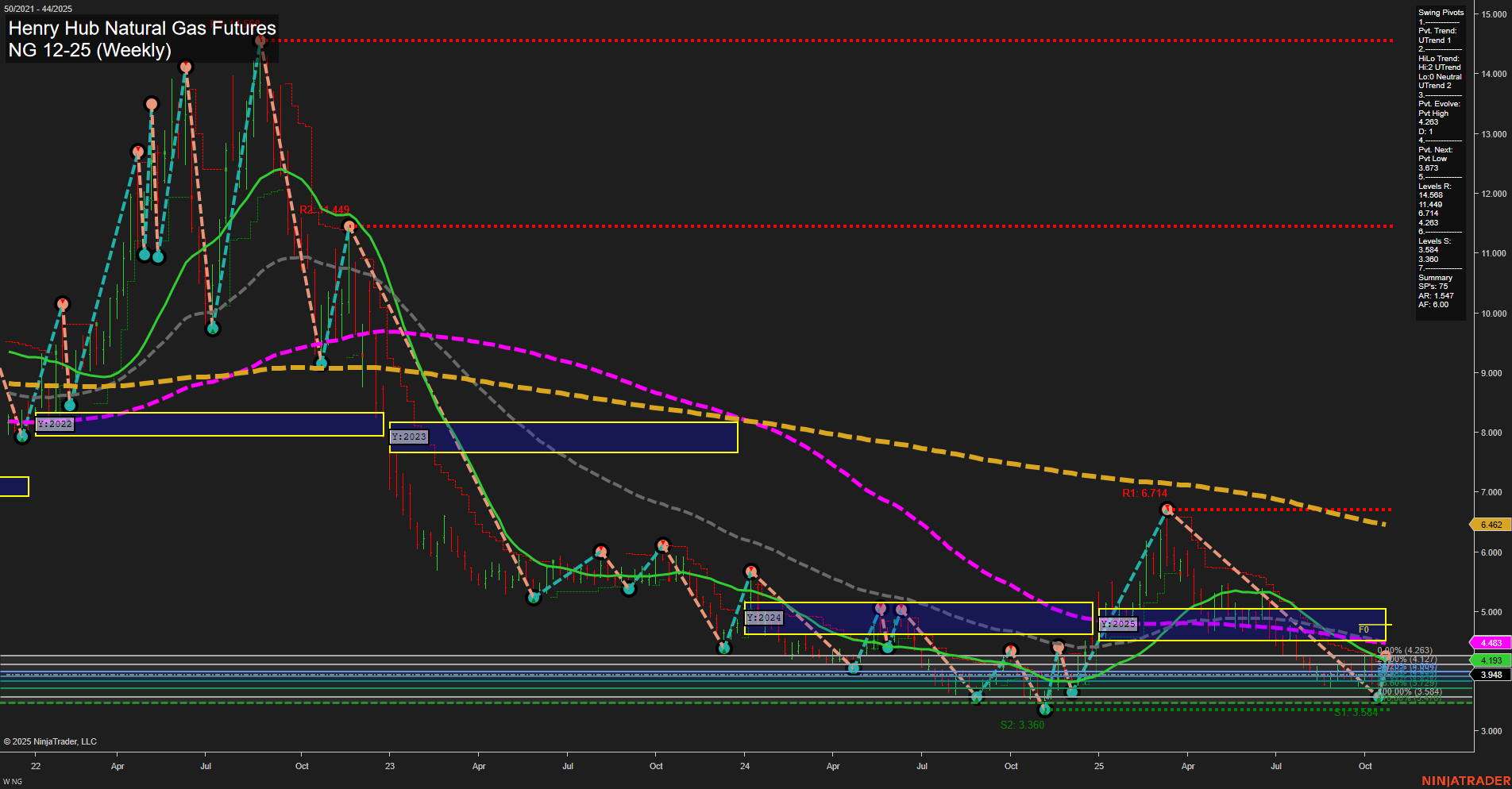

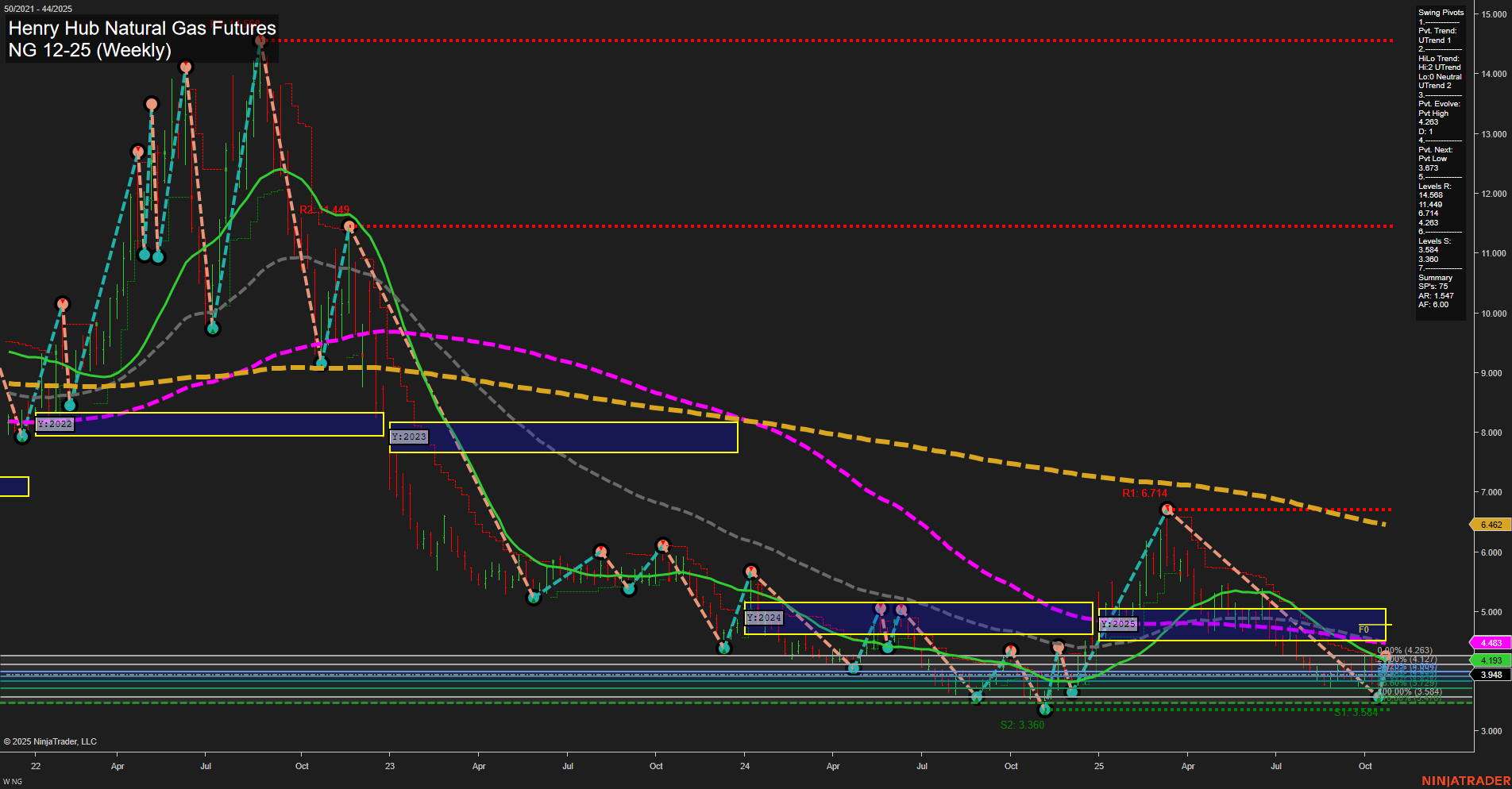

NG Henry Hub Natural Gas Futures Weekly Chart Analysis: 2025-Oct-27 07:14 CT

Price Action

- Last: 3.962,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 4.193,

- 4. Pvt. Next: Pvt low 3.534,

- 5. Levels R: 14.698, 11.448, 6.714, 4.193,

- 6. Levels S: 3.584, 3.380.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: [Not shown] [Not shown],

- (Intermediate-Term) 10 Week: [Not shown] [Not shown],

- (Long-Term) 20 Week: 3.948 Down Trend,

- (Long-Term) 55 Week: 4.483 Down Trend,

- (Long-Term) 100 Week: 6.462 Down Trend,

- (Long-Term) 200 Week: [Not shown] [Not shown].

Recent Trade Signals

- 27 Oct 2025: Short NG 12-25 @ 3.962 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

Natural gas futures are currently trading in a consolidation phase after a prolonged downtrend, with price action showing medium-sized bars and slow momentum. The short- and intermediate-term swing pivot trends have shifted to an uptrend, suggesting a potential for a short-term bounce or retracement, but the overall structure remains capped by significant resistance levels, notably at 4.193 and higher at 6.714. Long-term moving averages (20, 55, 100 week) are all trending down, reinforcing a bearish bias for the broader trend. The recent short signal aligns with the prevailing long-term downtrend, while the neutral stance in the short and intermediate term reflects a market in transition, possibly awaiting a catalyst for a decisive move. Key support is clustered just below at 3.584 and 3.380, with any break below these levels potentially opening the door to further downside. The market appears to be in a corrective phase within a larger bearish cycle, with volatility subdued and no clear breakout or reversal pattern evident at this time.

Chart Analysis ATS AI Generated: 2025-10-27 07:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.