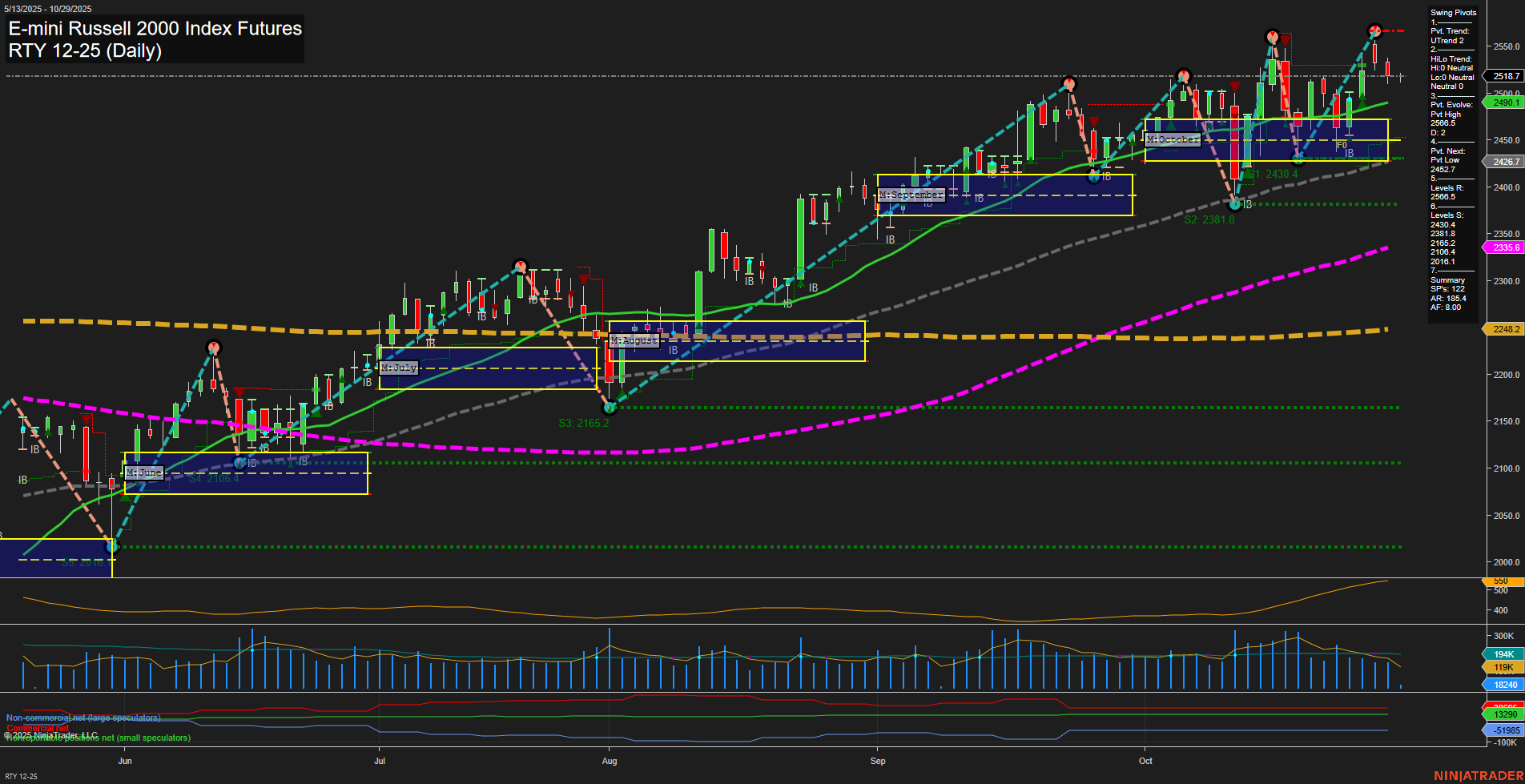

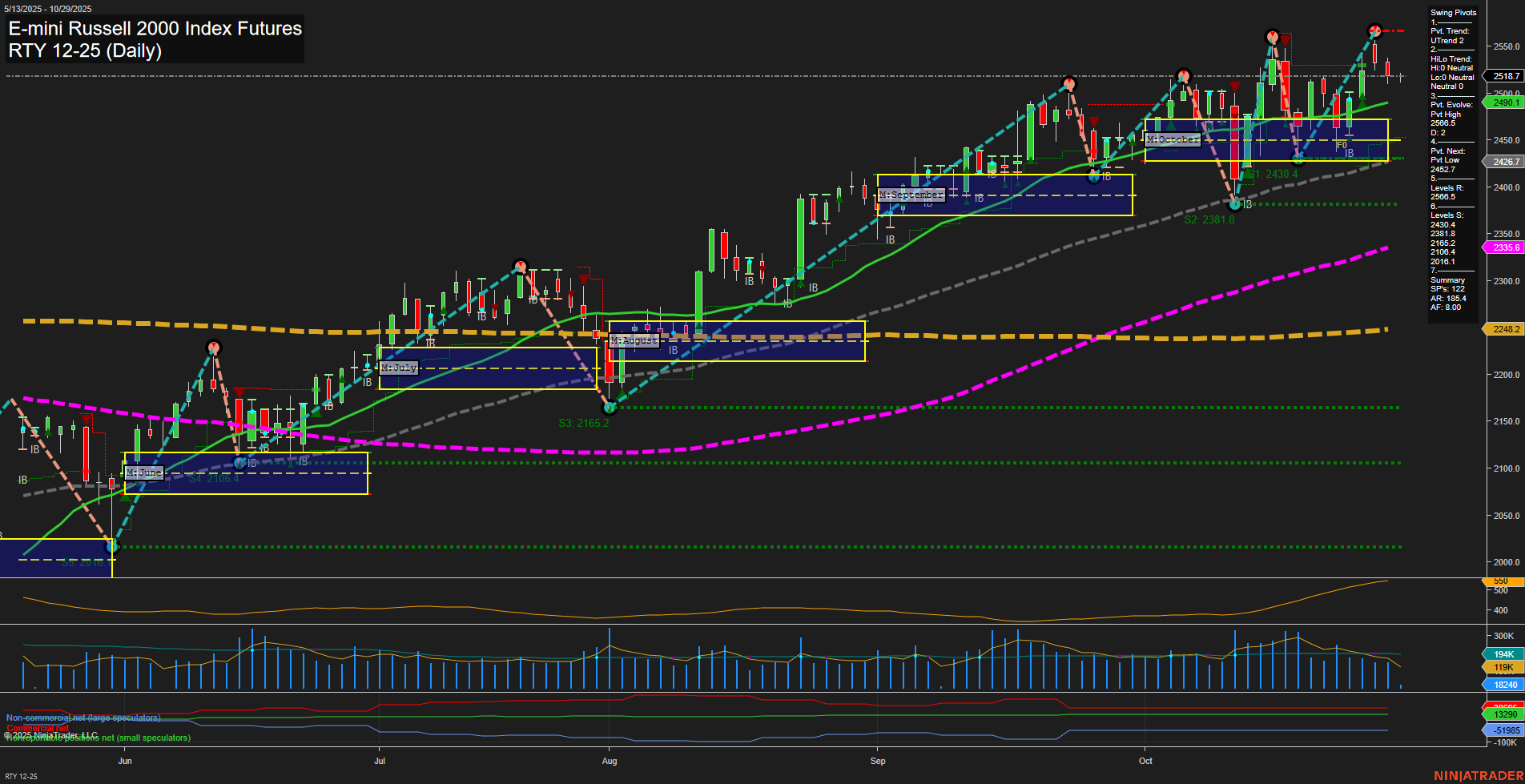

RTY E-mini Russell 2000 Index Futures Daily Chart Analysis: 2025-Oct-29 07:12 CT

Price Action

- Last: 2517.8,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 44%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 38%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt High 2569.8,

- 4. Pvt. Next: Pvt Low 2462.7,

- 5. Levels R: 2569.8, 2555.5, 2527.2,

- 6. Levels S: 2430.4, 2381.8, 2165.2.

Daily Benchmarks

- (Short-Term) 5 Day: 2491.0 Up Trend,

- (Short-Term) 10 Day: 2465.2 Up Trend,

- (Intermediate-Term) 20 Day: 2491.1 Up Trend,

- (Intermediate-Term) 55 Day: 2435.6 Up Trend,

- (Long-Term) 100 Day: 2335.6 Up Trend,

- (Long-Term) 200 Day: 2248.2 Up Trend.

Additional Metrics

Recent Trade Signals

- 28 Oct 2025: Short RTY 12-25 @ 2515.9 Signals.USAR.TR120

- 28 Oct 2025: Short RTY 12-25 @ 2524.4 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The RTY E-mini Russell 2000 is currently trading at 2517.8, with medium-sized bars and average momentum, indicating a balanced but cautious market tone. The short-term WSFG trend is down, with price below the weekly NTZ, and recent short signals suggest some near-term weakness or consolidation. However, the intermediate and long-term trends remain bullish, as reflected by the MSFG and YSFG both showing price above their respective NTZs and uptrends. All benchmark moving averages from short to long-term are in uptrends, supporting the underlying strength in the broader trend. Swing pivots show the current trend as up, with the most recent pivot high at 2569.8 and next key support at 2462.7. Volatility remains elevated (ATR 405), but volume is moderate. Overall, the market is in a consolidation phase short-term, with a bullish bias for the intermediate and long-term, as the index holds above key moving averages and support levels, despite recent pullbacks and short-term resistance tests.

Chart Analysis ATS AI Generated: 2025-10-29 07:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.