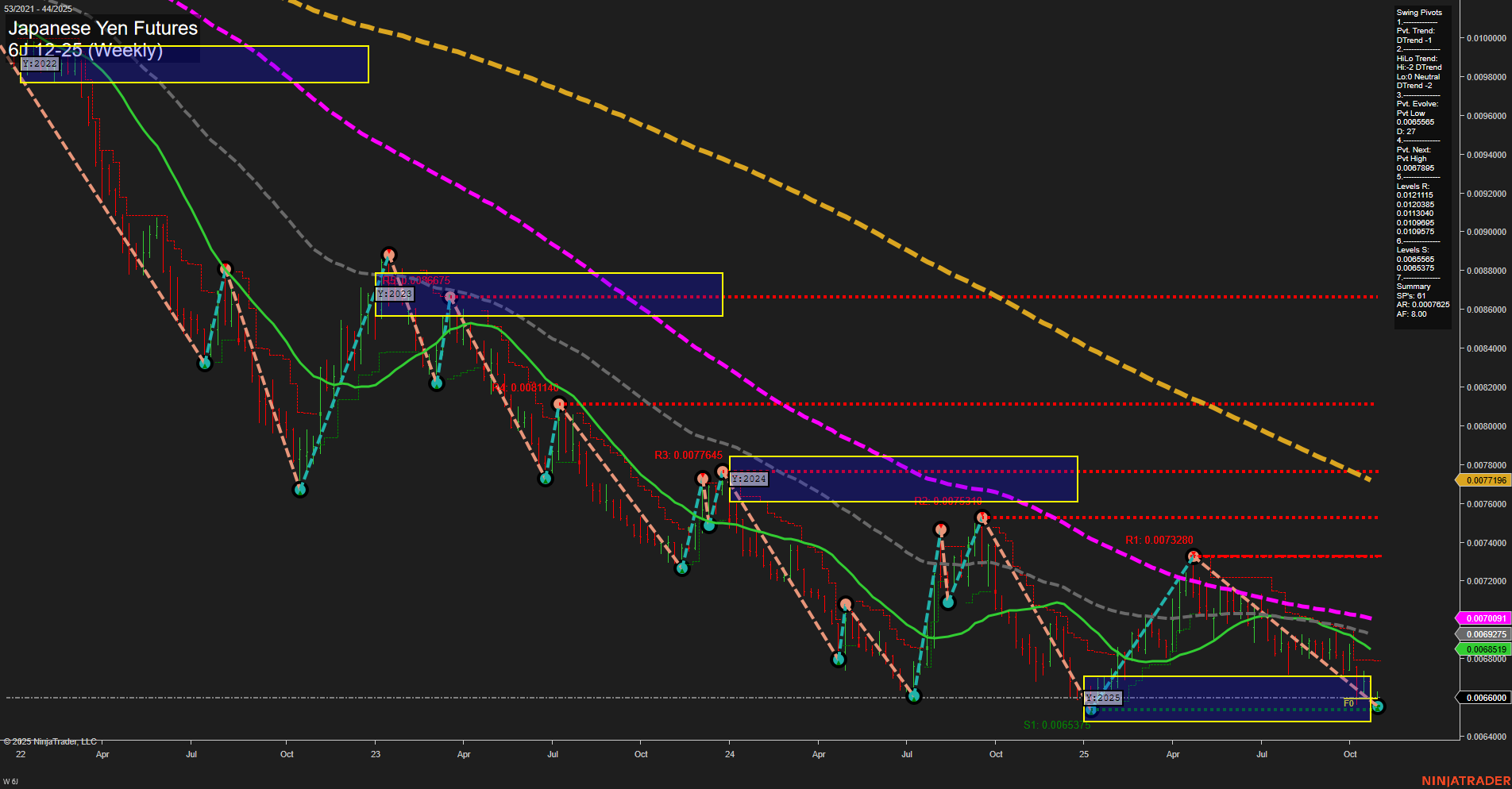

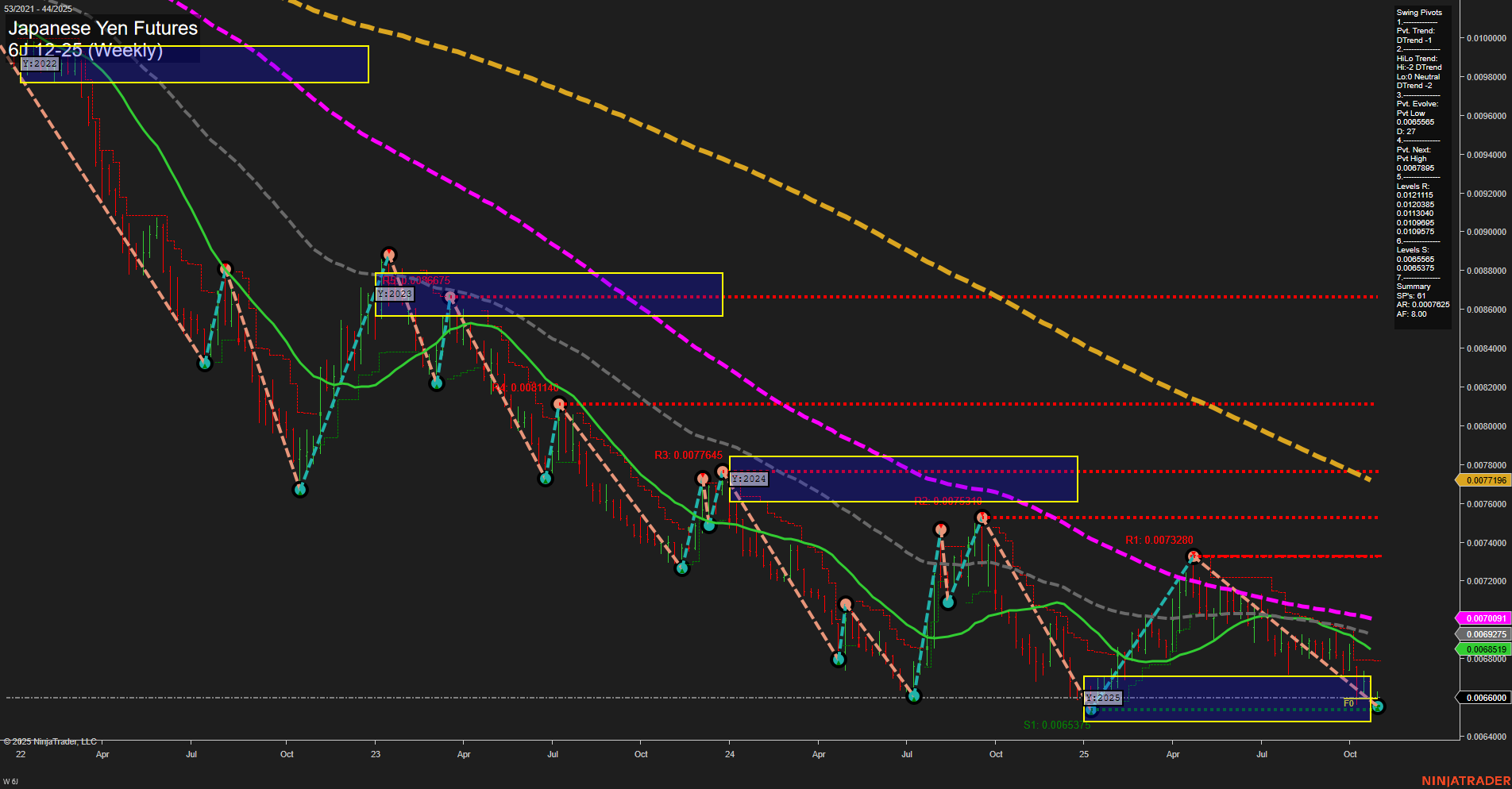

6J Japanese Yen Futures Weekly Chart Analysis: 2025-Oct-29 07:02 CT

Price Action

- Last: 0.0066000,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -77%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 0.0066000,

- 4. Pvt. Next: Pvt high 0.0070875,

- 5. Levels R: 0.0073280, 0.0071091, 0.0070645, 0.0069815, 0.0069575,

- 6. Levels S: 0.0066537, 0.0066375, 0.0065919.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.0068575 Down Trend,

- (Intermediate-Term) 10 Week: 0.0069257 Down Trend,

- (Long-Term) 20 Week: 0.0070091 Down Trend,

- (Long-Term) 55 Week: 0.0073280 Down Trend,

- (Long-Term) 100 Week: 0.0077196 Down Trend,

- (Long-Term) 200 Week: 0.0081222 Down Trend.

Recent Trade Signals

- 29 Oct 2025: Long 6J 12-25 @ 0.0065995 Signals.USAR-WSFG

- 28 Oct 2025: Long 6J 12-25 @ 0.006598 Signals.USAR.TR120

- 23 Oct 2025: Short 6J 12-25 @ 0.006581 Signals.USAR.TR720

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The Japanese Yen futures market remains in a pronounced long-term and intermediate-term downtrend, as evidenced by all major moving averages trending lower and swing pivot trends confirming downside momentum. Price action has recently tested and bounced from a key support zone near 0.0066000, with the latest weekly bars showing medium size and slow momentum, suggesting a pause or potential basing after extended declines. Short-term signals have flipped to neutral with recent long entries, but these are counter-trend relative to the dominant bearish structure. Resistance levels overhead remain significant, and the market would need to reclaim and hold above the 20- and 55-week moving averages to shift the broader trend. For now, the chart reflects a market in consolidation at support, with any upside likely to face strong resistance from the prevailing downtrend and overhead technical levels.

Chart Analysis ATS AI Generated: 2025-10-29 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.