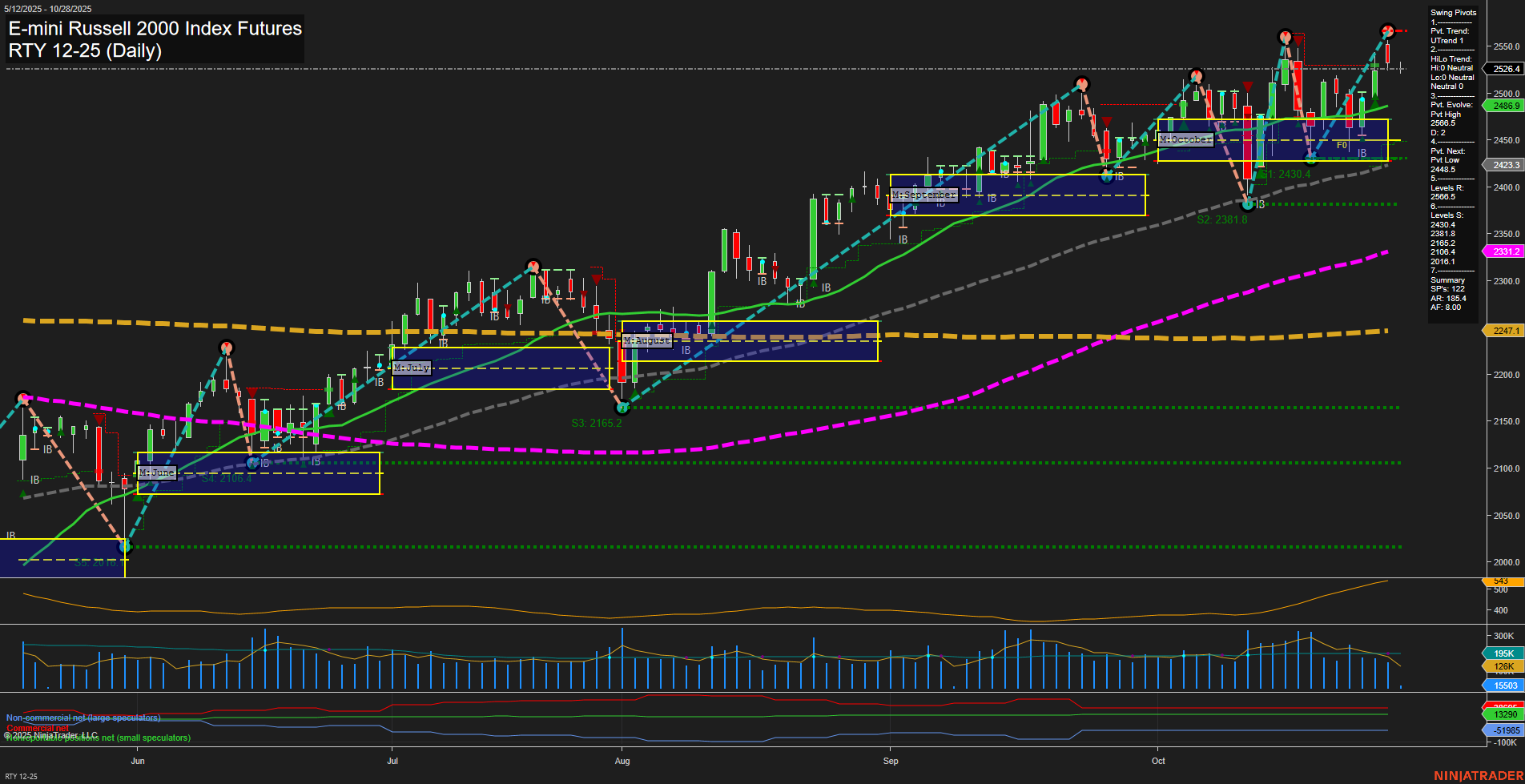

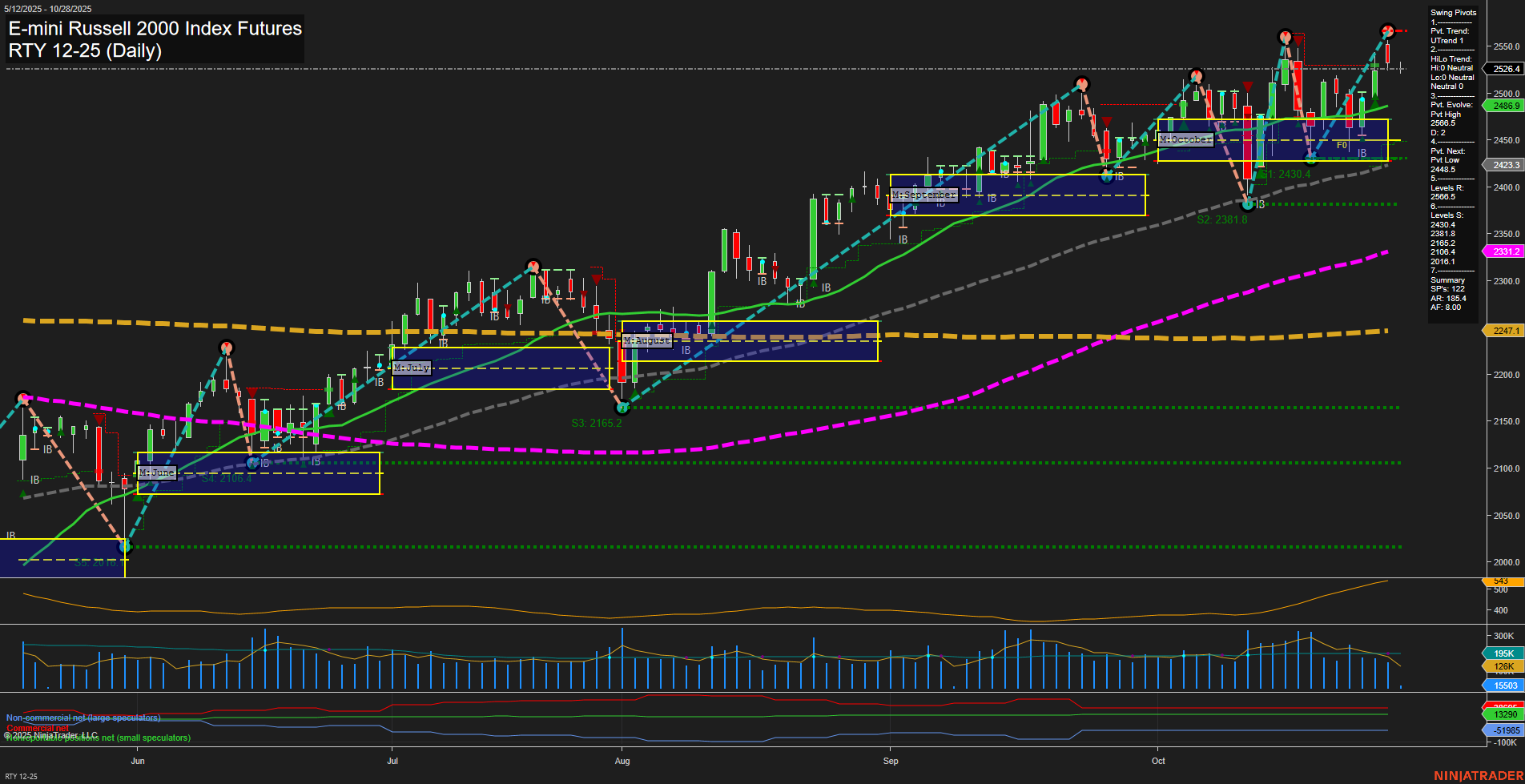

RTY E-mini Russell 2000 Index Futures Daily Chart Analysis: 2025-Oct-28 07:46 CT

Price Action

- Last: 2526.4,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 63%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 39%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt High 2526.4,

- 4. Pvt. Next: Pvt Low 2432.3,

- 5. Levels R: 2526.5, 2500.5, 2488.5,

- 6. Levels S: 2430.4, 2381.8, 2165.2.

Daily Benchmarks

- (Short-Term) 5 Day: 2488.9 Up Trend,

- (Short-Term) 10 Day: 2448.5 Up Trend,

- (Intermediate-Term) 20 Day: 2486.9 Up Trend,

- (Intermediate-Term) 55 Day: 2331.2 Up Trend,

- (Long-Term) 100 Day: 2247.1 Up Trend,

- (Long-Term) 200 Day: 2247.1 Up Trend.

Additional Metrics

Recent Trade Signals

- 28 Oct 2025: Short RTY 12-25 @ 2524.4 Signals.USAR-WSFG

- 23 Oct 2025: Long RTY 12-25 @ 2493.6 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The RTY E-mini Russell 2000 Index Futures daily chart shows a market that has maintained a strong upward bias across all major timeframes, with price currently above all key moving averages and session fib grid levels. The short-term swing pivot trend is up, with the most recent pivot high aligning with the current price, while the next potential pivot low is set at 2432.3, providing a clear support reference. Intermediate-term HiLo trend is neutral, suggesting some consolidation or indecision after a strong rally, but the overall structure remains constructive. The recent trade signals reflect both bullish and bearish activity, indicating active swing trading conditions with potential for both trend continuation and short-term pullbacks. Volatility, as measured by ATR, remains elevated, and volume is steady, supporting the current price action. The market is in a phase where higher lows and higher highs dominate, but with the latest short signal, traders should be attentive to possible short-term retracements within the broader uptrend. Overall, the technical landscape favors a bullish outlook in the short and long term, with intermediate-term consolidation or rotation likely as the market digests recent gains.

Chart Analysis ATS AI Generated: 2025-10-28 07:47 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.