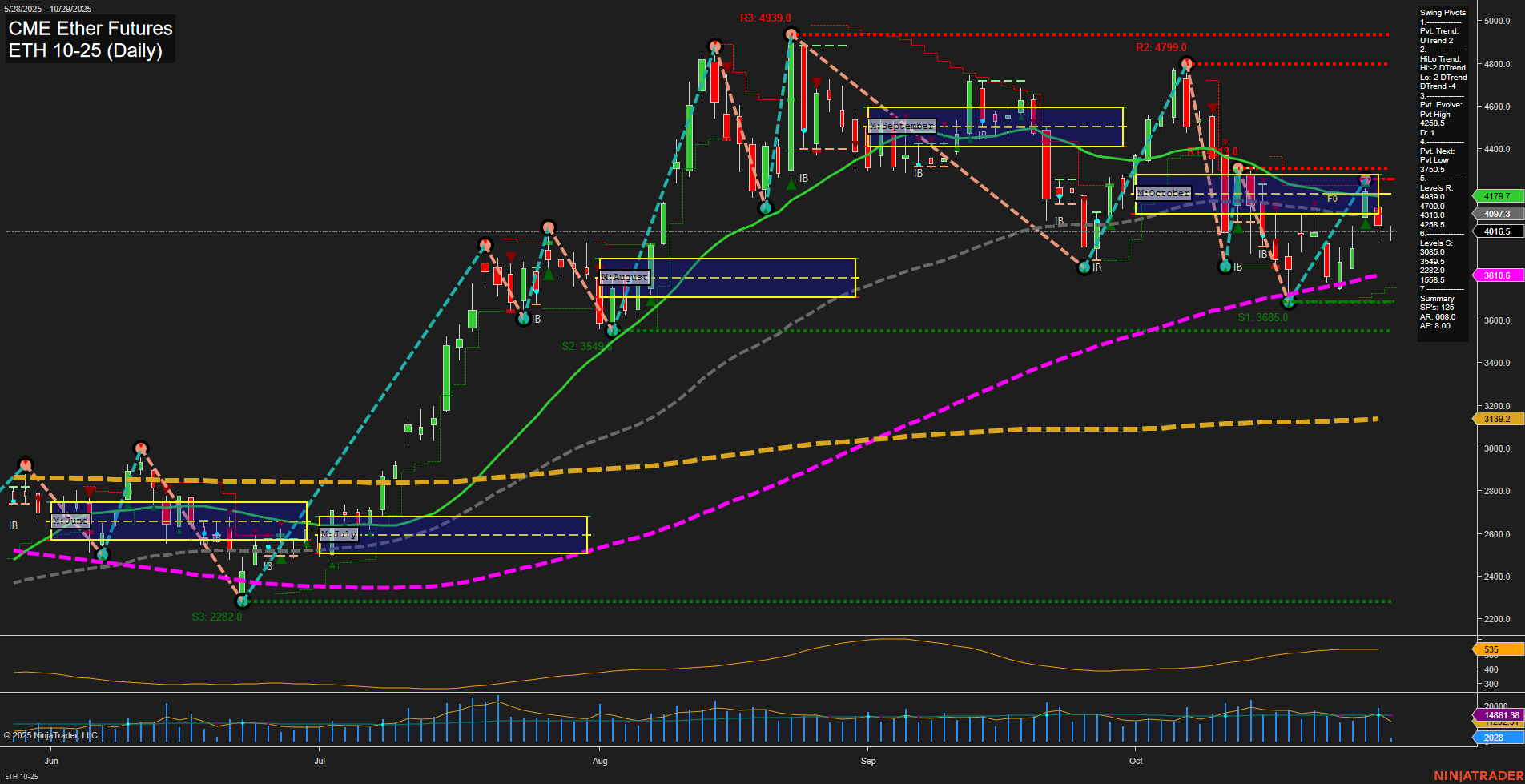

The current ETH CME Ether Futures daily chart reflects a market in transition. Price action is consolidating near 4016.5 with medium-sized bars and slow momentum, indicating a pause after recent volatility. Short-term and intermediate-term trends are both bearish, as confirmed by the downward direction of the 5, 10, 20, and 55-day moving averages, and the swing pivot trend (DTrend) with the most recent pivot low at 3685. Resistance levels are stacked above, with significant barriers at 4186, 4298, and 4799, while support is anchored at 3685 and 3549. The weekly session fib grid (WSFG) shows price above the NTZ center, suggesting some underlying short-term strength, but the monthly session fib grid (MSFG) trend is down, with price below the NTZ, highlighting intermediate-term weakness. The long-term outlook remains bullish, supported by the 100 and 200-day moving averages trending up and the yearly session fib grid (YSFG) in an uptrend. Recent trade signals have shifted to the short side, with two short entries on October 28th, following a failed long attempt on October 27th. Volatility (ATR) is moderate, and volume remains healthy, but the overall setup suggests the market is in a corrective phase within a larger bullish structure. The chart is showing a classic swing trader’s environment: a pullback or retracement within a long-term uptrend, with the potential for further downside in the short to intermediate term before any resumption of the broader uptrend. Key levels to watch are the support at 3685 for a potential bounce or breakdown, and resistance at 4186 and above for signs of reversal or continued selling pressure.