars reflecting steady participation. Both short-term and intermediate-term swing pivot trends are upward, supported by rising 5- and 10-week moving averages, and the 20-week benchmark also trending higher. However, the longer-term 55-, 100-, and 200-week moving averages remain in a downtrend, indicating that the broader bearish structure is still intact. The price is currently trading above key intermediate-term support levels and is approaching resistance zones, with the next major resistance at 127.03125 and support at 115.66225 and 109.31250. The neutral bias across the session fib grids (weekly, monthly, yearly) suggests a consolidation phase, with no clear breakout or breakdown from the current range. Recent price action reflects a recovery from the lows, forming higher swing lows and testing previous resistance, but the market remains below the long-term moving averages, which could act as overhead resistance. The overall structure hints at a potential base-building phase, but confirmation of a sustained trend reversal would require a decisive move above the 127.03125 and 134.59375 resistance levels. Until then, the market is likely to remain choppy, with short- and intermediate-term bullish momentum countered by long-term bearish pressure.