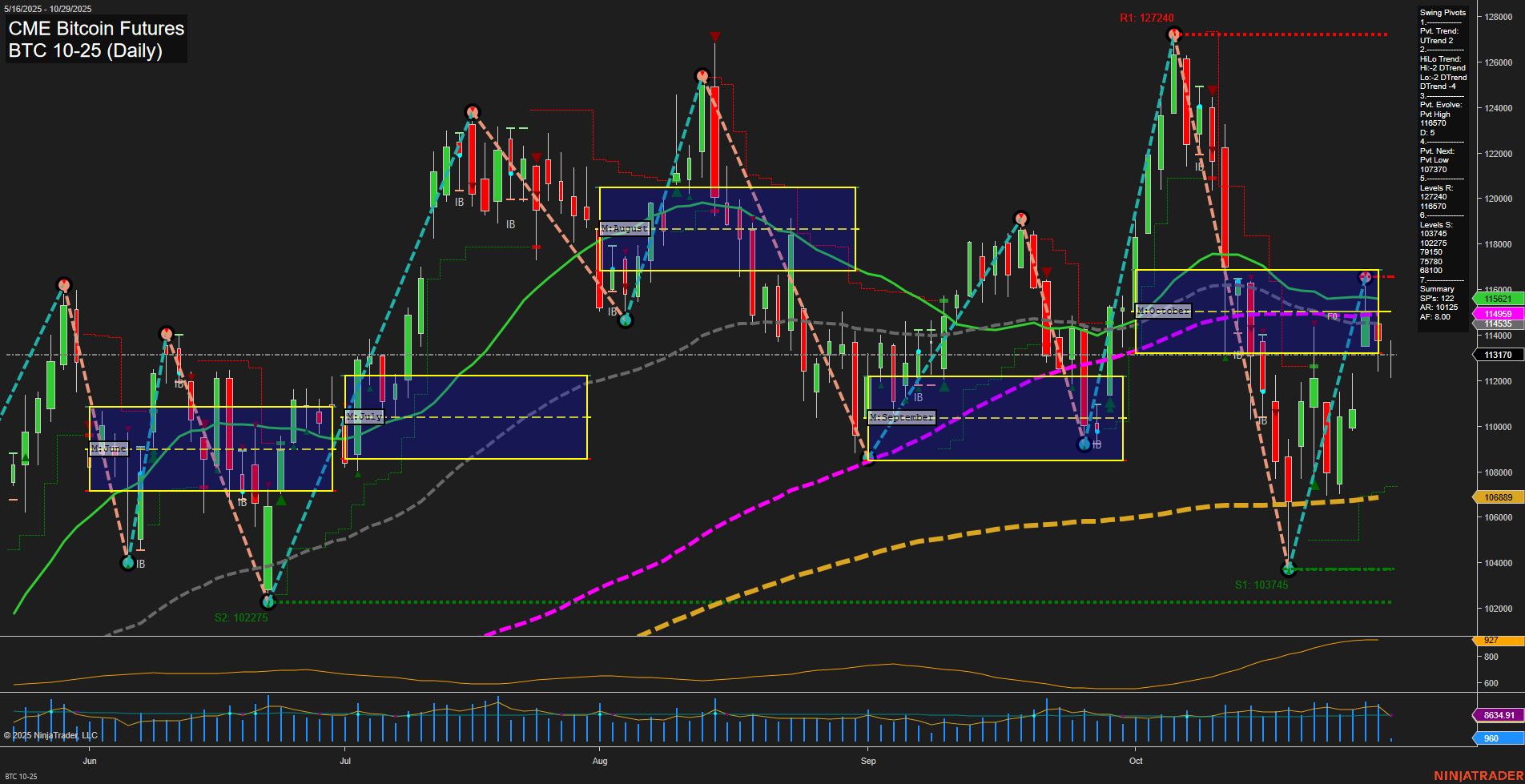

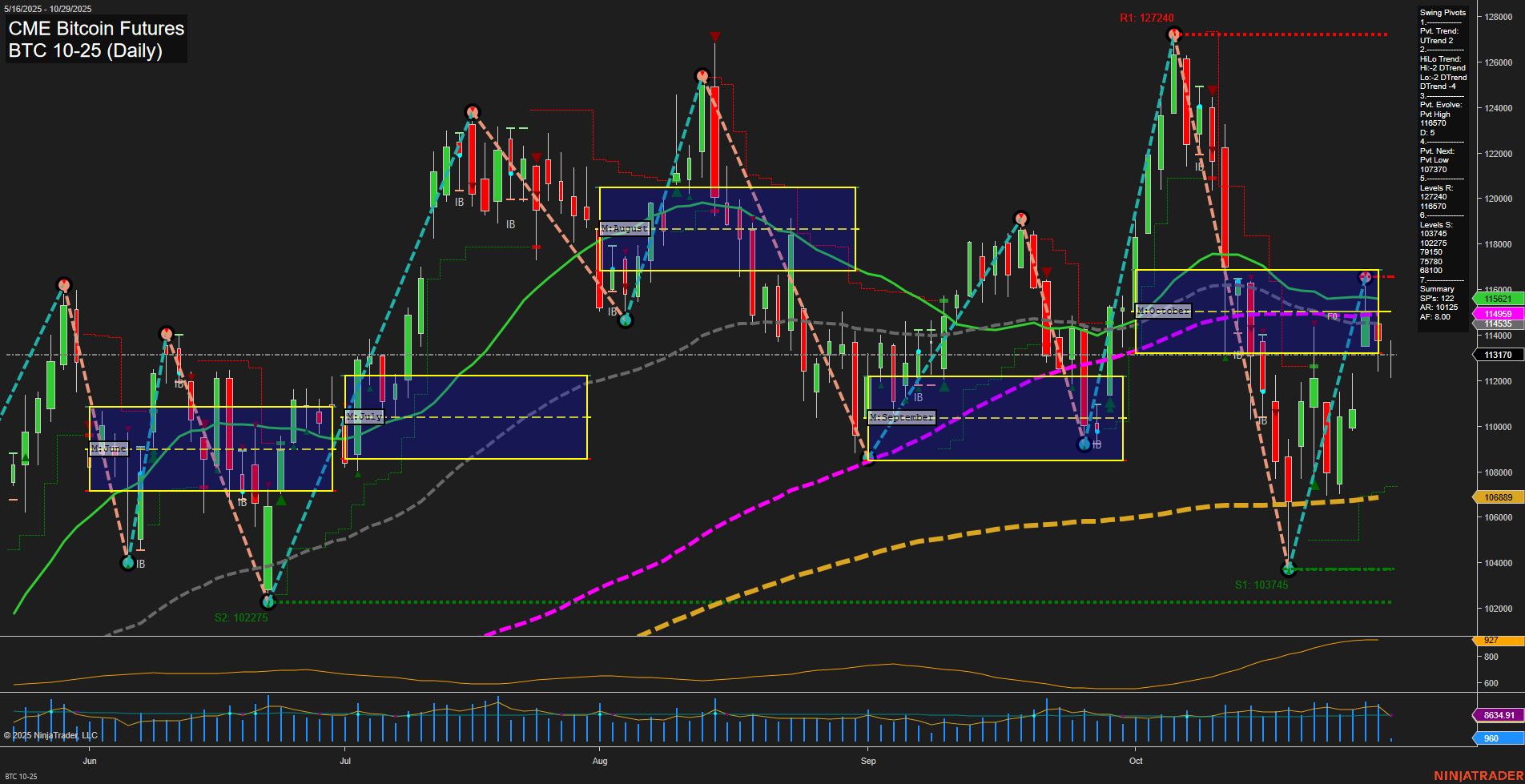

BTC CME Bitcoin Futures Daily Chart Analysis: 2025-Oct-29 07:02 CT

Price Action

- Last: 114595,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 19%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -12%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 49%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 119070,

- 4. Pvt. Next: Pvt low 107370,

- 5. Levels R: 127240, 119070, 116670,

- 6. Levels S: 107370, 103745, 102775.

Daily Benchmarks

- (Short-Term) 5 Day: 115261 Down Trend,

- (Short-Term) 10 Day: 114555 Down Trend,

- (Intermediate-Term) 20 Day: 114959 Down Trend,

- (Intermediate-Term) 55 Day: 116349 Down Trend,

- (Long-Term) 100 Day: 115921 Down Trend,

- (Long-Term) 200 Day: 106889 Up Trend.

Additional Metrics

Recent Trade Signals

- 29 Oct 2025: Short BTC 10-25 @ 112555 Signals.USAR.TR120

- 28 Oct 2025: Short BTC 10-25 @ 113145 Signals.USAR-MSFG

- 27 Oct 2025: Long BTC 10-25 @ 115395 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

BTC CME Bitcoin Futures are currently experiencing a corrective phase after a recent swing high, with price action showing medium-sized bars and average momentum. The short-term and intermediate-term trends are both down, as confirmed by the swing pivot structure (DTrend) and all key moving averages (5, 10, 20, 55, 100-day) trending lower. The price is trading below the monthly session fib grid (MSFG) NTZ center, reinforcing the intermediate-term bearish bias, while the weekly session fib grid (WSFG) remains positive, suggesting some underlying support on a shorter time frame. The long-term trend, however, remains bullish, with the 200-day moving average still rising and price holding above it. Recent trade signals have shifted to the short side, reflecting the prevailing downward momentum. Key resistance levels are clustered above at 116670, 119070, and 127240, while support is found at 107370, 103745, and 102775. Volatility remains moderate (ATR 1025), and volume is steady. Overall, the market is in a pullback or retracement phase within a larger bullish structure, with the potential for further downside in the short to intermediate term before any significant recovery or trend continuation.

Chart Analysis ATS AI Generated: 2025-10-29 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.