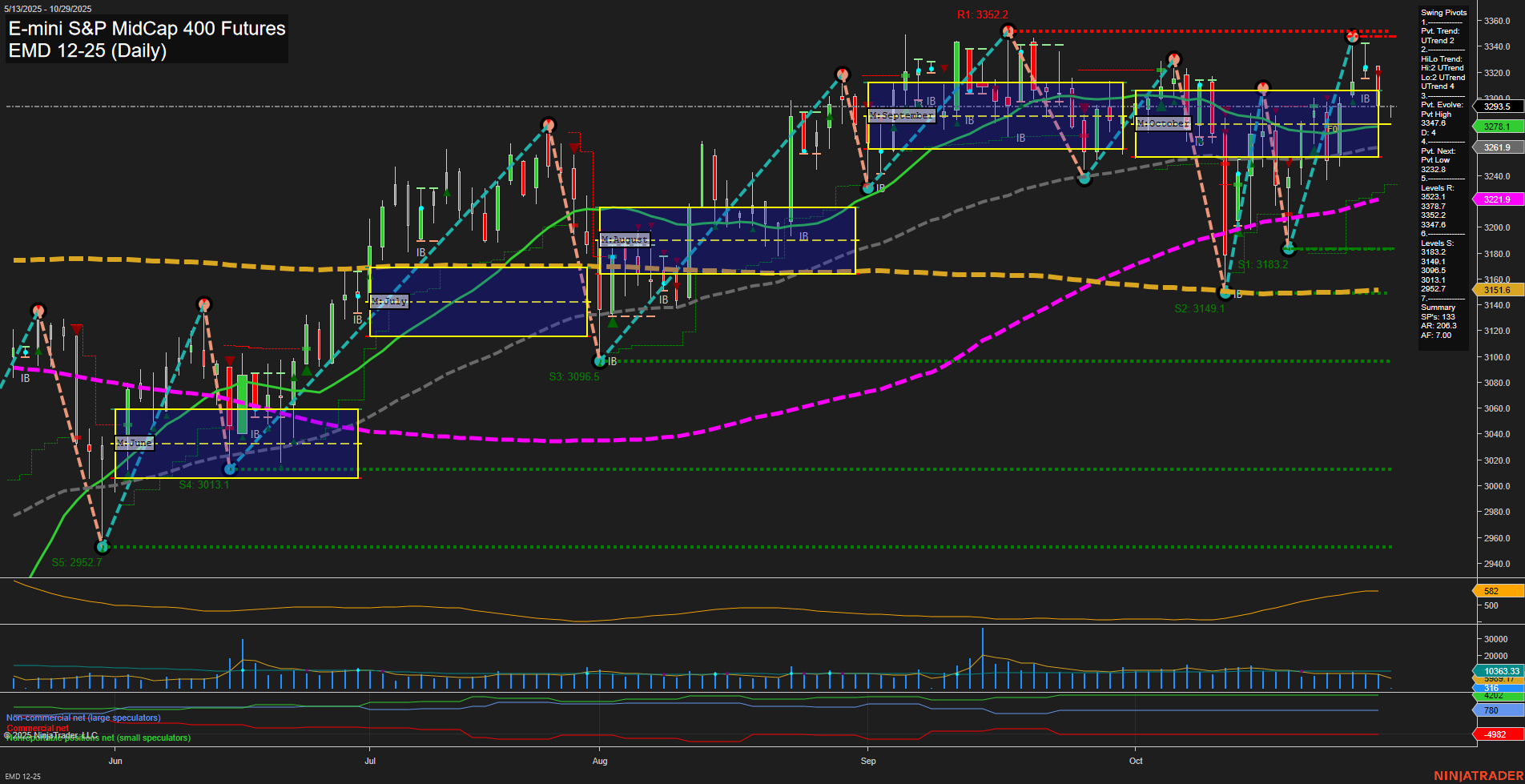

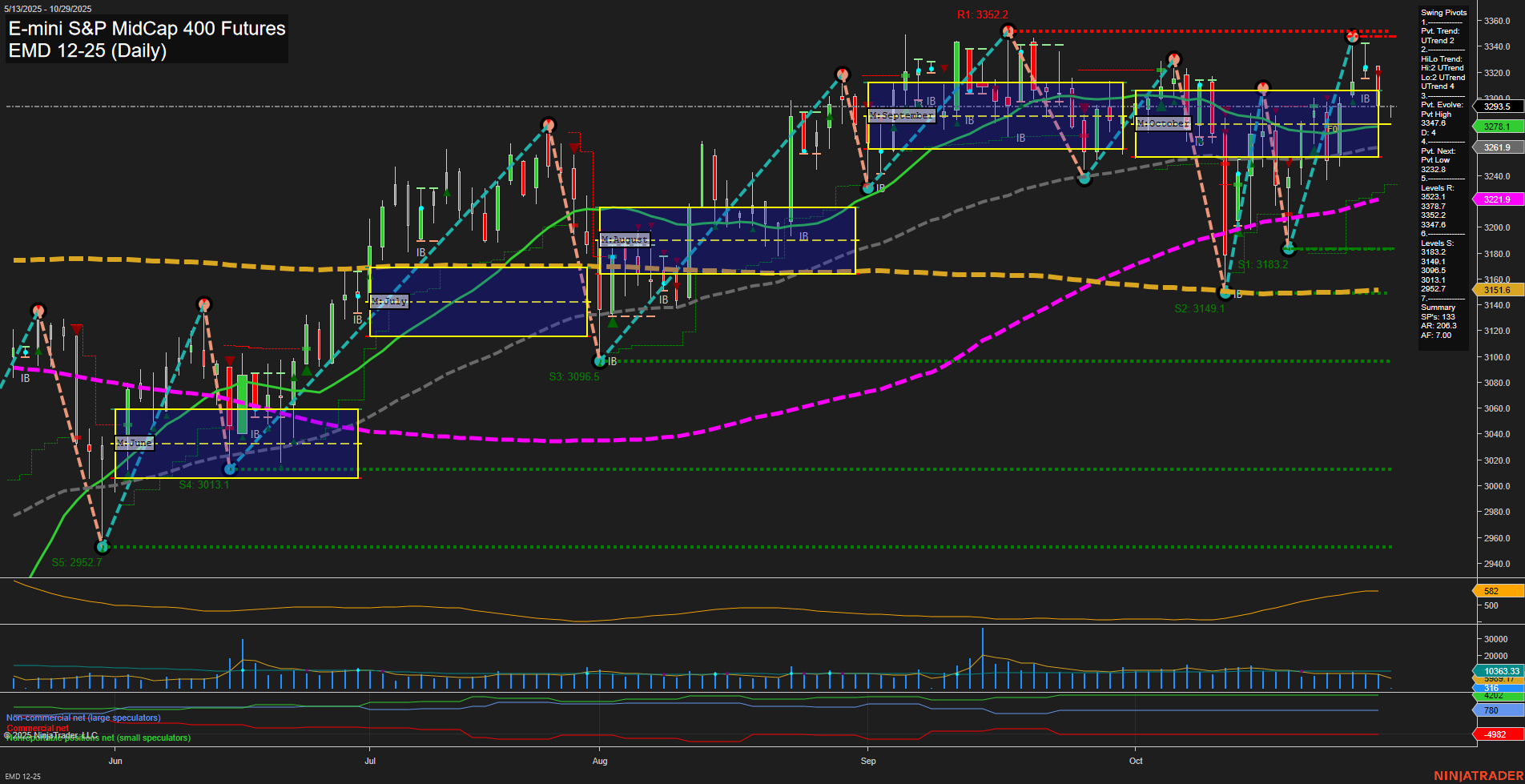

EMD E-mini S&P MidCap 400 Futures Daily Chart Analysis: 2025-Oct-29 07:04 CT

Price Action

- Last: 3293.5,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: -14%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 12%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 3347.6,

- 4. Pvt. Next: Pvt Low 3278.1,

- 5. Levels R: 3352.2, 3347.6, 3328.8,

- 6. Levels S: 3278.1, 3228.8, 3183.2.

Daily Benchmarks

- (Short-Term) 5 Day: 3296.1 Up Trend,

- (Short-Term) 10 Day: 3261.9 Up Trend,

- (Intermediate-Term) 20 Day: 3271.9 Up Trend,

- (Intermediate-Term) 55 Day: 3151.6 Up Trend,

- (Long-Term) 100 Day: 3221.9 Up Trend,

- (Long-Term) 200 Day: 3150.0 Up Trend.

Additional Metrics

Recent Trade Signals

- 28 Oct 2025: Short EMD 12-25 @ 3294.5 Signals.USAR-WSFG

- 28 Oct 2025: Short EMD 12-25 @ 3300.6 Signals.USAR.TR120

- 23 Oct 2025: Long EMD 12-25 @ 3300.1 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The EMD futures daily chart shows a market in transition. Short-term price action is mixed, with medium-sized bars and average momentum, and the latest trade signals indicate a recent shift to short positions, aligning with the WSFG (weekly) trend turning down and price now below the NTZ center. However, the intermediate and long-term trends remain firmly bullish, as reflected in the MSFG and YSFG grids, both showing price above their respective NTZ centers and uptrends. All benchmark moving averages from short to long-term are trending higher, supporting the underlying strength. Swing pivots confirm an uptrend in both short and intermediate timeframes, with resistance levels overhead and support clustered below. Volatility (ATR) is moderate, and volume remains steady. The market appears to be in a pullback or consolidation phase within a broader uptrend, with recent highs being tested and some short-term resistance emerging. This environment suggests a choppy, range-bound short-term outlook, but the prevailing structure favors continuation of the larger bullish trend unless key support levels are broken.

Chart Analysis ATS AI Generated: 2025-10-29 07:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.