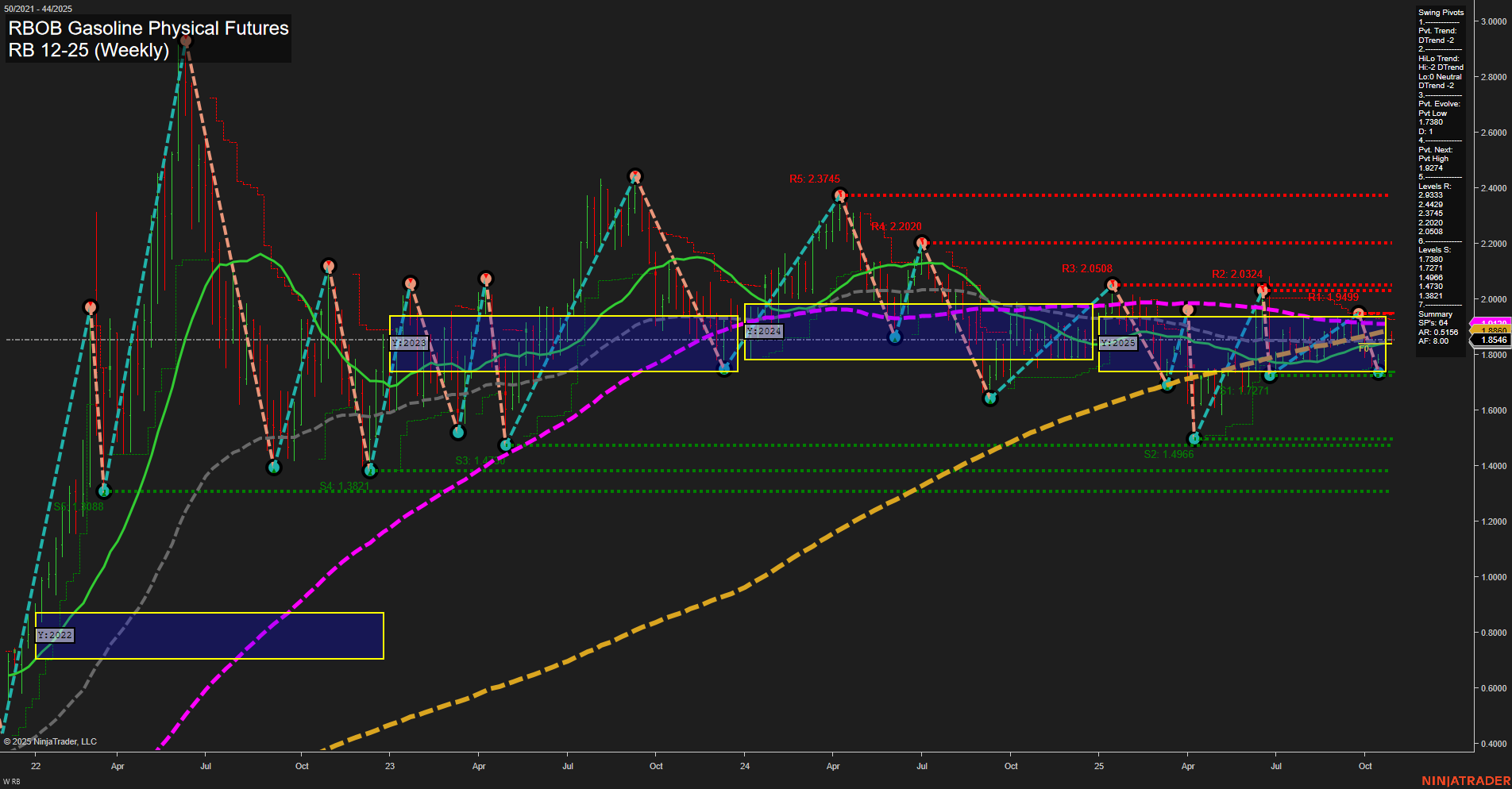

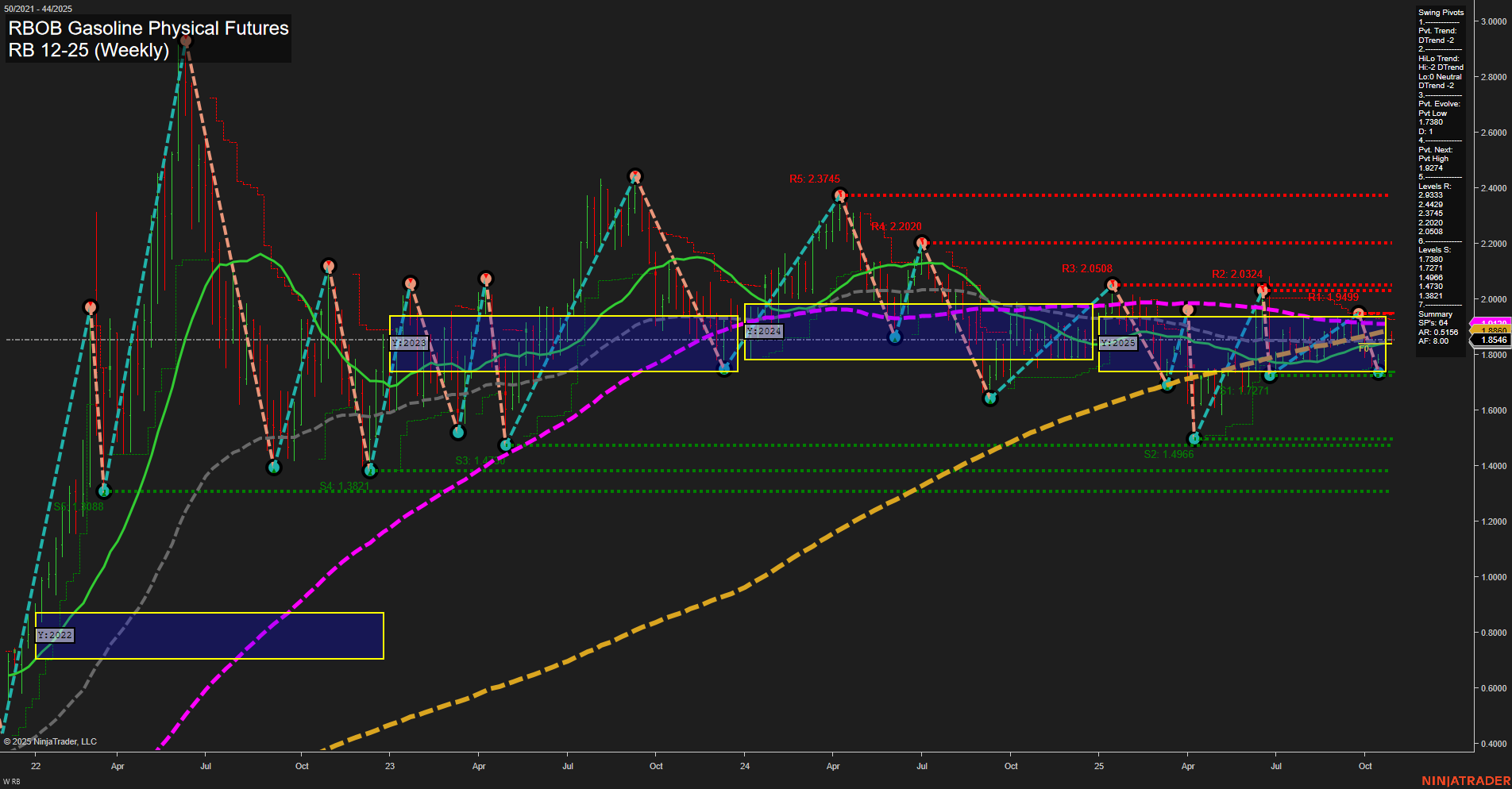

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Oct-28 07:46 CT

Price Action

- Last: 1.8546,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -8%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -9%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.7380,

- 4. Pvt. Next: Pvt high 1.9743,

- 5. Levels R: 2.3745, 2.2200, 2.0508, 2.0324, 1.9743,

- 6. Levels S: 1.7380, 1.4986, 1.3921, 1.3088.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.8814 Down Trend,

- (Intermediate-Term) 10 Week: 1.8911 Down Trend,

- (Long-Term) 20 Week: 1.9008 Down Trend,

- (Long-Term) 55 Week: 1.8721 Up Trend,

- (Long-Term) 100 Week: 1.7271 Up Trend,

- (Long-Term) 200 Week: 1.4516 Up Trend.

Recent Trade Signals

- 28 Oct 2025: Short RB 12-25 @ 1.8556 Signals.USAR-WSFG

- 27 Oct 2025: Long RB 12-25 @ 1.8766 Signals.USAR-MSFG

- 23 Oct 2025: Long RB 12-25 @ 1.8816 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The RBOB Gasoline futures market is currently experiencing a short- and intermediate-term downtrend, as indicated by both the WSFG and MSFG trends, as well as the swing pivot trends (DTrend) and the downward direction of the 5, 10, and 20-week moving averages. Price is trading below the NTZ center on both the weekly and monthly session grids, reinforcing the bearish bias in the near term. However, the yearly session grid remains in an uptrend, with price still above the yearly NTZ center and long-term moving averages (55, 100, 200 week) trending higher, suggesting underlying long-term strength. The most recent trade signals show mixed activity, with a short signal following two recent longs, reflecting choppy, range-bound price action near key support and resistance levels. The market is consolidating within a broad range, with significant resistance overhead and support levels below, indicating a potential for further volatility and possible breakout or breakdown scenarios as the market tests these boundaries.

Chart Analysis ATS AI Generated: 2025-10-28 07:46 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.