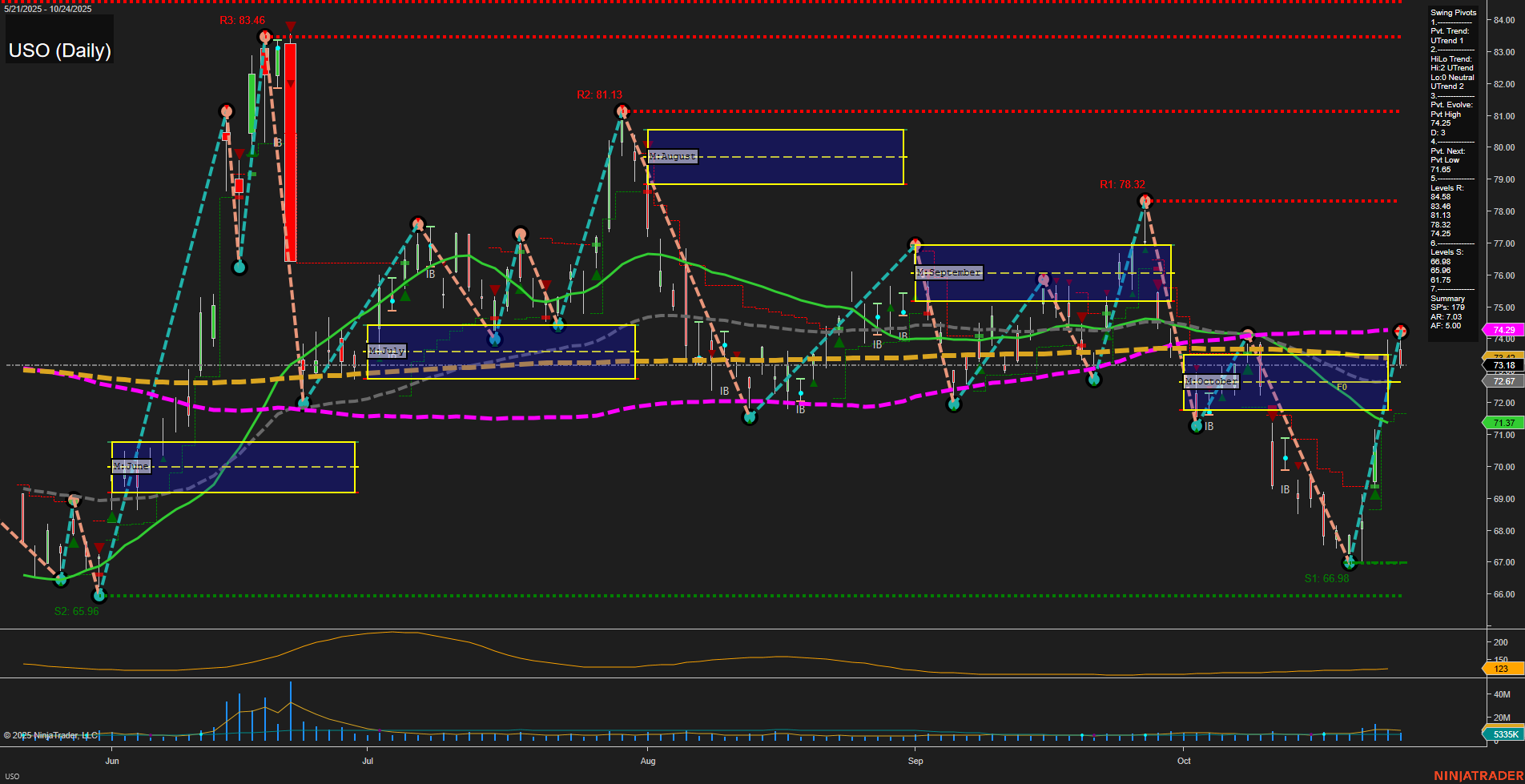

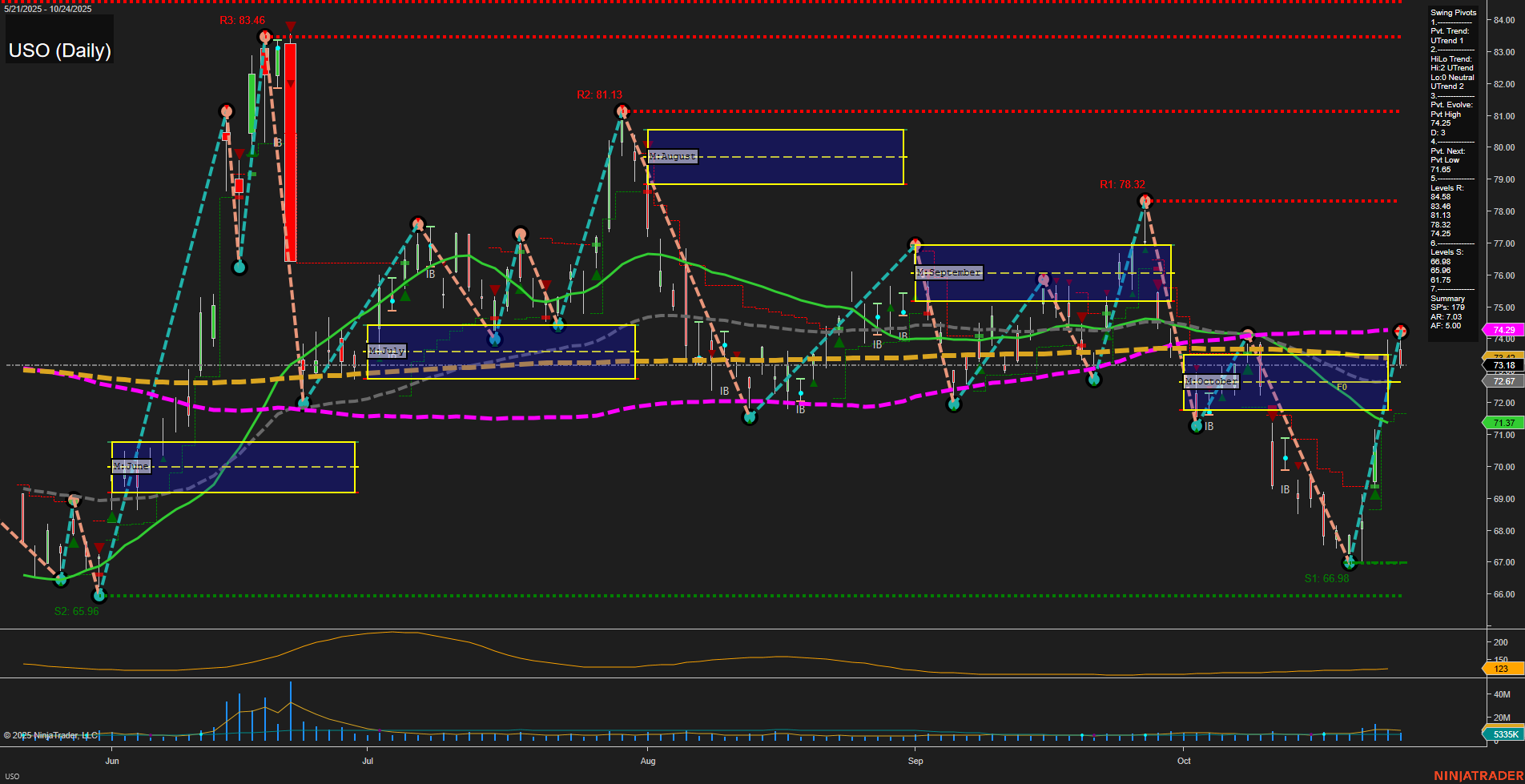

USO United States Oil Fund LP Daily Chart Analysis: 2025-Oct-27 07:23 CT

Price Action

- Last: 73.18,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 74.23,

- 4. Pvt. Next: Pvt Low 71.66,

- 5. Levels R: 83.46, 81.13, 78.32, 74.23,

- 6. Levels S: 71.66, 68.98, 66.98, 65.96.

Daily Benchmarks

- (Short-Term) 5 Day: 72.67 Up Trend,

- (Short-Term) 10 Day: 71.37 Up Trend,

- (Intermediate-Term) 20 Day: 73.18 Up Trend,

- (Intermediate-Term) 55 Day: 74.19 Down Trend,

- (Long-Term) 100 Day: 74.99 Down Trend,

- (Long-Term) 200 Day: 72.67 Up Trend.

Additional Metrics

- ATR: 138,

- VOLMA: 2577640.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

USO is showing a strong short-term and intermediate-term bullish reversal, with price surging off recent lows and large, fast momentum bars confirming aggressive buying. The short-term and intermediate-term moving averages have turned up, and the swing pivot trend has shifted to an uptrend, with the most recent pivot high at 74.23 and next support at 71.66. However, the 55-day and 100-day moving averages remain in a downtrend, indicating that the longer-term structure is still neutral and has not fully confirmed a sustained uptrend. Resistance levels are stacked above at 74.23, 78.32, 81.13, and 83.46, while support is layered at 71.66, 68.98, and lower. The ATR and volume metrics suggest heightened volatility and participation, typical of a reversal or breakout environment. Overall, the chart reflects a transition from a corrective phase to a potential new upswing, but longer-term confirmation is still pending. Swing traders should note the potential for further upside tests toward resistance, but also be aware of the overhead supply and the need for continued momentum to sustain the move.

Chart Analysis ATS AI Generated: 2025-10-27 07:24 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.