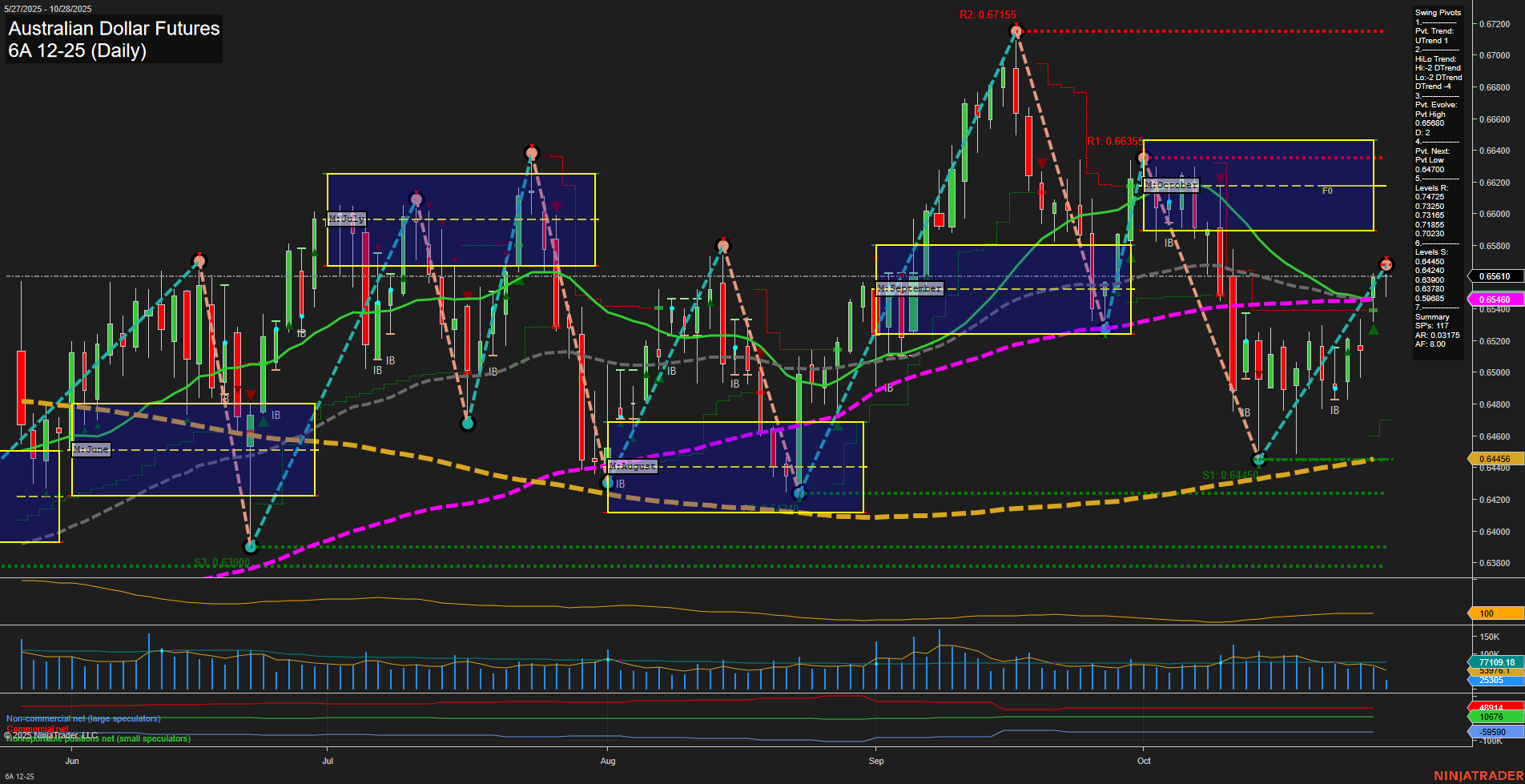

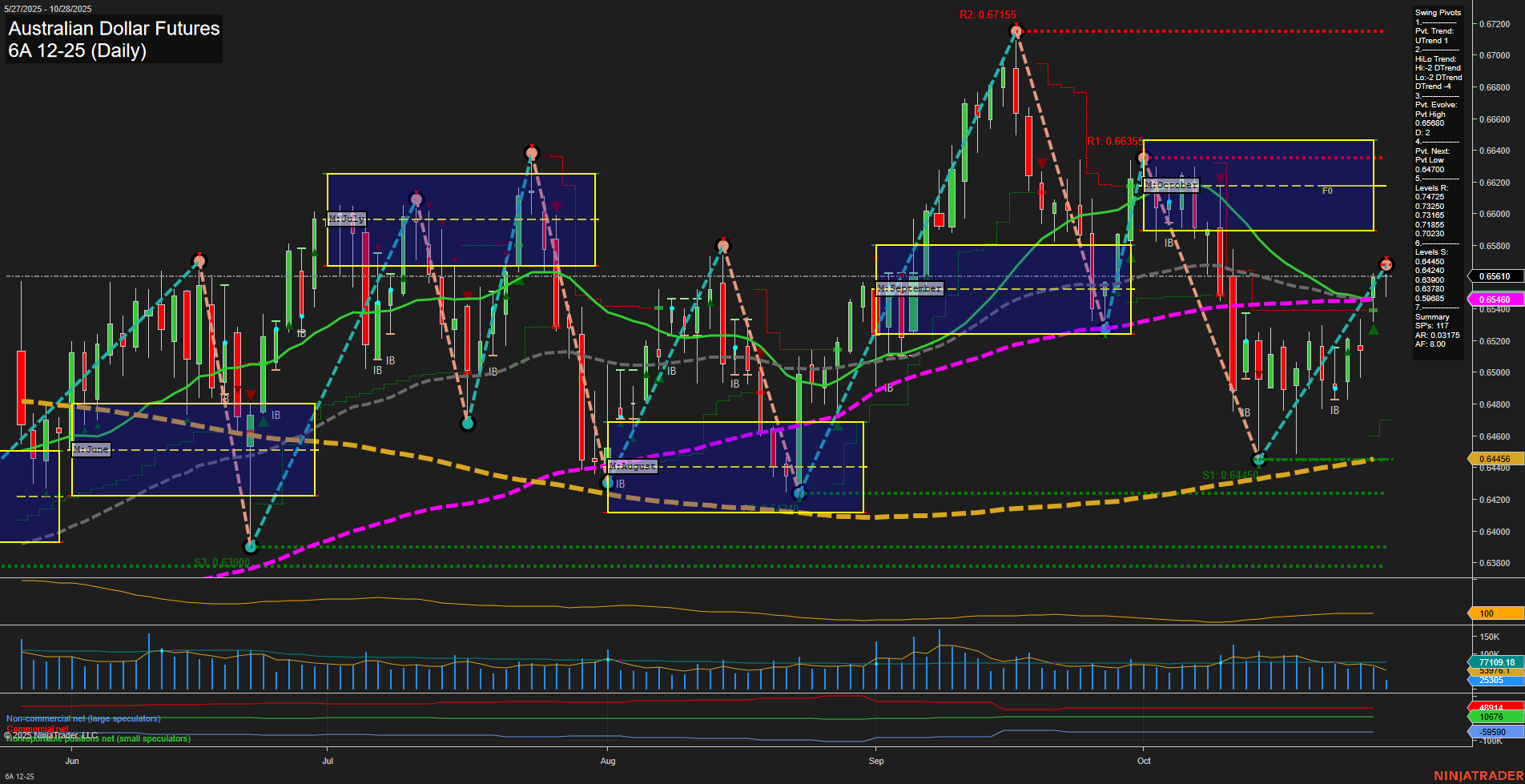

6A Australian Dollar Futures Daily Chart Analysis: 2025-Oct-28 07:30 CT

Price Action

- Last: 0.65460,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 0.65480,

- 4. Pvt. Next: Pvt low 0.64450,

- 5. Levels R: 0.65480, 0.66355, 0.67155,

- 6. Levels S: 0.64450, 0.63900.

Daily Benchmarks

- (Short-Term) 5 Day: 0.64870 Up Trend,

- (Short-Term) 10 Day: 0.64630 Up Trend,

- (Intermediate-Term) 20 Day: 0.65486 Up Trend,

- (Intermediate-Term) 55 Day: 0.65370 Down Trend,

- (Long-Term) 100 Day: 0.65500 Down Trend,

- (Long-Term) 200 Day: 0.64844 Down Trend.

Additional Metrics

Recent Trade Signals

- 28 Oct 2025: Long 6A 12-25 @ 0.656 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The Australian Dollar Futures (6A) daily chart shows a recent shift to a short-term uptrend, with price action rebounding from support and breaking above key short-term moving averages. The current swing pivot trend is up, with the most recent pivot high at 0.65480 acting as immediate resistance, while 0.64450 is the next key support. Intermediate and long-term trends remain neutral, as price is consolidating near major moving averages and the monthly/weekly session fib grids indicate a neutral bias. The 20-day MA is now trending up, but the 55, 100, and 200-day MAs are still in downtrends, suggesting the broader trend is still undecided. Volatility (ATR) is moderate, and volume is steady. The recent long signal aligns with the short-term bullish momentum, but the market is still within a broader consolidation range, with no clear breakout above major resistance or breakdown below support. This environment favors tactical swing trading, focusing on short-term moves within the established range.

Chart Analysis ATS AI Generated: 2025-10-28 07:30 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.