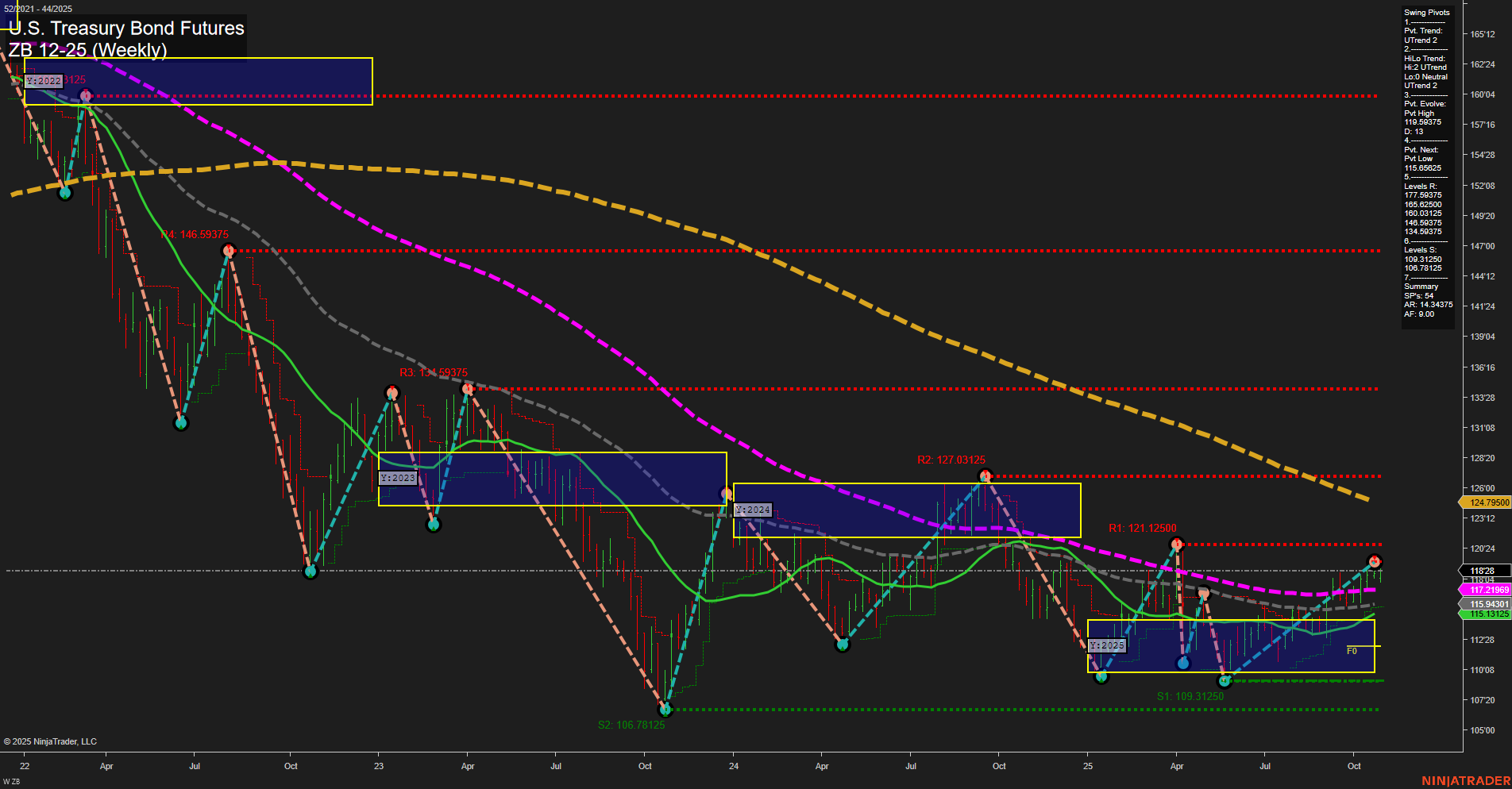

The ZB U.S. Treasury Bond Futures weekly chart shows a market in recovery mode from prior lows, with price action currently exhibiting medium-sized bars and average momentum. Both short-term and intermediate-term swing pivot trends are up, supported by a series of higher lows and a recent pivot high at 124.69375. The price is trading above the 5, 10, 20, and 55-week moving averages, all of which are trending upward, indicating sustained bullish momentum in the short and intermediate timeframes. However, the 100 and 200-week moving averages remain in a downtrend, reflecting that the longer-term structure is still neutral and has not fully reversed from the broader bearish cycle seen in previous years. The price is currently within a neutral zone on the yearly, monthly, and weekly session fib grids, suggesting a period of consolidation or base-building after a significant rally from the lows. Key resistance levels are stacked above, with 127.03125 and 134.69375 as notable hurdles, while support is well-defined at 115.66225 and 109.31250. The overall technical landscape points to a market that is attempting to transition from a long-term downtrend to a more neutral or potentially bullish phase, but confirmation will require a sustained breakout above the 100-week moving average and key resistance levels. The current environment favors swing trading strategies that capitalize on the prevailing uptrend in the short and intermediate term, while remaining mindful of the overhead resistance and the still-neutral long-term trend.