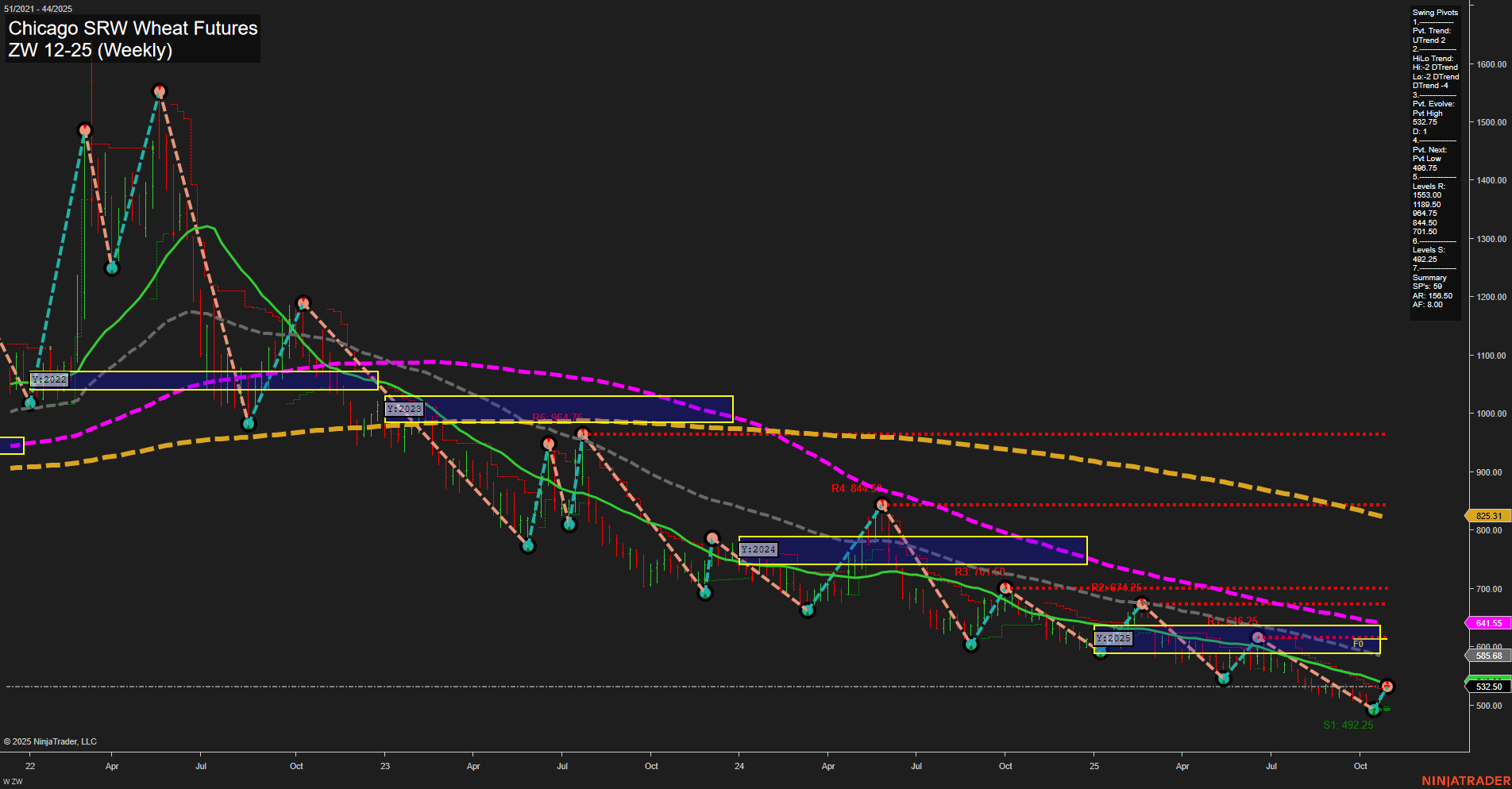

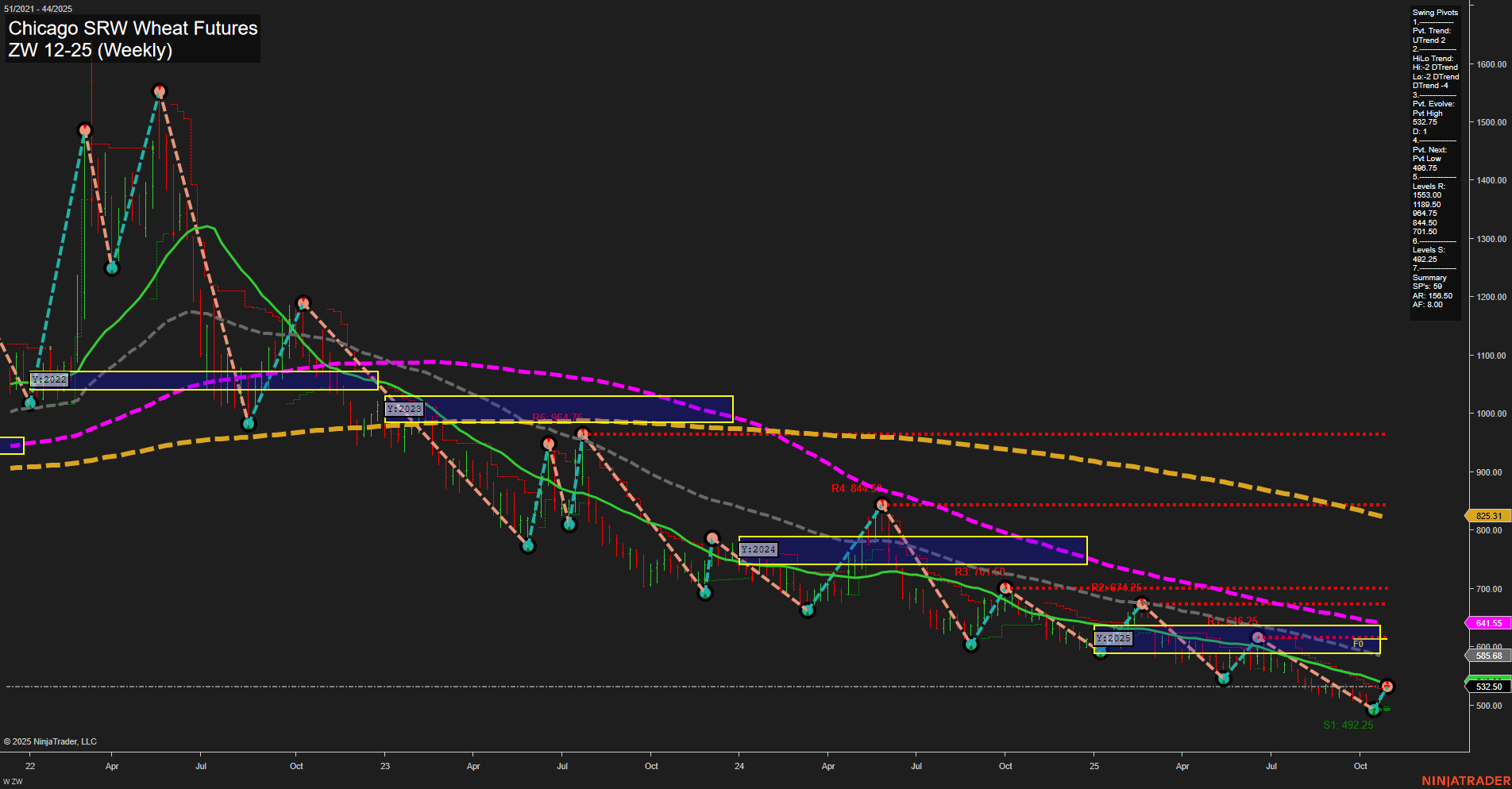

ZW Chicago SRW Wheat Futures Weekly Chart Analysis: 2025-Oct-28 07:56 CT

Price Action

- Last: 532.50,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 107%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 83%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -34%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 532.79,

- 4. Pvt. Next: Pvt low 492.25,

- 5. Levels R: 1193.00, 1043.50, 984.75, 841.50, 701.50,

- 6. Levels S: 492.25.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 558.66 Down Trend,

- (Intermediate-Term) 10 Week: 585.66 Down Trend,

- (Long-Term) 20 Week: 641.55 Down Trend,

- (Long-Term) 55 Week: 825.31 Down Trend,

- (Long-Term) 100 Week: 0.00,

- (Long-Term) 200 Week: 0.00.

Recent Trade Signals

- 24 Oct 2025: Long ZW 12-25 @ 512.75 Signals.USAR-MSFG

- 23 Oct 2025: Long ZW 12-25 @ 507.75 Signals.USAR-WSFG

- 21 Oct 2025: Short ZW 12-25 @ 500 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

The ZW Chicago SRW Wheat Futures weekly chart shows a market in transition. Price action has been subdued with small bars and slow momentum, but recent short-term and intermediate-term signals have shifted bullish, as reflected in the WSFG and MSFG trends both turning up and price moving above their respective NTZ/F0% levels. The most recent swing pivot has evolved to a new high at 532.79, with the next key support at 492.25, indicating a potential higher low formation. However, the long-term YSFG trend remains firmly down, with price still well below the yearly NTZ and all major long-term moving averages trending lower. Resistance levels are stacked far above current price, highlighting the depth of the prior downtrend. Recent trade signals show a shift to long positions in the short and intermediate term, but the overall structure suggests this could be a countertrend rally within a broader bearish context. The market may be attempting a base or recovery, but long-term headwinds persist, and the price remains in a lower range relative to historical resistance. Volatility appears to be compressing, and the market is at a technical inflection point where a sustained move above short-term resistance could signal further upside retracement, while failure to hold recent gains could see a retest of support.

Chart Analysis ATS AI Generated: 2025-10-28 07:56 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.