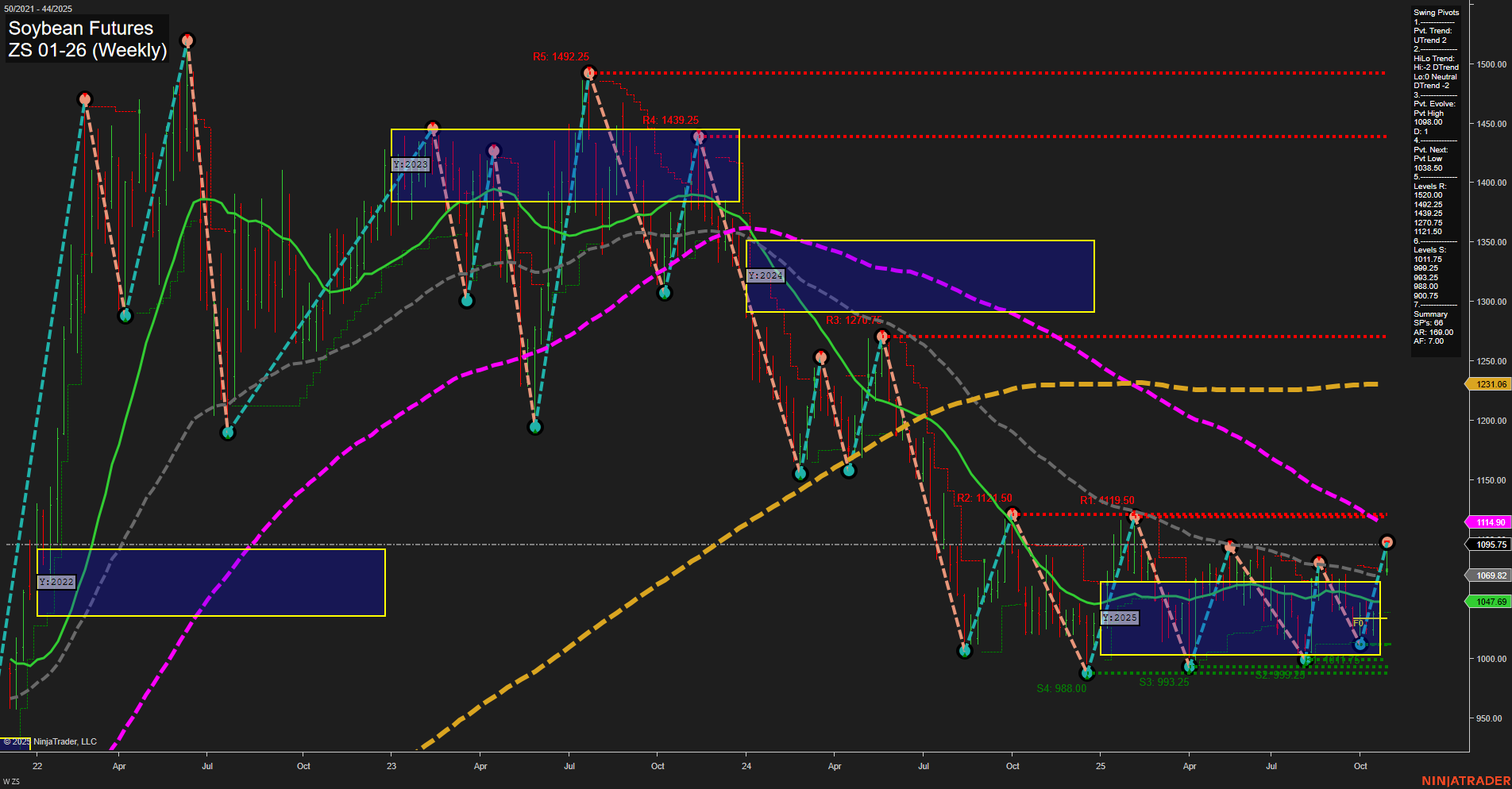

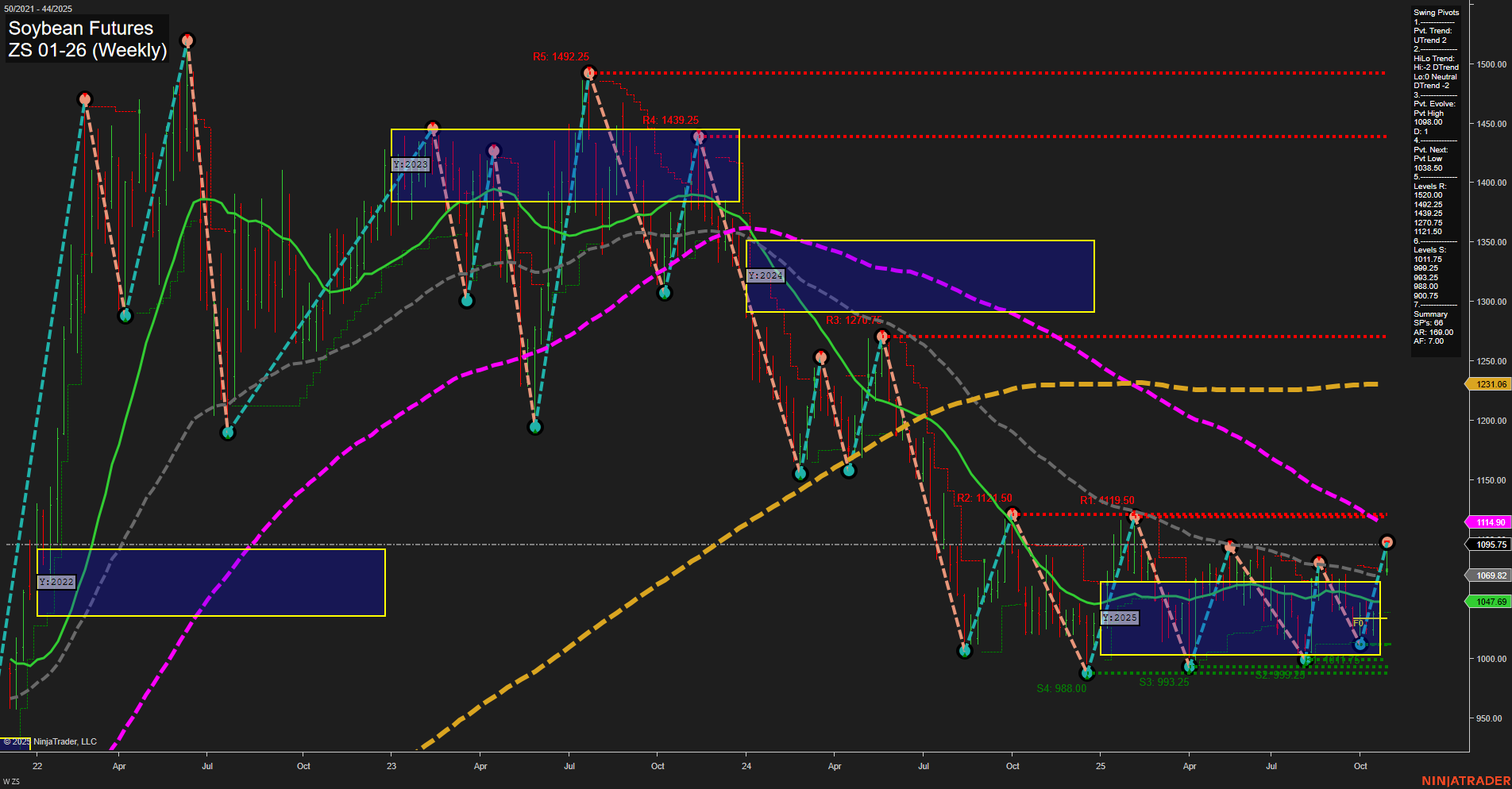

ZS Soybean Futures Weekly Chart Analysis: 2025-Oct-28 07:55 CT

Price Action

- Last: 1095.75,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 131%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 144%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 20%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 1095.00,

- 4. Pvt. Next: Pvt Low 993.25,

- 5. Levels R: 1492.25, 1439.25, 1402.00, 1270.75, 1171.50,

- 6. Levels S: 1095.75, 988.00, 969.25, 963.25, 960.00, 905.75.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: [Not shown] [Trend not shown],

- (Intermediate-Term) 10 Week: [Not shown] [Trend not shown],

- (Long-Term) 20 Week: 1047.69 Down Trend,

- (Long-Term) 55 Week: 1231.06 Down Trend,

- (Long-Term) 100 Week: 1114.90 Down Trend,

- (Long-Term) 200 Week: [Not shown] [Trend not shown].

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

Soybean futures have recently shown a short-term bullish reversal, with price action breaking above the NTZ center and confirming an uptrend in the weekly session fib grid. However, the intermediate and long-term trends remain bearish, as indicated by the downward direction of the major moving averages and the prevailing downtrend in the HiLo swing structure. The market is currently testing a key resistance zone near 1095.75, with significant overhead resistance levels above, while support is clustered just below the current price. The recent price action suggests a potential for further short-term upside, but the broader context remains corrective, with rallies facing strong resistance from higher timeframe sellers. The market is in a consolidation phase, with volatility and choppy swings between support and resistance, and no clear breakout from the larger range established over the past year.

Chart Analysis ATS AI Generated: 2025-10-28 07:55 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.