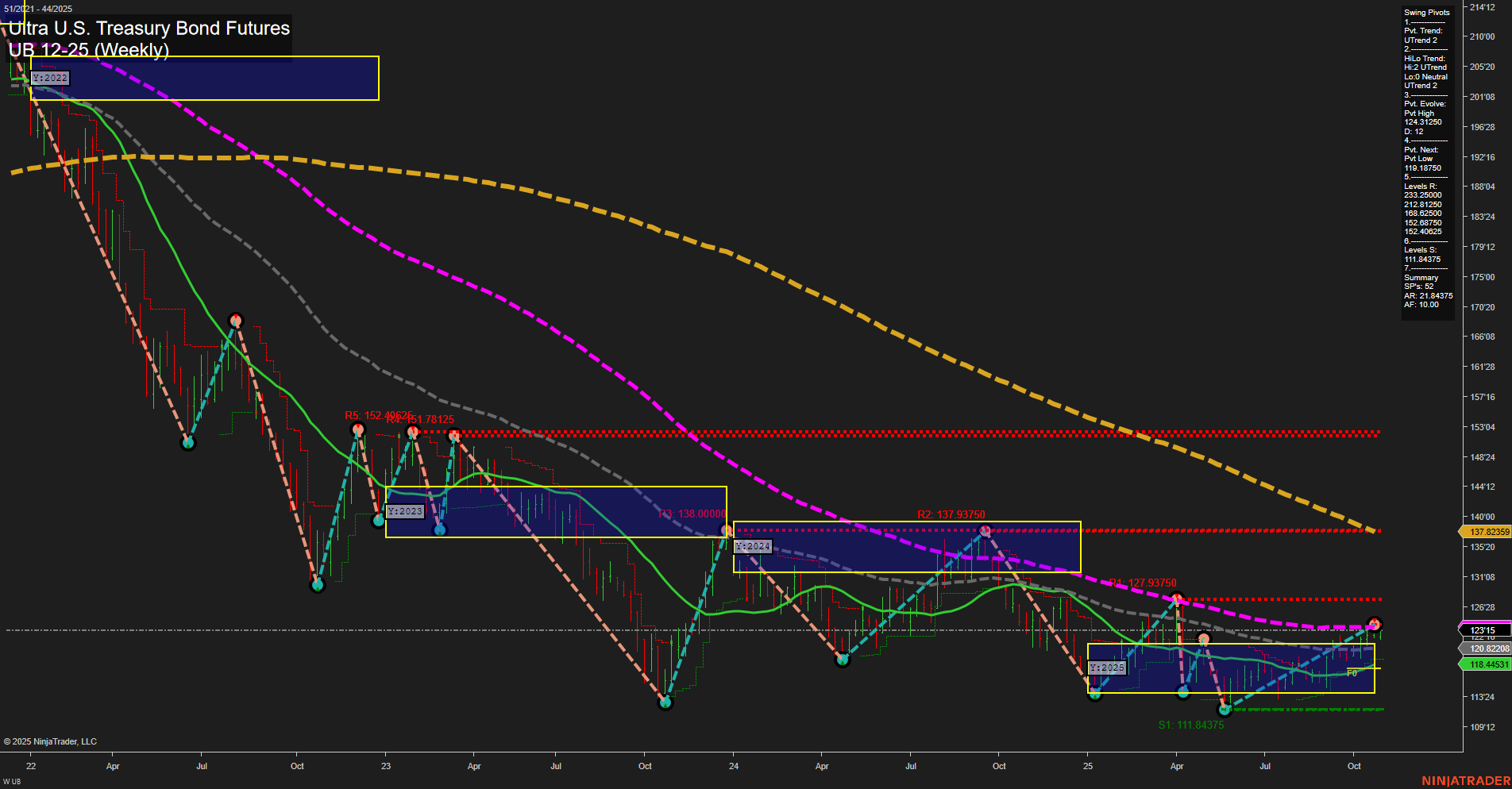

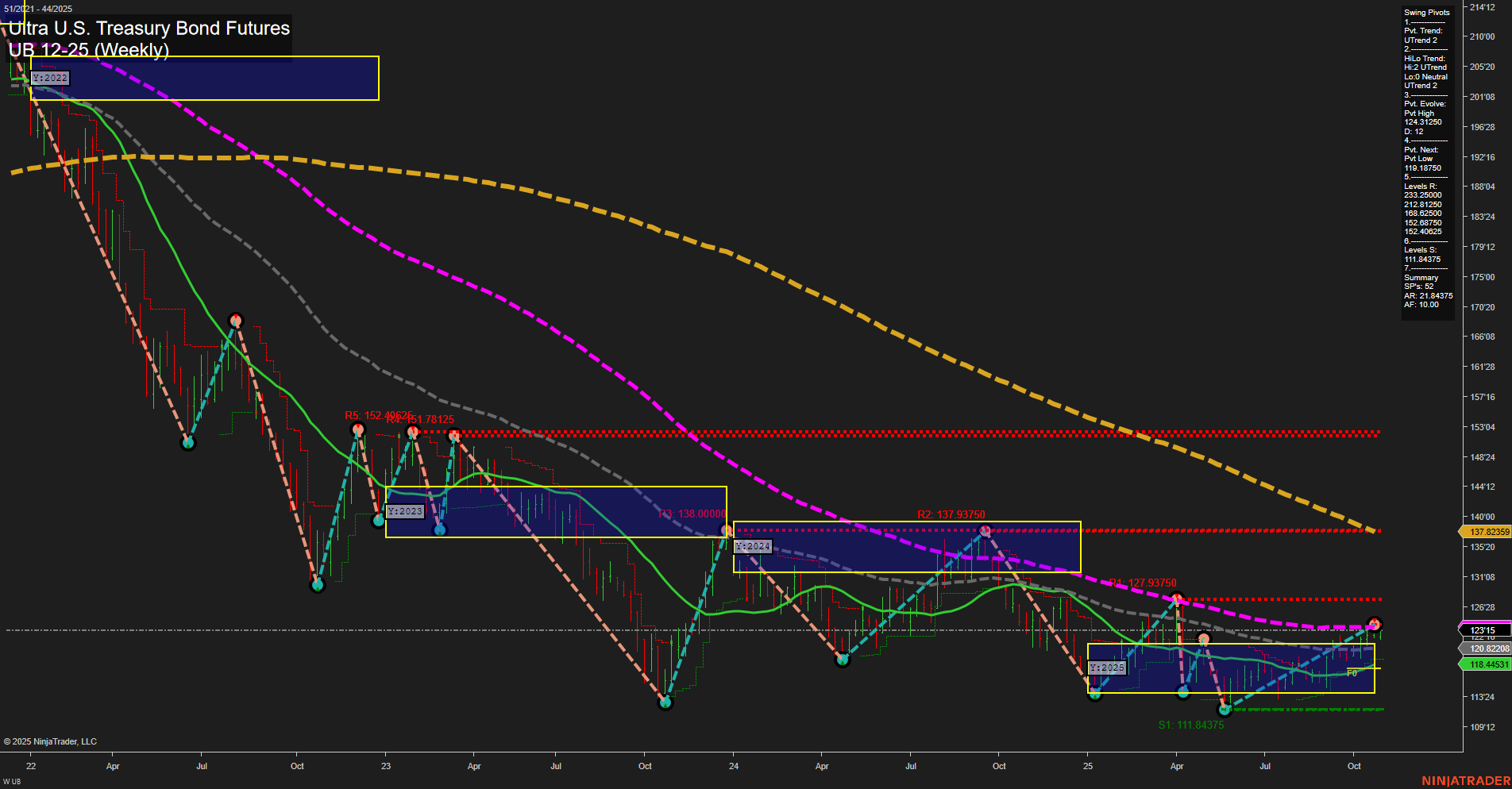

UB Ultra U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Oct-28 07:50 CT

Price Action

- Last: 123'15,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 31%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 70%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend 2,

- (Intermediate-Term) 2. HiLo Trend: UTrend 2,

- 3. Pvt. Evolve: Pvt high 124'13.25,

- 4. Pvt. Next: Pvt low 119'18.75,

- 5. Levels R: 152'16, 151'28.5, 138'00, 137'29.75, 127'29.75,

- 6. Levels S: 120'28.25, 118'14.5, 111'8.4375.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 121'25 Up Trend,

- (Intermediate-Term) 10 Week: 121'09 Up Trend,

- (Long-Term) 20 Week: 122'11 Up Trend,

- (Long-Term) 55 Week: 118'14.5 Up Trend,

- (Long-Term) 100 Week: 137'29.75 Down Trend,

- (Long-Term) 200 Week: 152'16 Down Trend.

Recent Trade Signals

- 27 Oct 2025: Long UB 12-25 @ 123.25 Signals.USAR.TR120

- 27 Oct 2025: Long UB 12-25 @ 122.78125 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a notable shift in sentiment, with price action breaking above key NTZ/F0% levels across short, intermediate, and long-term session fib grids. Momentum is average, and the medium-sized bars reflect a steady, constructive advance. Both short-term and intermediate-term swing pivot trends are up, supported by recent higher highs and higher lows, and the evolving pivot high at 124'13.25 signals continued upward pressure. Resistance levels remain well above current price, while support is firming up around 120'28.25 and 118'14.5. All key weekly moving averages up to the 55-week are trending higher, confirming the bullish structure, though the 100- and 200-week MAs remain in a downtrend, tempering the long-term outlook to neutral. Recent trade signals confirm renewed buying interest. Overall, the market is in a recovery phase, with a bullish bias in the short and intermediate term, while the long-term trend is stabilizing but not yet fully reversed.

Chart Analysis ATS AI Generated: 2025-10-28 07:51 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.