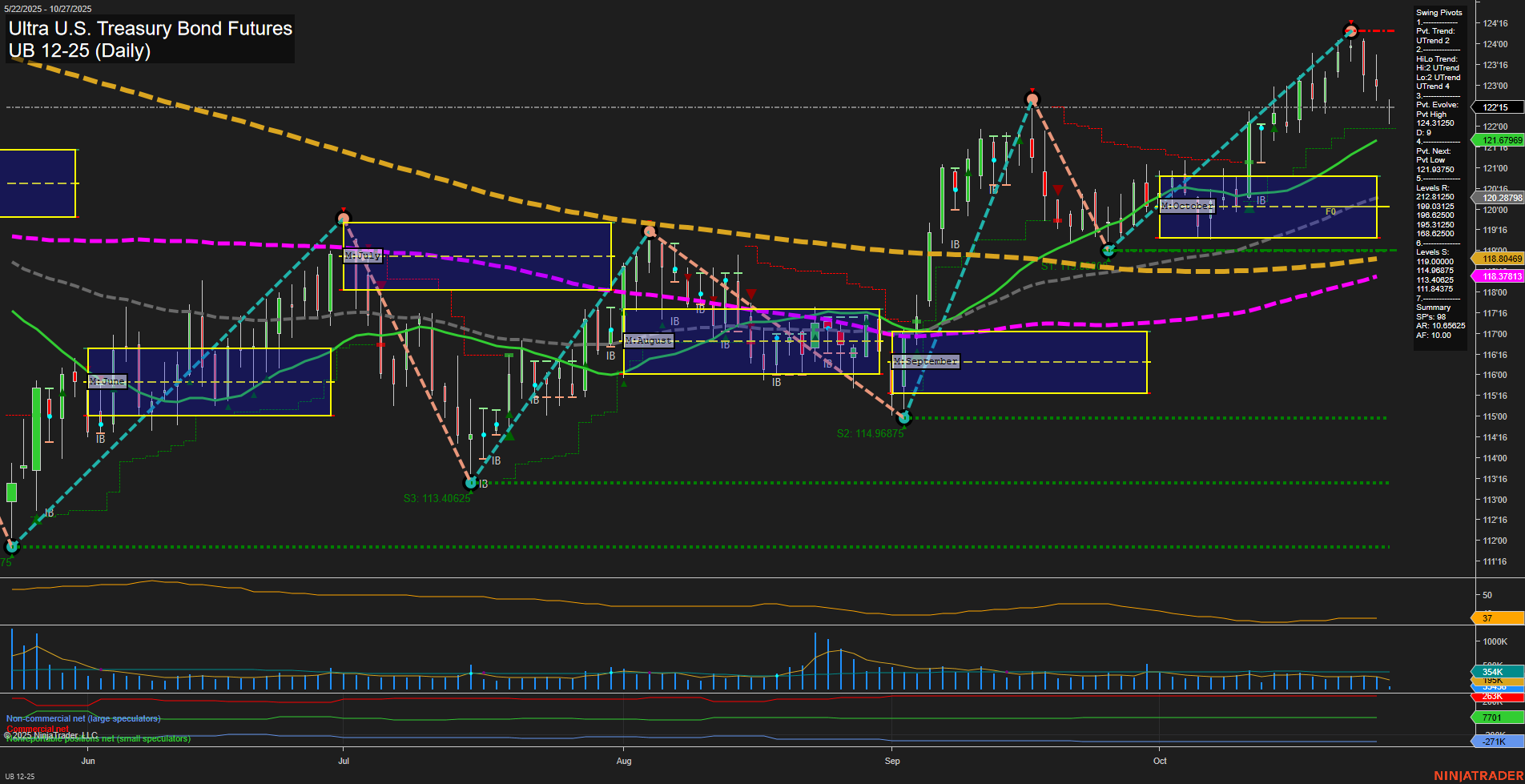

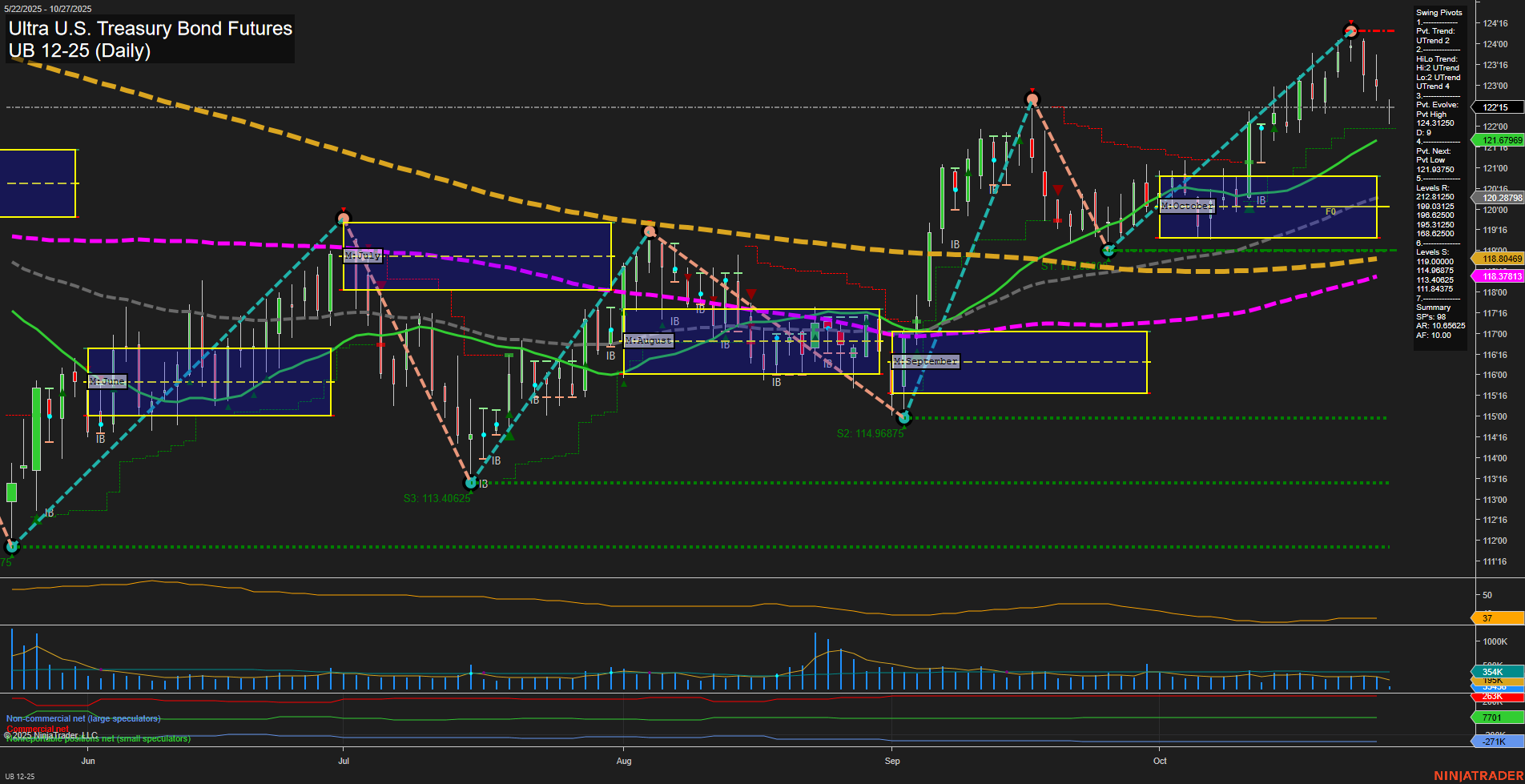

UB Ultra U.S. Treasury Bond Futures Daily Chart Analysis: 2025-Oct-27 07:22 CT

Price Action

- Last: 121.87596,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 47%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 13%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 124.31250,

- 4. Pvt. Next: Pvt Low 121.03750,

- 5. Levels R: 124.31250, 122.715,

- 6. Levels S: 121.03750, 120.28750, 119.03125, 118.62500, 116.96875, 114.96875, 113.40625.

Daily Benchmarks

- (Short-Term) 5 Day: 123.15625 Down Trend,

- (Short-Term) 10 Day: 122.34375 Down Trend,

- (Intermediate-Term) 20 Day: 121.87596 Up Trend,

- (Intermediate-Term) 55 Day: 118.80469 Up Trend,

- (Long-Term) 100 Day: 118.37813 Up Trend,

- (Long-Term) 200 Day: 119.98750 Down Trend.

Additional Metrics

Recent Trade Signals

- 23 Oct 2025: Short UB 12-25 @ 123.15625 Signals.USAR.TR120

- 20 Oct 2025: Short UB 12-25 @ 122.34375 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures daily chart shows a market in transition. Short-term momentum has shifted bearish, as indicated by the recent short trade signals and the price now trading below both the 5-day and 10-day moving averages, with the WSFG (weekly) trend also down. However, the intermediate and long-term outlooks remain bullish, supported by the MSFG and YSFG trends, as well as price holding above the 20, 55, and 100-day moving averages. The swing pivot structure is in an uptrend, with the most recent pivot high at 124.31250 and the next key support at 121.03750. Volatility is moderate, and volume remains steady. The market appears to be in a corrective pullback within a broader uptrend, with the potential for further downside in the short term before resuming higher if support levels hold. The overall structure suggests a choppy environment with a short-term retracement against a prevailing intermediate and long-term bullish trend.

Chart Analysis ATS AI Generated: 2025-10-27 07:22 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.