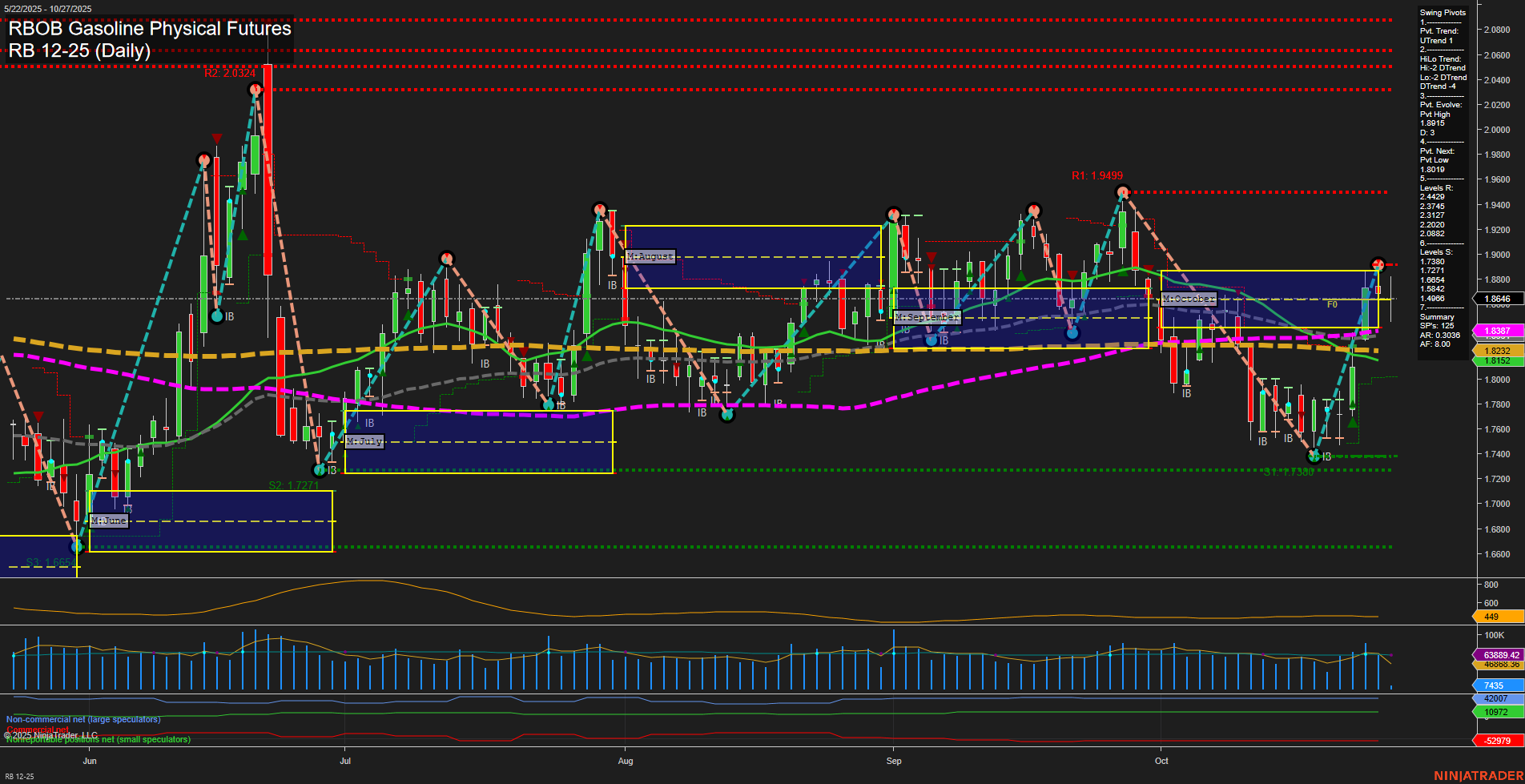

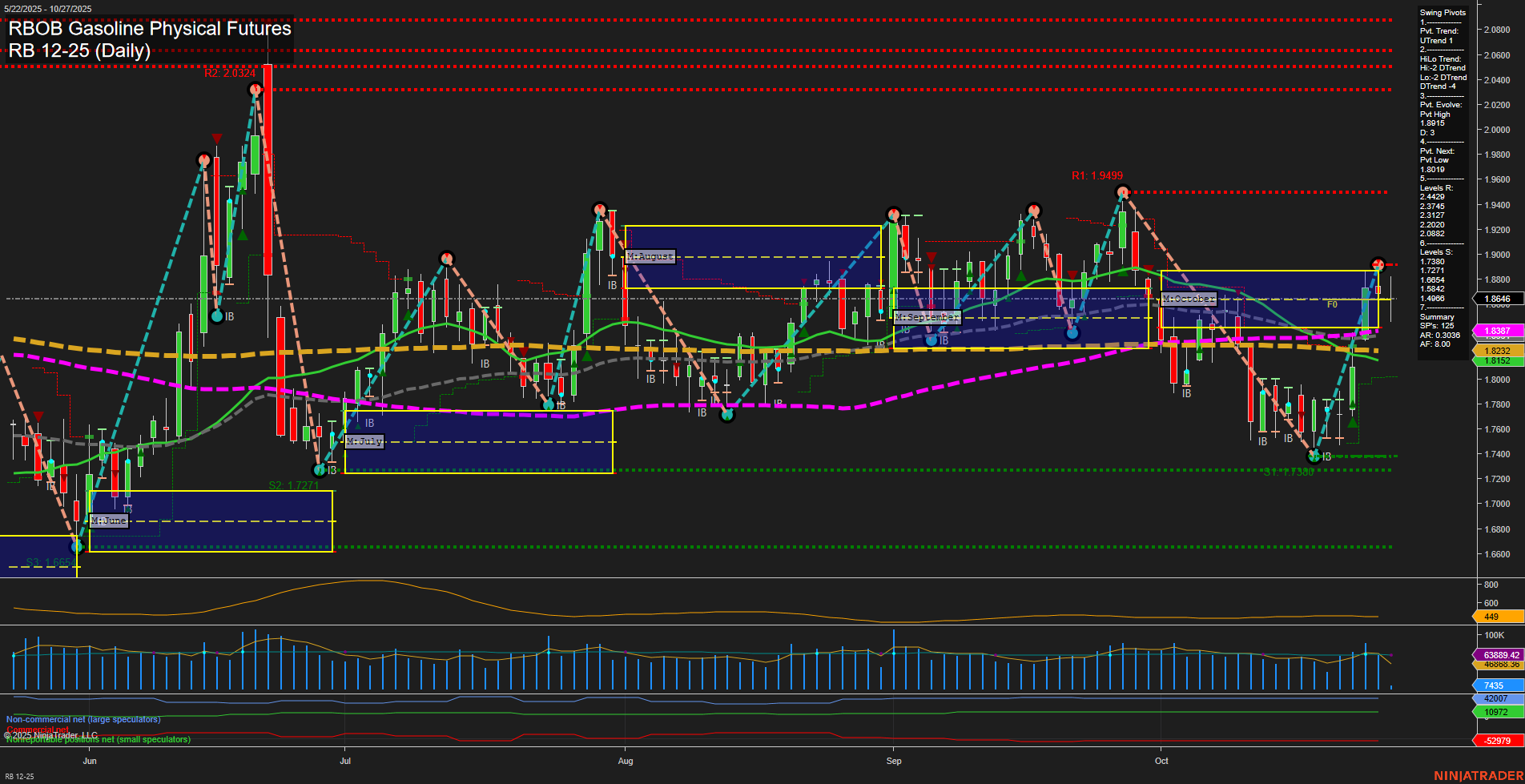

RB RBOB Gasoline Physical Futures Daily Chart Analysis: 2025-Oct-27 07:17 CT

Price Action

- Last: 1.8646,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.7473,

- 4. Pvt. Next: Pvt high 1.9499,

- 5. Levels R: 1.9499, 1.9019, 1.8761, 1.8742, 1.8726, 1.8682,

- 6. Levels S: 1.7473, 1.7271, 1.6822.

Daily Benchmarks

- (Short-Term) 5 Day: 1.8387 Up Trend,

- (Short-Term) 10 Day: 1.8232 Up Trend,

- (Intermediate-Term) 20 Day: 1.8152 Up Trend,

- (Intermediate-Term) 55 Day: 1.8327 Down Trend,

- (Long-Term) 100 Day: 1.8492 Down Trend,

- (Long-Term) 200 Day: 1.8852 Down Trend.

Additional Metrics

Recent Trade Signals

- 27 Oct 2025: Short RB 12-25 @ 1.8474 Signals.USAR-WSFG

- 27 Oct 2025: Long RB 12-25 @ 1.8766 Signals.USAR-MSFG

- 23 Oct 2025: Long RB 12-25 @ 1.8816 Signals.USAR.TR720

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The RBOB Gasoline futures market is currently exhibiting a mixed technical structure. Short-term momentum has shifted bullish, as indicated by the recent pivot low and a series of higher closes above the 5, 10, and 20-day moving averages, all trending upward. However, the intermediate-term trend remains neutral, with the 55-day and 100-day moving averages still in a downtrend, suggesting that the market has not yet fully reversed the prior decline. The long-term trend is also neutral, as the 200-day moving average is still sloping downward, and price is oscillating near this level.

Swing pivots show a recent transition from a significant low (1.7473) with the next key resistance at 1.9499, highlighting a potential range-bound environment between these levels. The ATR and volume metrics indicate moderate volatility and participation, with no extreme spikes. Recent trade signals reflect this indecision, with both long and short entries triggered in close succession, underscoring the choppy, two-way nature of the current market.

Overall, the market is in a recovery phase from a recent sell-off, but faces overhead resistance and lacks a clear, sustained trend in the intermediate and long-term timeframes. Price action is likely to remain volatile within established support and resistance bands until a decisive breakout or breakdown occurs.

Chart Analysis ATS AI Generated: 2025-10-27 07:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.