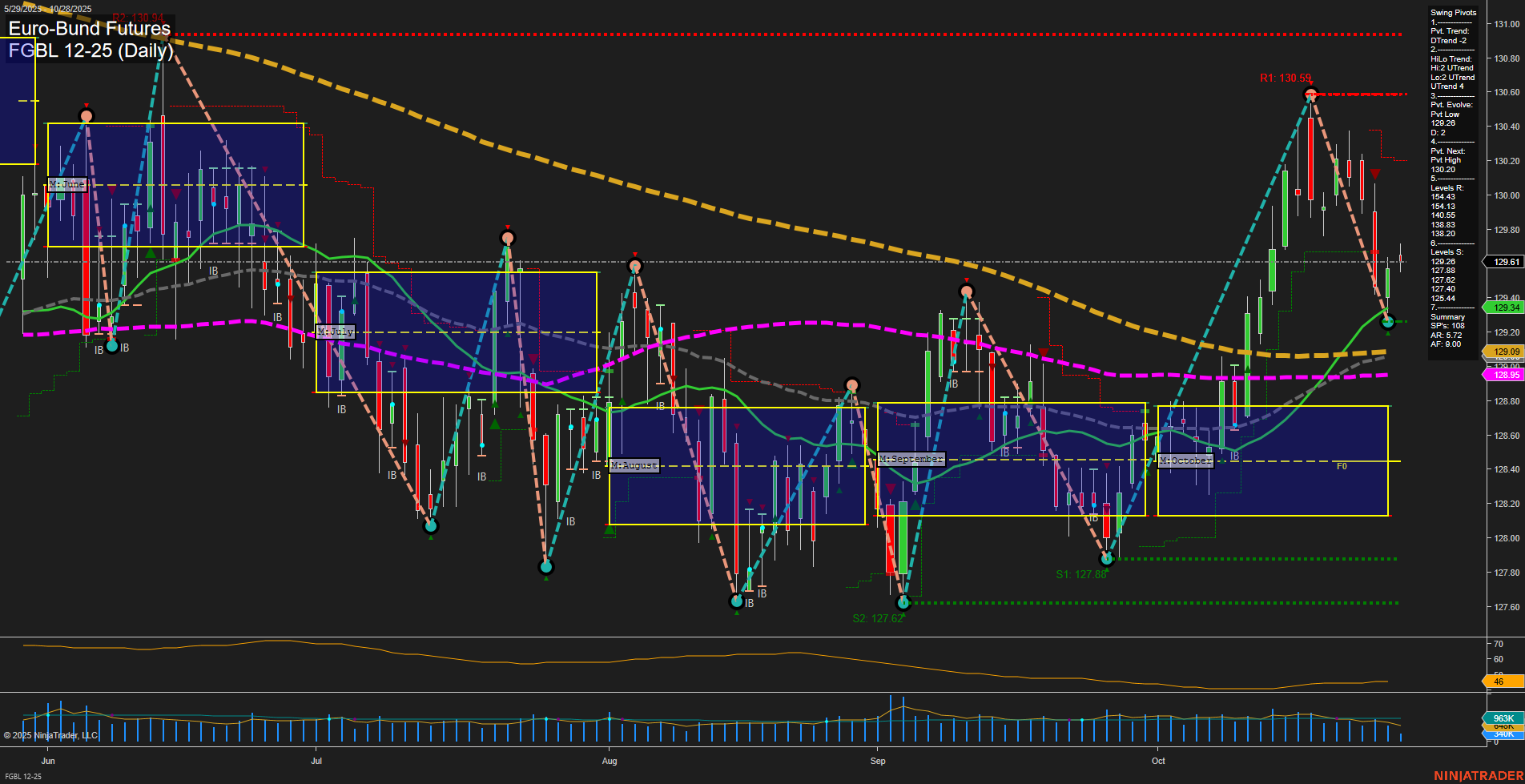

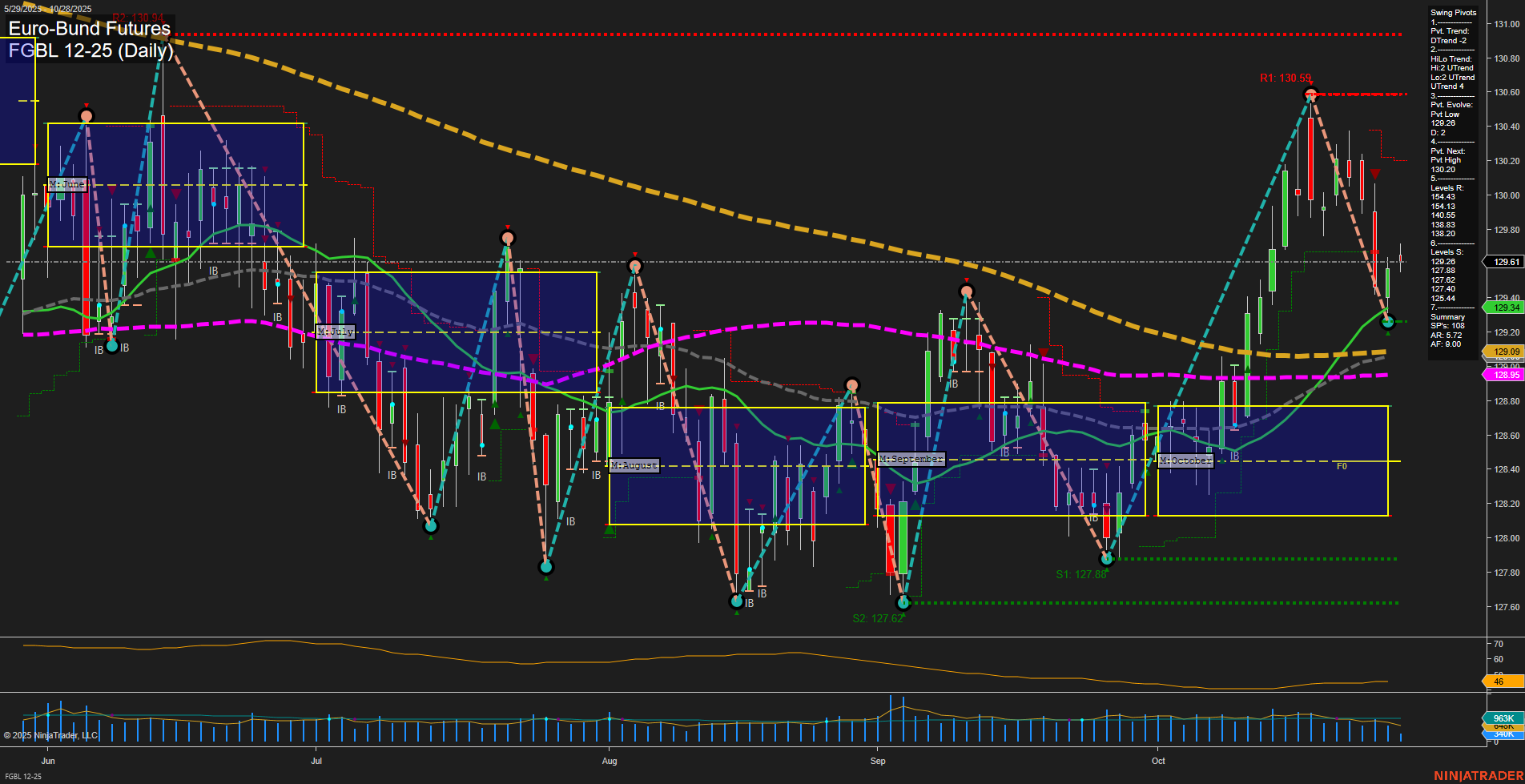

FGBL Euro-Bund Futures Daily Chart Analysis: 2025-Oct-28 07:40 CT

Price Action

- Last: 129.61,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 11%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 72%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -9%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 129.12,

- 4. Pvt. Next: Pvt high 130.28,

- 5. Levels R: 130.59, 129.96, 129.88, 129.63, 129.28,

- 6. Levels S: 129.12, 128.85, 127.86, 127.62, 127.44.

Daily Benchmarks

- (Short-Term) 5 Day: 129.09 Up Trend,

- (Short-Term) 10 Day: 128.95 Up Trend,

- (Intermediate-Term) 20 Day: 129.34 Up Trend,

- (Intermediate-Term) 55 Day: 128.95 Up Trend,

- (Long-Term) 100 Day: 129.05 Up Trend,

- (Long-Term) 200 Day: 129.53 Down Trend.

Additional Metrics

Recent Trade Signals

- 28 Oct 2025: Long FGBL 12-25 @ 129.63 Signals.USAR-WSFG

- 23 Oct 2025: Short FGBL 12-25 @ 129.96 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

The FGBL Euro-Bund Futures daily chart shows a market in transition. Price action has been volatile with large bars and fast momentum, reflecting recent swings and a sharp move off the recent pivot low at 129.12. The short-term swing pivot trend has shifted to down (DTrend), but the intermediate-term HiLo trend remains up (UTrend), indicating a possible pullback within a broader recovery. Price is currently above both the weekly and monthly session fib grid NTZ centers, supporting an intermediate-term bullish bias. All short- and intermediate-term moving averages are trending up, while the 200-day MA remains in a downtrend, highlighting a longer-term bearish overhang. Resistance is layered above at 129.63, 129.88, 129.96, and 130.59, with support at 129.12 and further below. Recent trade signals show a short-term reversal attempt, with a new long signal following a short signal last week, underscoring the choppy, two-way action. Overall, the market is consolidating after a strong rally, with short-term direction uncertain, intermediate-term structure constructive, and long-term trend still negative.

Chart Analysis ATS AI Generated: 2025-10-28 07:41 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.