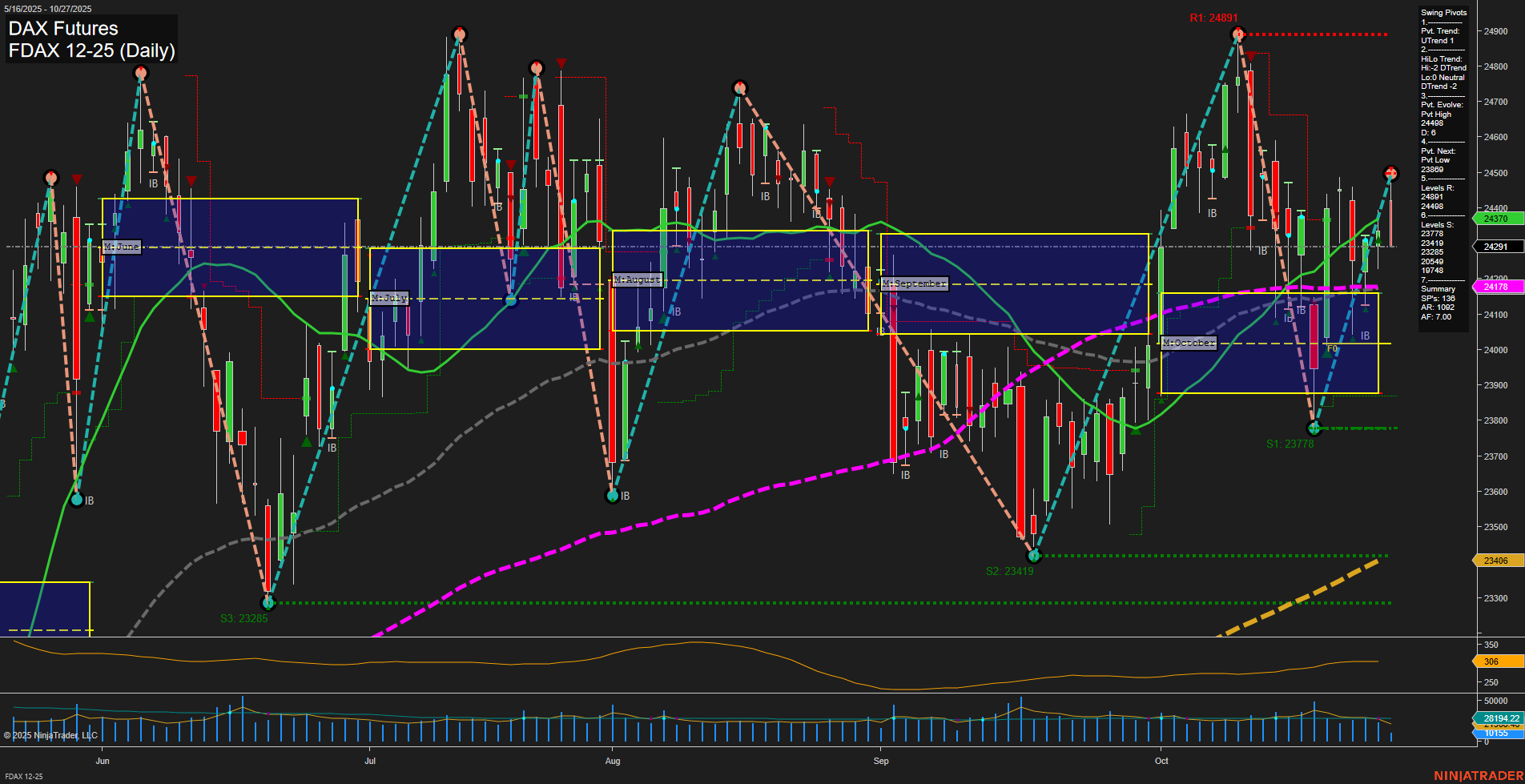

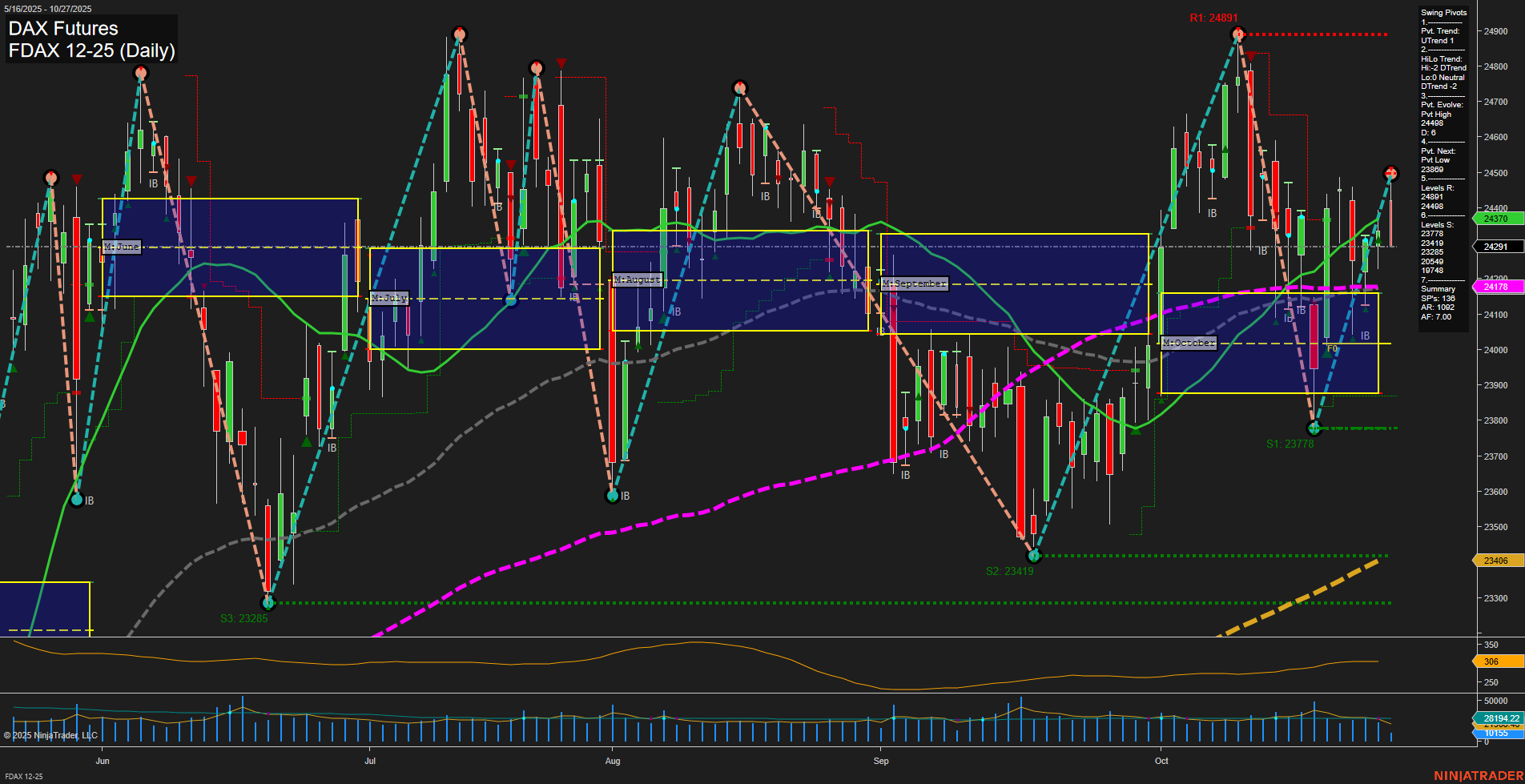

FDAX DAX Futures Daily Chart Analysis: 2025-Oct-27 07:09 CT

Price Action

- Last: 24460,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: -16%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 33%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 115%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 24891,

- 4. Pvt. Next: Pvt Low 23888,

- 5. Levels R: 24891, 24408,

- 6. Levels S: 23778, 23419, 23285.

Daily Benchmarks

- (Short-Term) 5 Day: 24370 Up Trend,

- (Short-Term) 10 Day: 24291 Up Trend,

- (Intermediate-Term) 20 Day: 24178 Up Trend,

- (Intermediate-Term) 55 Day: 24192 Up Trend,

- (Long-Term) 100 Day: 24155 Up Trend,

- (Long-Term) 200 Day: 23406 Up Trend.

Additional Metrics

Recent Trade Signals

- 27 Oct 2025: Long FDAX 12-25 @ 24460 Signals.USAR-WSFG

- 20 Oct 2025: Long FDAX 12-25 @ 24227 Signals.USAR-MSFG

- 20 Oct 2025: Long FDAX 12-25 @ 24227 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The FDAX daily chart shows a market in transition, with short-term momentum shifting upward as evidenced by the recent swing pivot uptrend and a series of long signals. Price has moved above key monthly and yearly session fib grid levels, and all benchmark moving averages are trending higher, supporting a bullish long-term structure. However, the intermediate-term HiLo trend remains down, suggesting some residual weakness or consolidation from the prior swing low. The market is currently testing resistance near 24408 and 24891, with support levels established at 23778 and below. Volatility (ATR) is moderate, and volume is steady, indicating healthy participation. The overall setup reflects a market that is attempting to resume its longer-term uptrend after a corrective phase, with the potential for further upside if resistance is cleared, but with some caution warranted due to the mixed intermediate-term signals.

Chart Analysis ATS AI Generated: 2025-10-27 07:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.