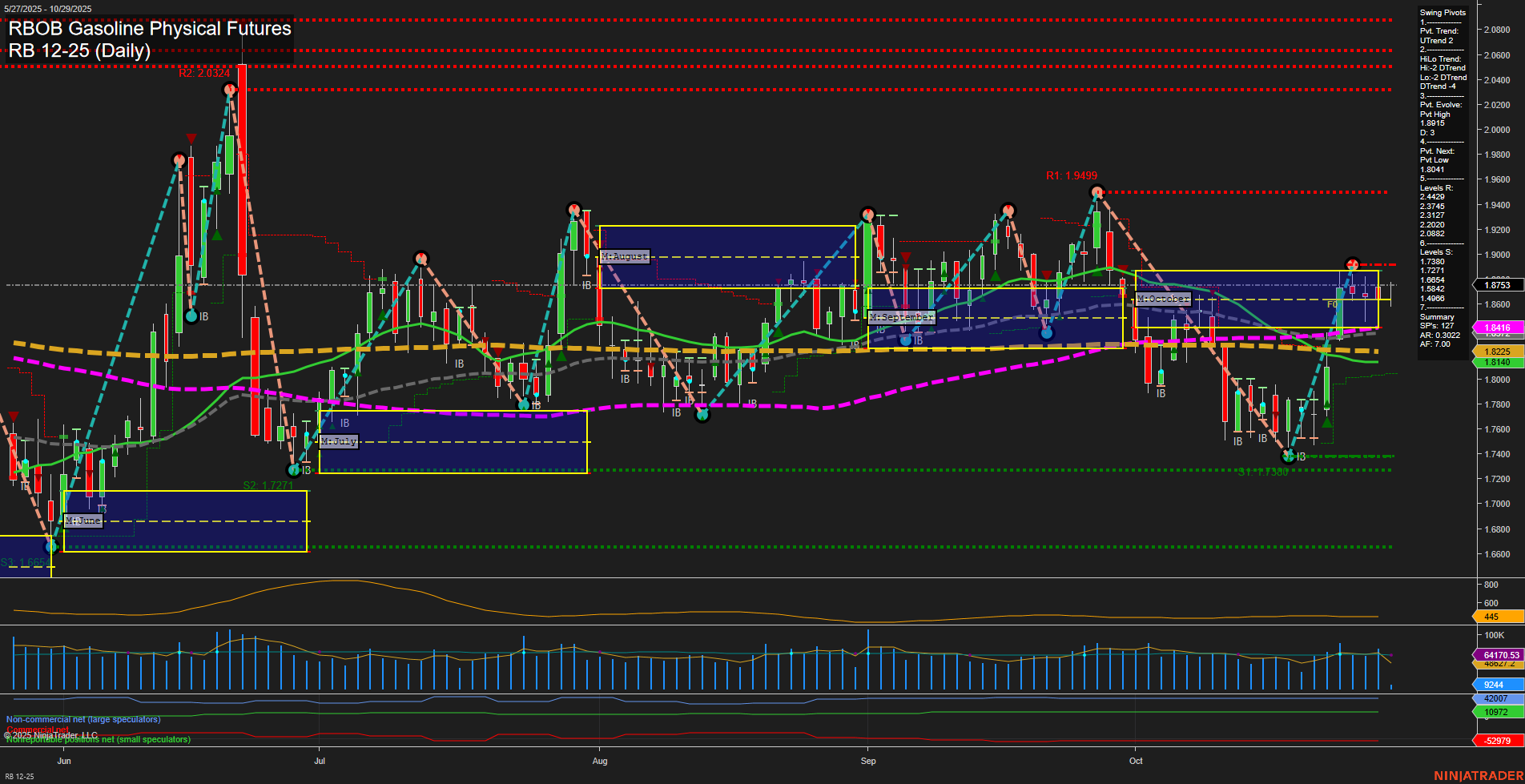

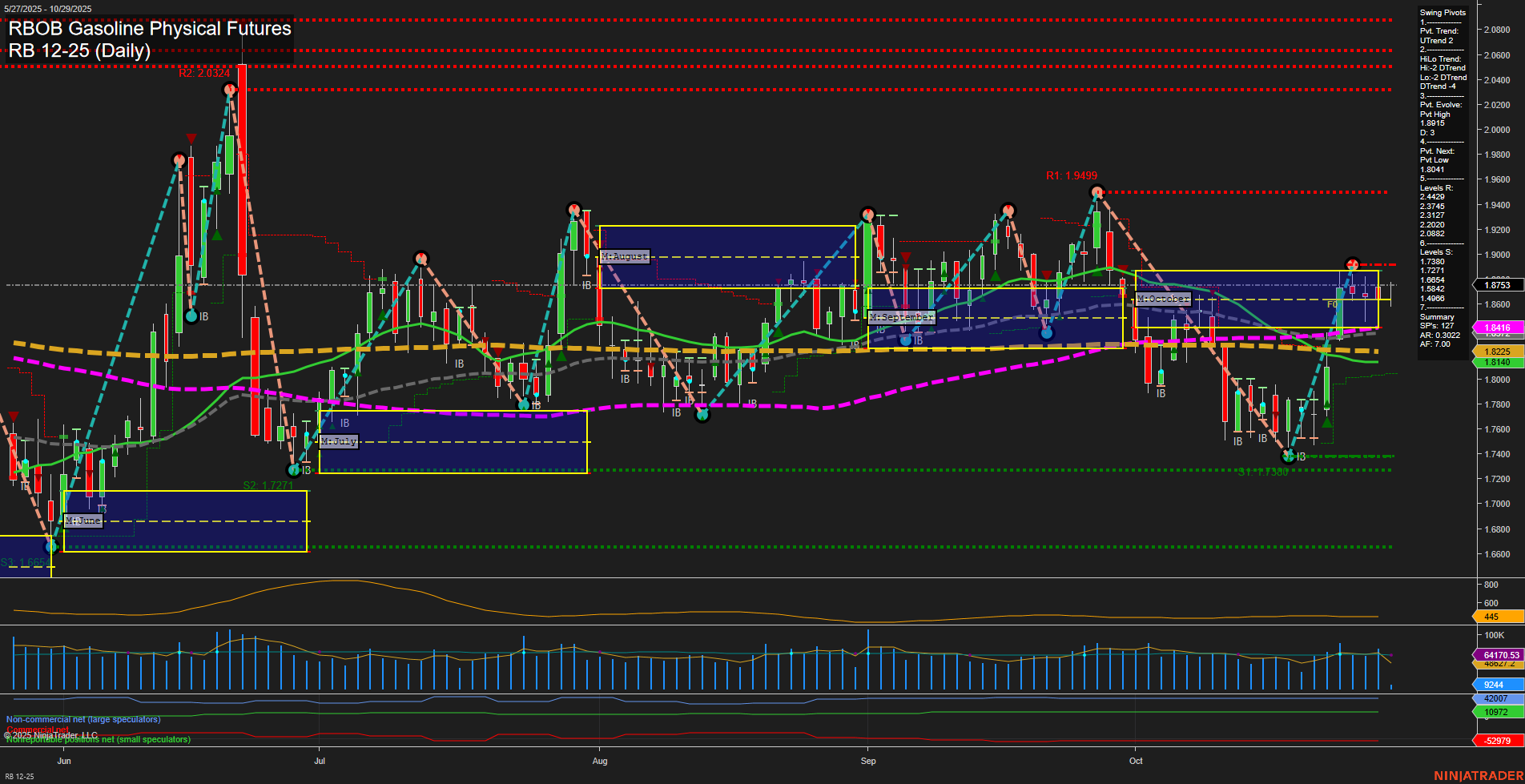

RB RBOB Gasoline Physical Futures Daily Chart Analysis: 2025-Oct-29 07:11 CT

Price Action

- Last: 1.8753,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 11%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 1.8915,

- 4. Pvt. Next: Pvt low 1.8041,

- 5. Levels R: 1.8915, 1.8822, 1.8761, 1.8721, 1.8664,

- 6. Levels S: 1.8041, 1.7930, 1.7771.

Daily Benchmarks

- (Short-Term) 5 Day: 1.8416 Up Trend,

- (Short-Term) 10 Day: 1.8225 Up Trend,

- (Intermediate-Term) 20 Day: 1.8141 Up Trend,

- (Intermediate-Term) 55 Day: 1.8416 Down Trend,

- (Long-Term) 100 Day: 1.8496 Down Trend,

- (Long-Term) 200 Day: 1.8225 Down Trend.

Additional Metrics

Recent Trade Signals

- 29 Oct 2025: Long RB 12-25 @ 1.8757 Signals.USAR-WSFG

- 28 Oct 2025: Short RB 12-25 @ 1.8491 Signals.USAR-MSFG

- 23 Oct 2025: Long RB 12-25 @ 1.8816 Signals.USAR.TR720

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

RBOB Gasoline futures are showing renewed upward momentum in the short term, with price action breaking above key NTZ/F0% levels on both the weekly and monthly session fib grids, and the short-term swing pivot trend confirming an uptrend. The last price is trading above all short-term and intermediate-term moving averages, which are in uptrends, while the longer-term benchmarks (55, 100, 200 day) remain in downtrends, suggesting a possible transition phase or early stage of a larger reversal. The intermediate-term swing pivot trend is still down, indicating some residual overhead resistance and the potential for choppy or consolidative action as the market tests higher levels. Recent trade signals reflect this mixed environment, with both long and short signals triggered in the past week. Volatility (ATR) and volume (VOLMA) are moderate, supporting the view of a market in the process of shifting from a corrective phase to a possible new uptrend. Key resistance levels are clustered just above the current price, while support is well-defined below, highlighting the importance of the 1.89–1.80 range for near-term direction. Overall, the technical structure suggests a bullish bias in the short and long term, with the intermediate-term trend still neutral as the market digests recent gains and tests resistance.

Chart Analysis ATS AI Generated: 2025-10-29 07:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.