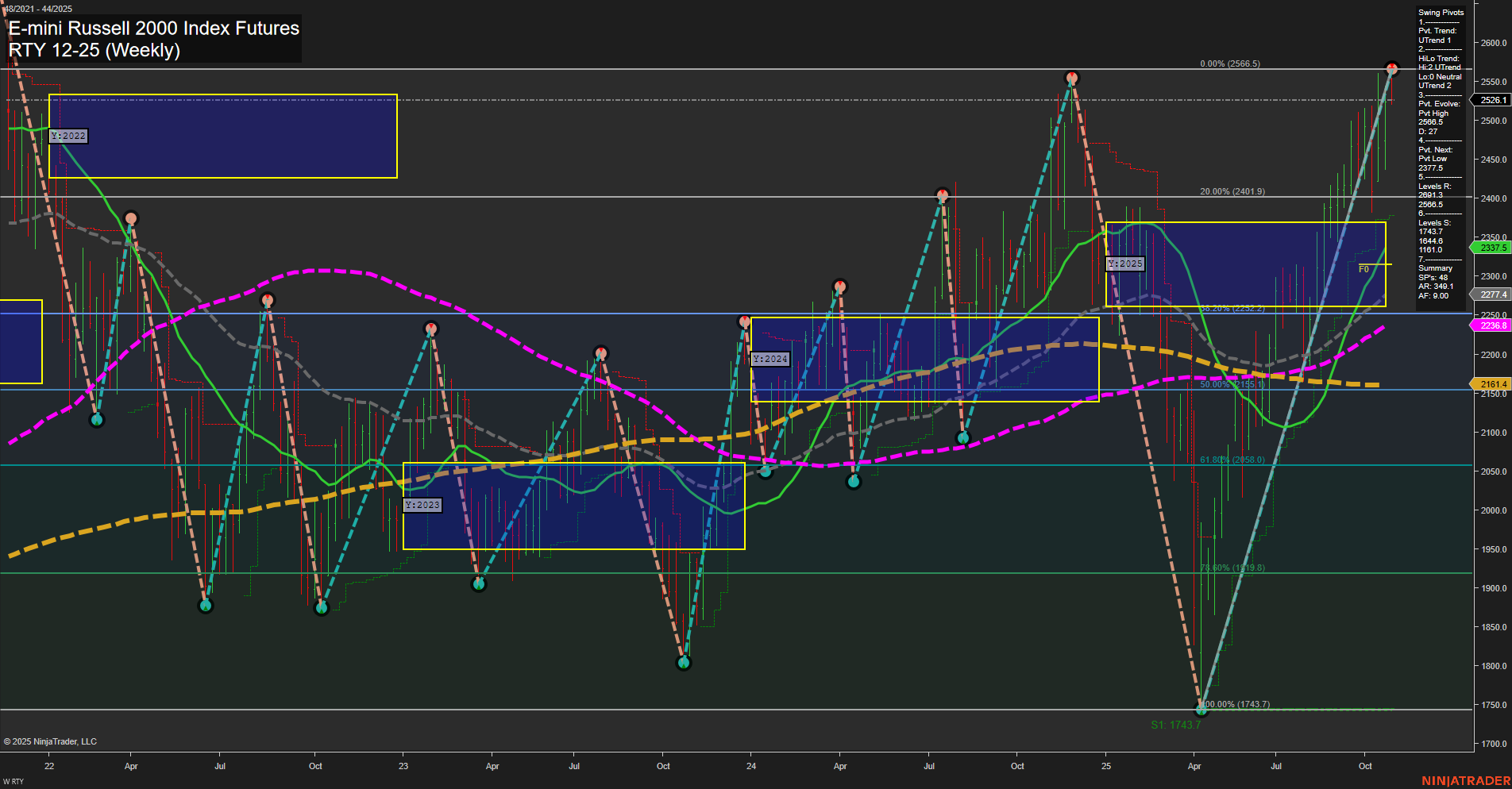

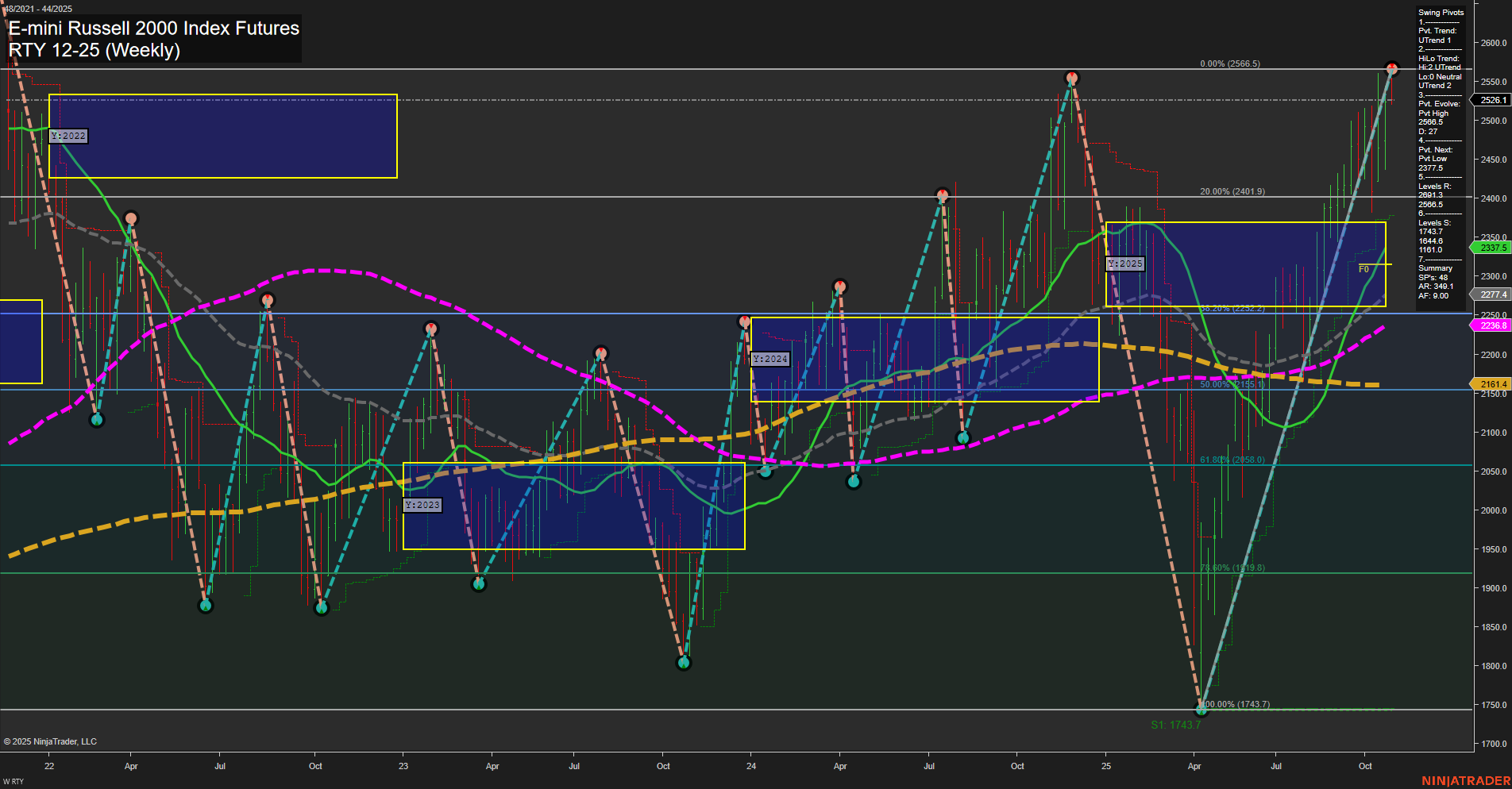

RTY E-mini Russell 2000 Index Futures Weekly Chart Analysis: 2025-Oct-28 07:47 CT

Price Action

- Last: 2526.1,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 63%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 39%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 2526.1,

- 4. Pvt. Next: Pvt low 2277.1,

- 5. Levels R: 2566.5, 2401.9, 2161.4,

- 6. Levels S: 2277.1, 1743.7.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 2335.7 Up Trend,

- (Intermediate-Term) 10 Week: 2236.8 Up Trend,

- (Long-Term) 20 Week: 2335.7 Up Trend,

- (Long-Term) 55 Week: 2236.8 Up Trend,

- (Long-Term) 100 Week: 2290.0 Up Trend,

- (Long-Term) 200 Week: 2161.4 Up Trend.

Recent Trade Signals

- 28 Oct 2025: Short RTY 12-25 @ 2524.4 Signals.USAR-WSFG

- 23 Oct 2025: Long RTY 12-25 @ 2493.6 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The RTY E-mini Russell 2000 Index Futures weekly chart shows a strong bullish structure across all timeframes. Price has surged to new swing highs with large, fast momentum bars, breaking above key resistance levels and maintaining position above all major moving averages. The Weekly, Monthly, and Yearly Session Fib Grids all indicate an upward trend, with price holding above their respective NTZ/F0% levels. Swing pivot analysis confirms an uptrend in both short- and intermediate-term, with the most recent pivot high at 2526.1 and the next significant support at 2277.1. All benchmark moving averages are trending upward, reinforcing the strength of the current rally. Recent trade signals show both long and short entries, reflecting active swing trading around these highs. The overall technical landscape suggests a robust uptrend, with the market exhibiting characteristics of a strong recovery and potential continuation, though volatility and rapid price movement are present as the index tests new highs.

Chart Analysis ATS AI Generated: 2025-10-28 07:47 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.