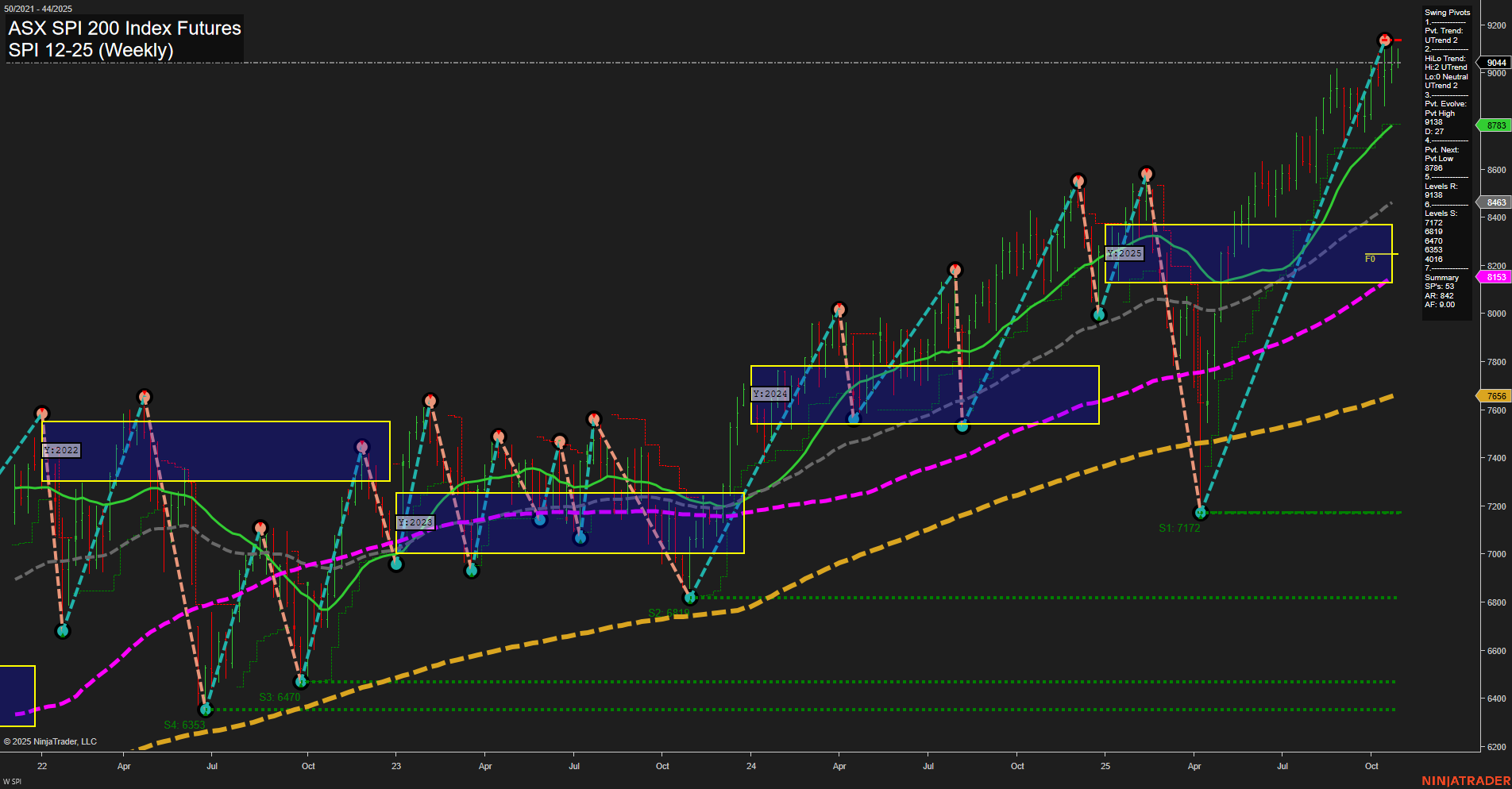

The SPI 200 Index Futures are exhibiting strong bullish momentum across all timeframes, with the last price at 9044 and large, fast-moving bars indicating robust buying interest. Both short-term and intermediate-term swing pivot trends are in clear uptrends, with the most recent pivot high at 9138 and the next significant support at 8788. All benchmark moving averages from 5-week to 200-week are trending upward, reinforcing the prevailing bullish structure. The price is well above key support levels and continues to make higher highs, suggesting trend continuation rather than reversal. The neutral bias in the session fib grids reflects a consolidation phase within the broader uptrend, but the overall technical landscape remains constructive for further upside. The market has shown resilience through previous pullbacks, quickly recovering and resuming its upward trajectory, which is characteristic of a strong trending environment. No significant resistance is visible until the recent pivot high, while multiple support levels below provide a cushion for any retracement. The chart structure suggests a healthy, sustained rally with potential for further gains as long as the uptrend in swing pivots and moving averages persists.