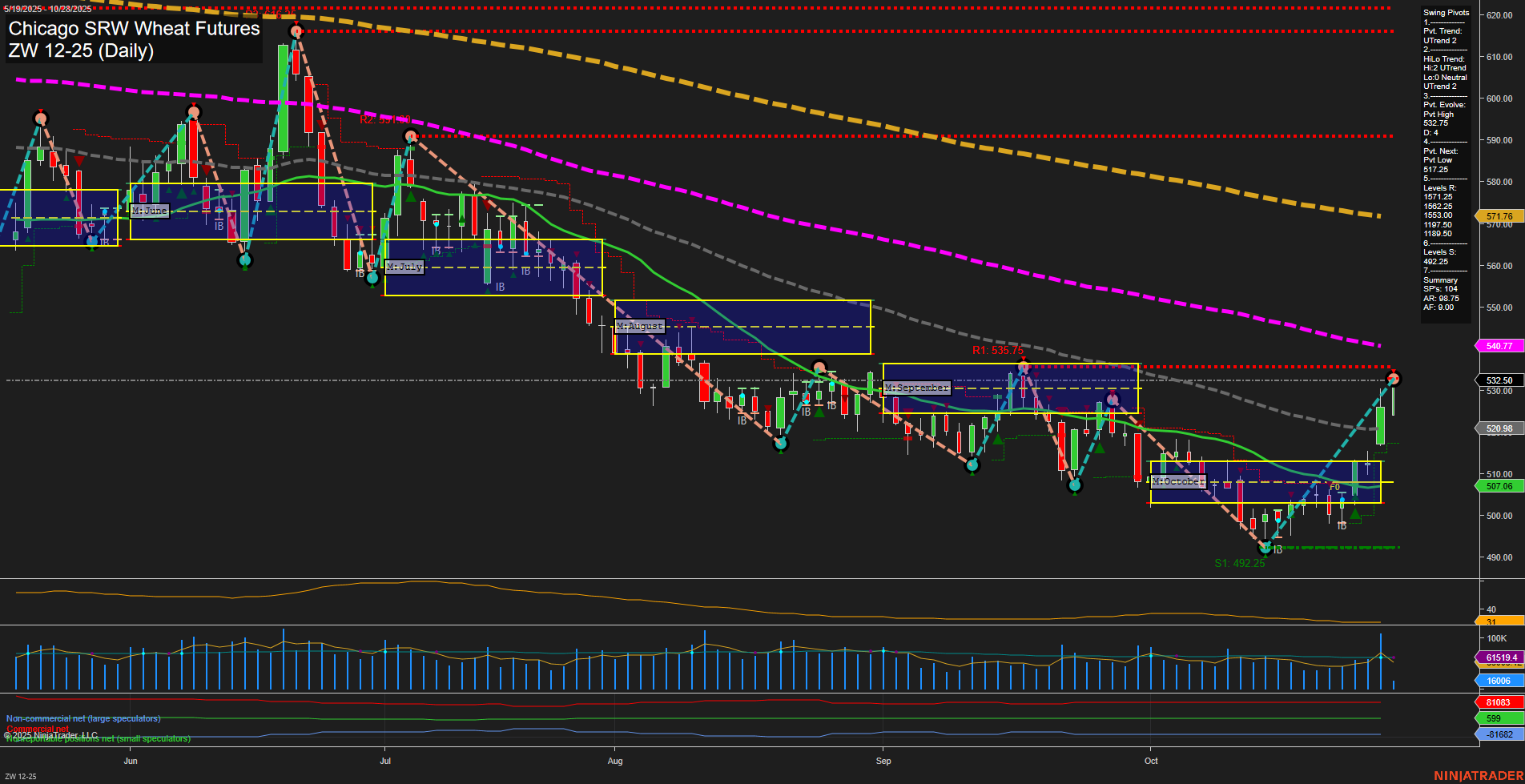

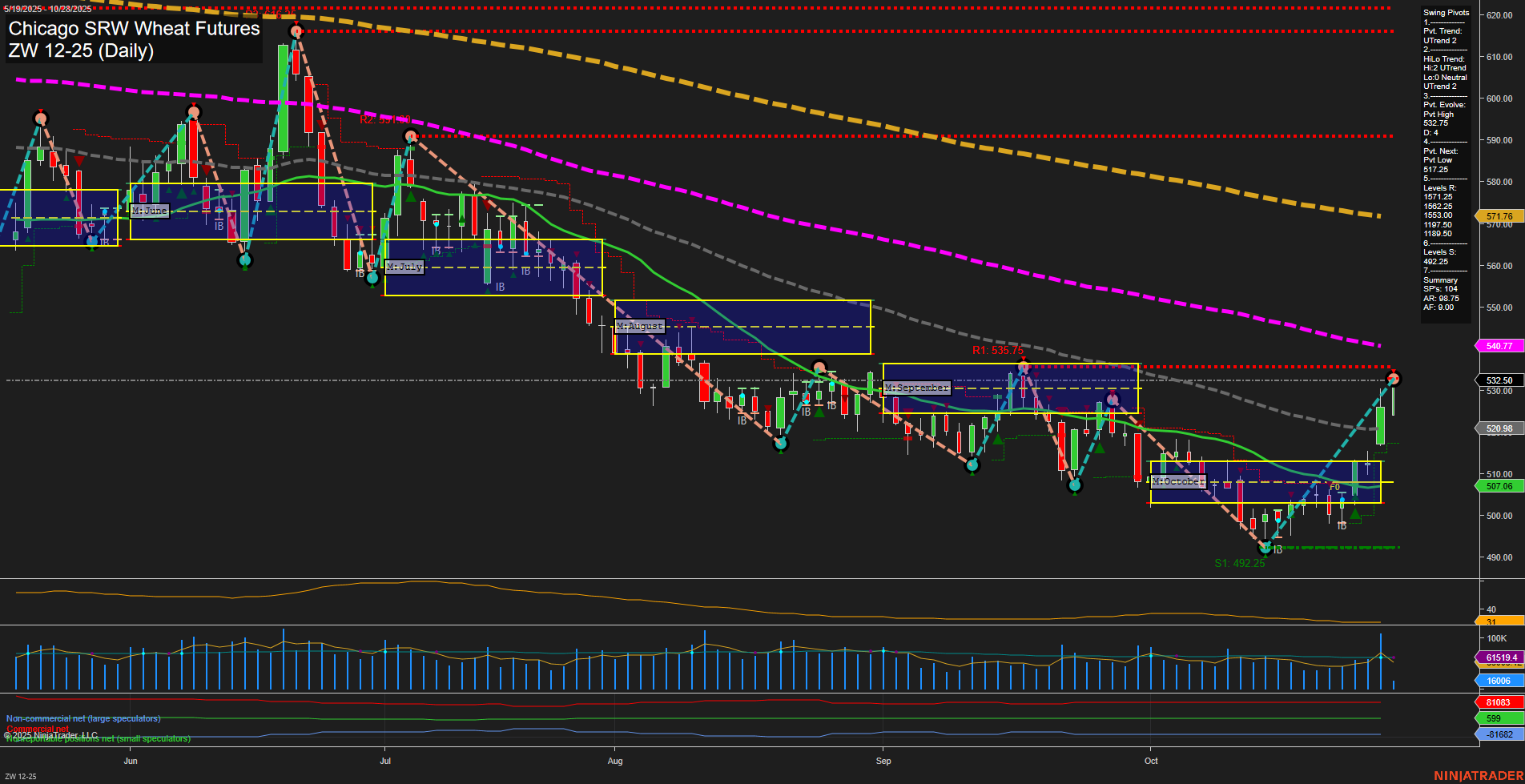

ZW Chicago SRW Wheat Futures Daily Chart Analysis: 2025-Oct-28 07:55 CT

Price Action

- Last: 532.50,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 107%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 83%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -34%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 532.75,

- 4. Pvt. Next: Pvt Low 507.25,

- 5. Levels R: 535.75, 555.25, 565.25, 595.25, 599.50, 611.00,

- 6. Levels S: 507.25, 492.25.

Daily Benchmarks

- (Short-Term) 5 Day: 507.06 Up Trend,

- (Short-Term) 10 Day: 507.06 Up Trend,

- (Intermediate-Term) 20 Day: 520.98 Up Trend,

- (Intermediate-Term) 55 Day: 540.77 Down Trend,

- (Long-Term) 100 Day: 571.77 Down Trend,

- (Long-Term) 200 Day: 610.00 Down Trend.

Additional Metrics

Recent Trade Signals

- 24 Oct 2025: Long ZW 12-25 @ 512.75 Signals.USAR-MSFG

- 23 Oct 2025: Long ZW 12-25 @ 507.75 Signals.USAR-WSFG

- 21 Oct 2025: Short ZW 12-25 @ 500 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

The ZW Chicago SRW Wheat Futures daily chart shows a strong short-term and intermediate-term bullish reversal, with price surging above both the weekly and monthly session fib grid NTZ levels. Large, fast momentum bars confirm aggressive buying, and recent swing pivots have shifted to an uptrend, with the latest pivot high at 532.75 and support at 507.25. Both the 5-day and 10-day moving averages have turned up, and the 20-day MA is also trending higher, reinforcing the short- and intermediate-term strength. However, the 55-day, 100-day, and 200-day moving averages remain in downtrends, highlighting that the longer-term structure is still bearish. The ATR and volume metrics indicate heightened volatility and participation, often seen during trend reversals or breakout moves. Recent trade signals have flipped to the long side, supporting the current bullish momentum. Overall, the market is experiencing a strong rally phase in the short and intermediate term, but the longer-term trend remains downward, suggesting this move could be a significant retracement or the early stage of a larger reversal.

Chart Analysis ATS AI Generated: 2025-10-28 07:56 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.