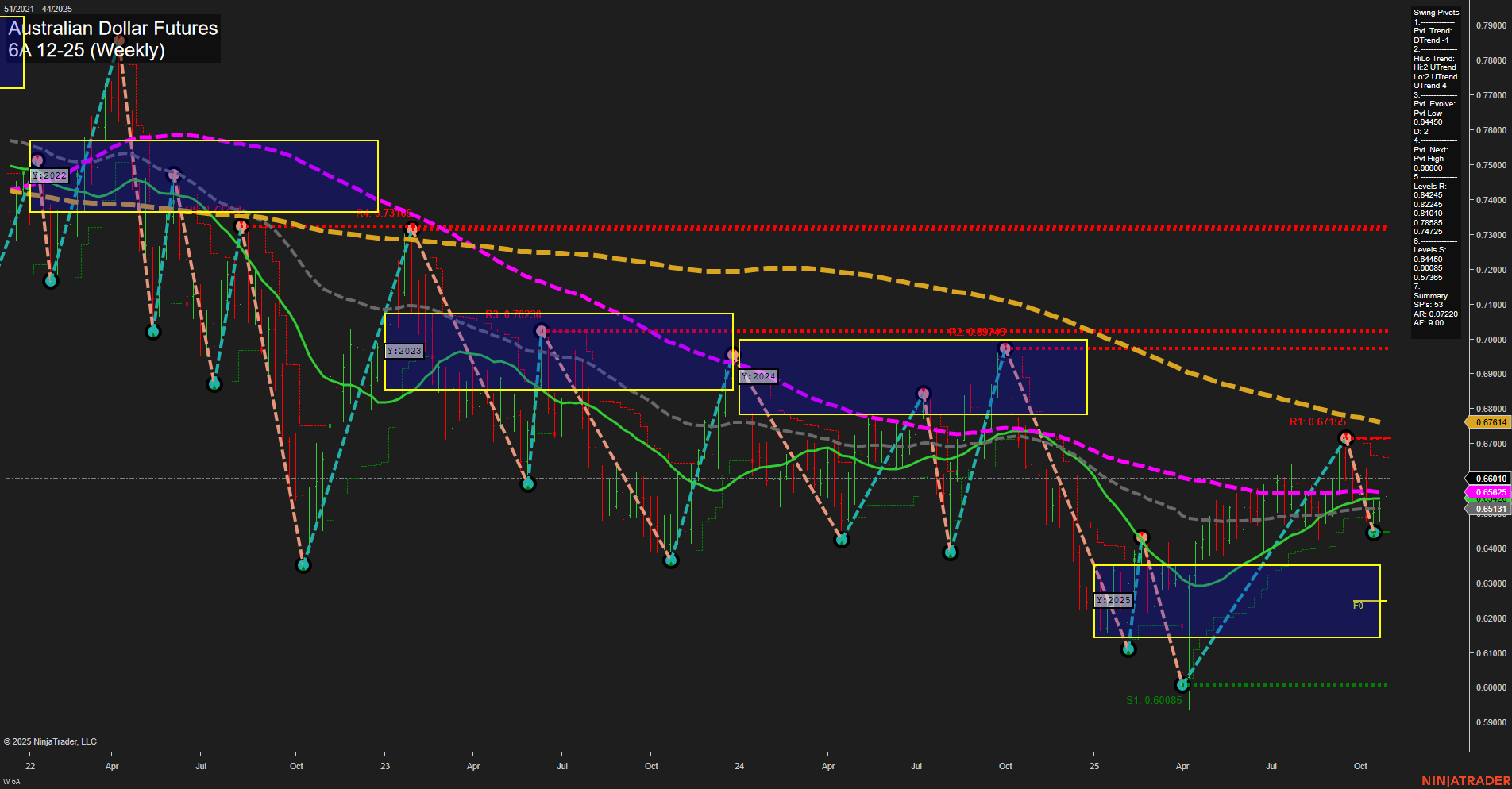

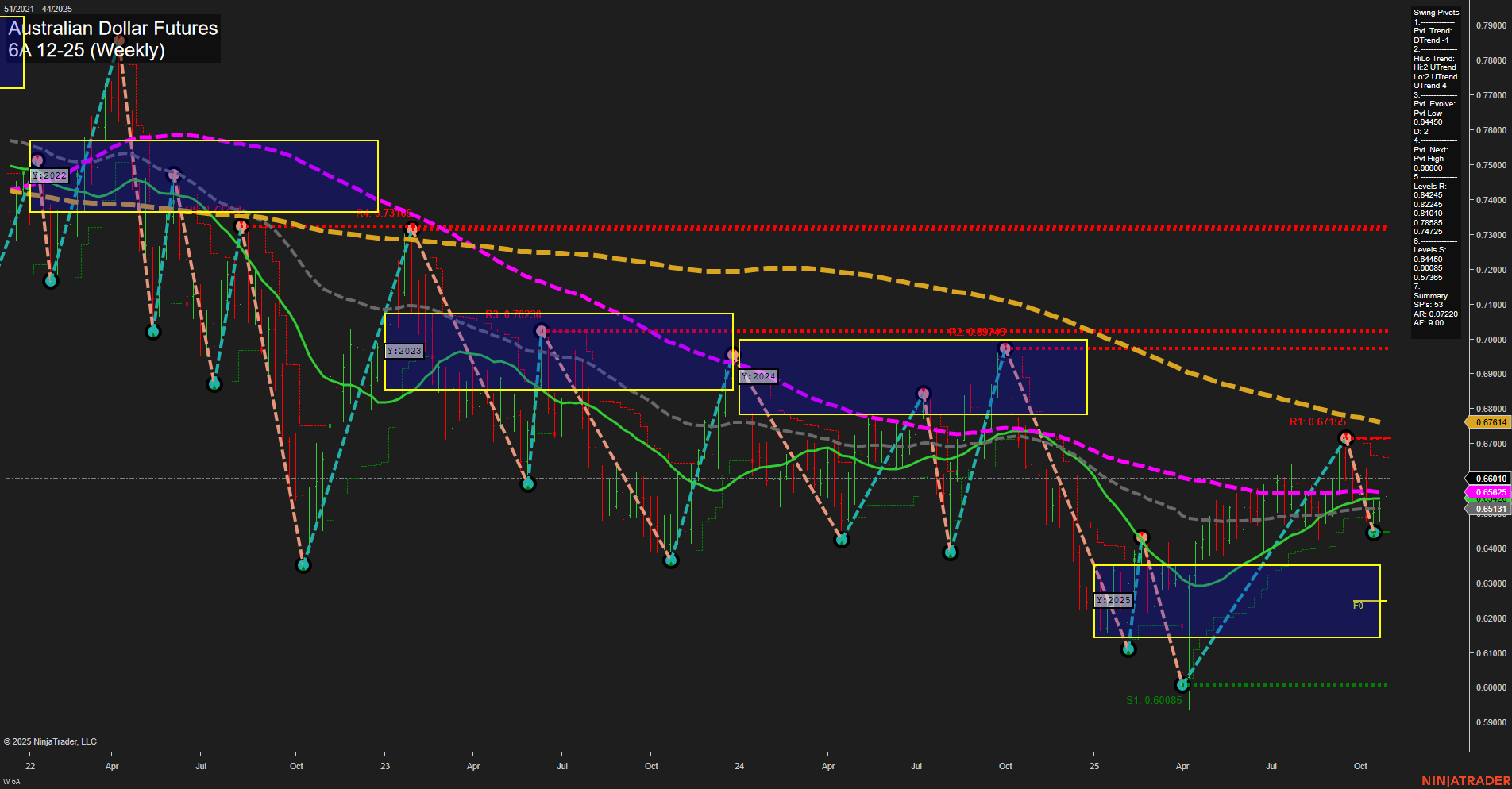

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Oct-29 07:00 CT

Price Action

- Last: 0.65525,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 0.65085,

- 4. Pvt. Next: Pvt high 0.67155,

- 5. Levels R: 0.67155, 0.68949, 0.70381, 0.72845,

- 6. Levels S: 0.65085, 0.60085.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65311 Up Trend,

- (Intermediate-Term) 10 Week: 0.65131 Up Trend,

- (Long-Term) 20 Week: 0.65610 Up Trend,

- (Long-Term) 55 Week: 0.66910 Down Trend,

- (Long-Term) 100 Week: 0.68011 Down Trend,

- (Long-Term) 200 Week: 0.70381 Down Trend.

Recent Trade Signals

- 28 Oct 2025: Long 6A 12-25 @ 0.65875 Signals.USAR.TR720

- 28 Oct 2025: Long 6A 12-25 @ 0.656 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The 6A Australian Dollar Futures weekly chart shows a market in transition, with recent price action characterized by medium-sized bars and average momentum, suggesting a balanced environment between buyers and sellers. Both short-term and intermediate-term swing pivot trends are upward, supported by recent long trade signals and rising 5- and 10-week moving averages. The 20-week moving average is also trending up, reinforcing the bullish tone in the near to intermediate term. However, the longer-term 55-, 100-, and 200-week moving averages remain in a downtrend, indicating that the broader trend is still neutral to bearish and that significant overhead resistance levels (notably at 0.67155 and above) could challenge further advances. The price is currently consolidating near the lower end of the yearly session fib grid, with neutral bias across all session grids, reflecting a lack of strong directional conviction on the higher timeframes. Support is established at 0.65085 and 0.60085, while resistance is layered above, suggesting a potential range-bound environment unless a breakout occurs. Overall, the chart reflects a market attempting to recover from prior lows, with bullish momentum in the short and intermediate term, but still facing structural resistance from the long-term downtrend.

Chart Analysis ATS AI Generated: 2025-10-29 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.