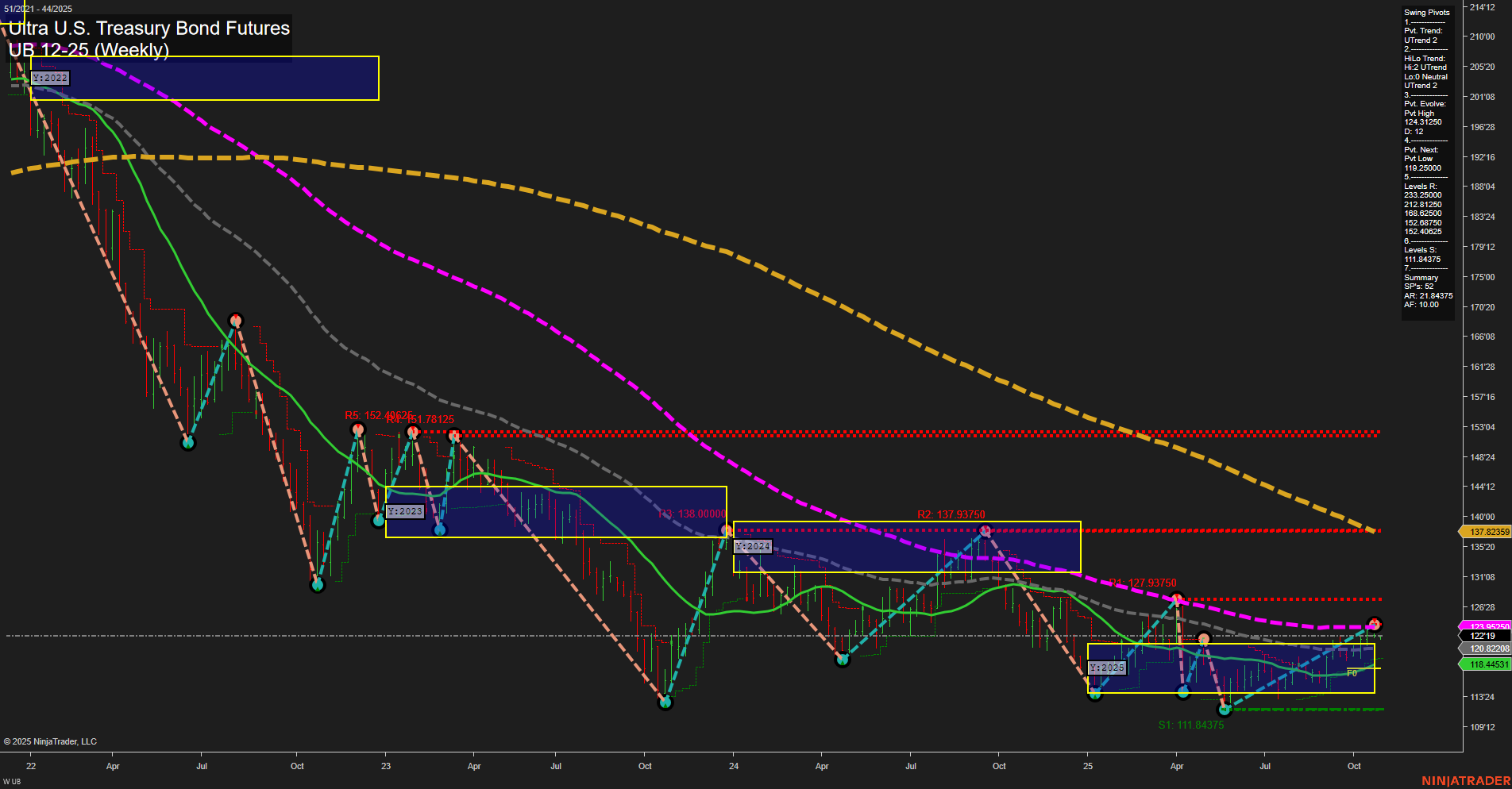

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action is currently near 123.16, with medium-sized bars and average momentum, indicating neither strong acceleration nor deceleration. The short-term WSFG trend is down, with price below the NTZ center, and recent short-term trade signals have been to the short side, suggesting some near-term pressure. However, both the intermediate-term (MSFG) and long-term (YSFG) session fib grid trends are up, with price above their respective NTZ centers, reflecting a broader recovery from prior lows. Swing pivots highlight an uptrend in both short- and intermediate-term metrics, with the most recent pivot high at 124.31 and the next key support at 119.25. Resistance levels are stacked well above current price, indicating room for potential rallies if momentum shifts. Weekly benchmarks show short- and intermediate-term moving averages trending up, while longer-term averages (55, 100, 200 week) remain in downtrends, underscoring the ongoing battle between recovery and the dominant long-term bearish structure. Recent trade signals have favored short-term shorts, but the intermediate-term structure is bullish, and the long-term remains bearish. This mixed environment suggests a choppy, potentially range-bound market with possible retracements and countertrend moves. The market is in a consolidation phase, with the potential for either a breakout continuation higher if intermediate-term strength persists, or renewed downside if short-term weakness accelerates.